Answered step by step

Verified Expert Solution

Question

1 Approved Answer

l a. Record the effect of the following transactions on the General Fund and governmental activities for the year ended June 30, 2023. b. Record

l

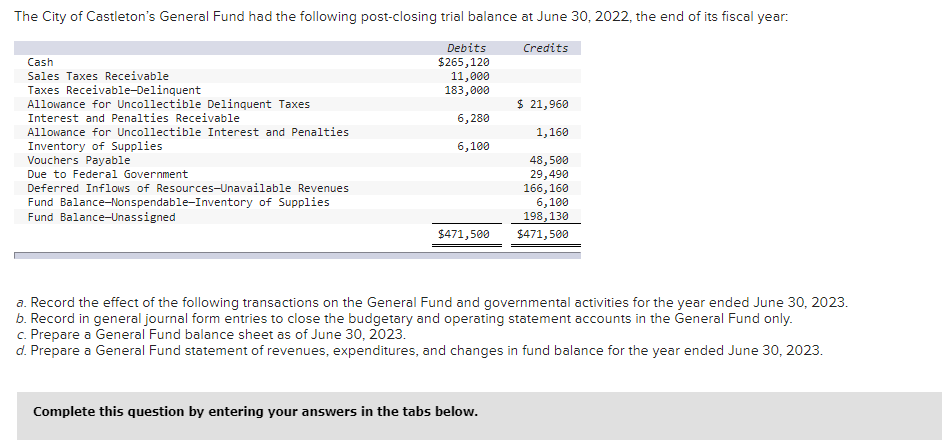

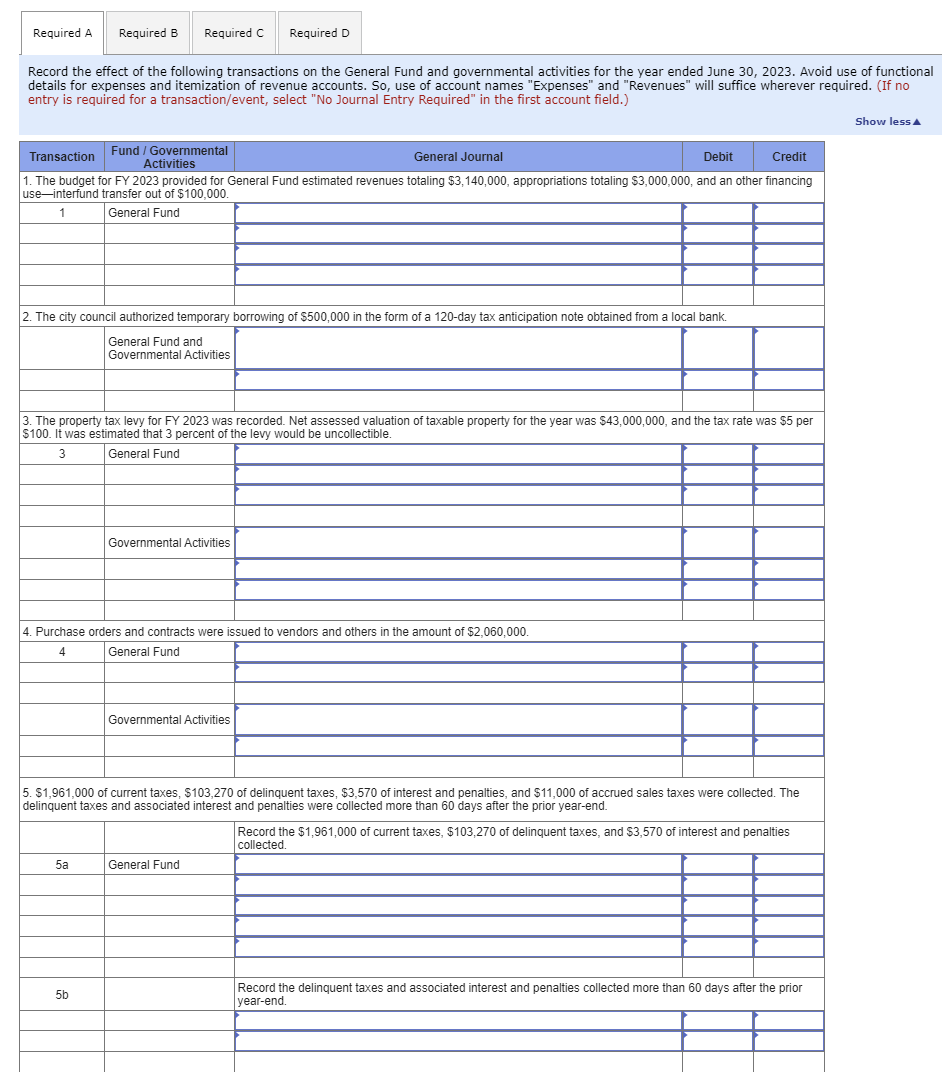

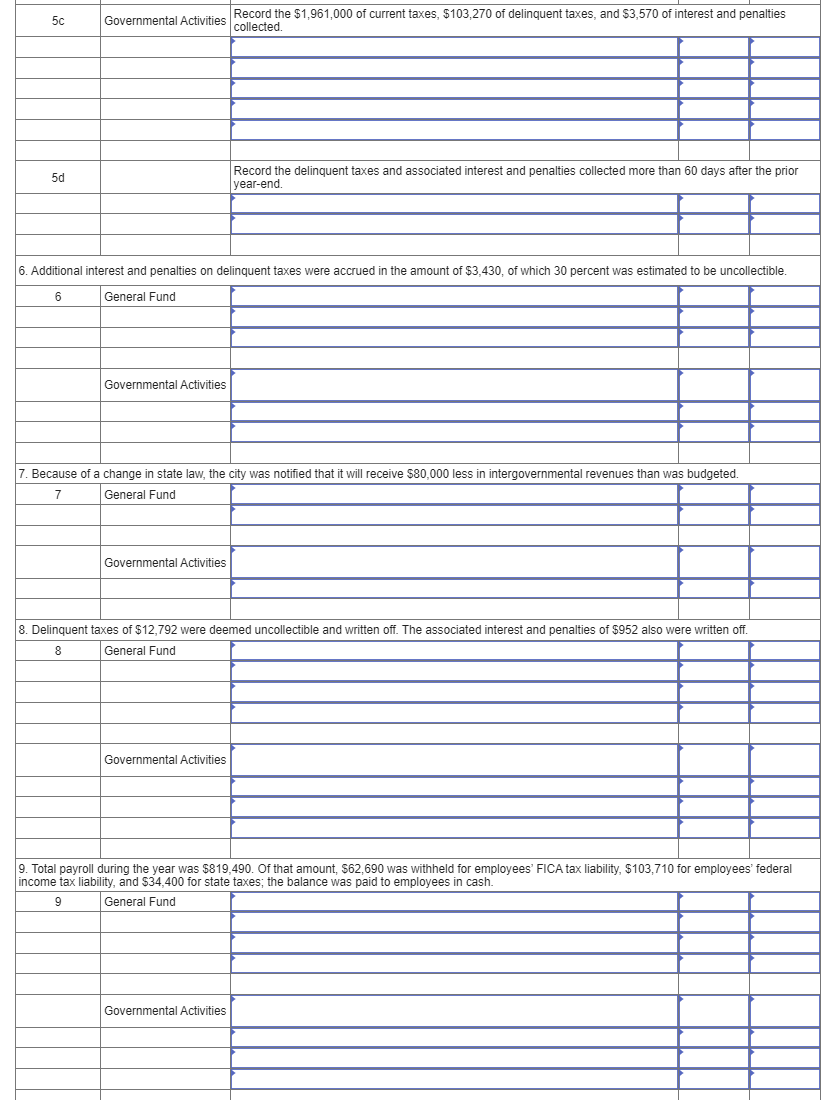

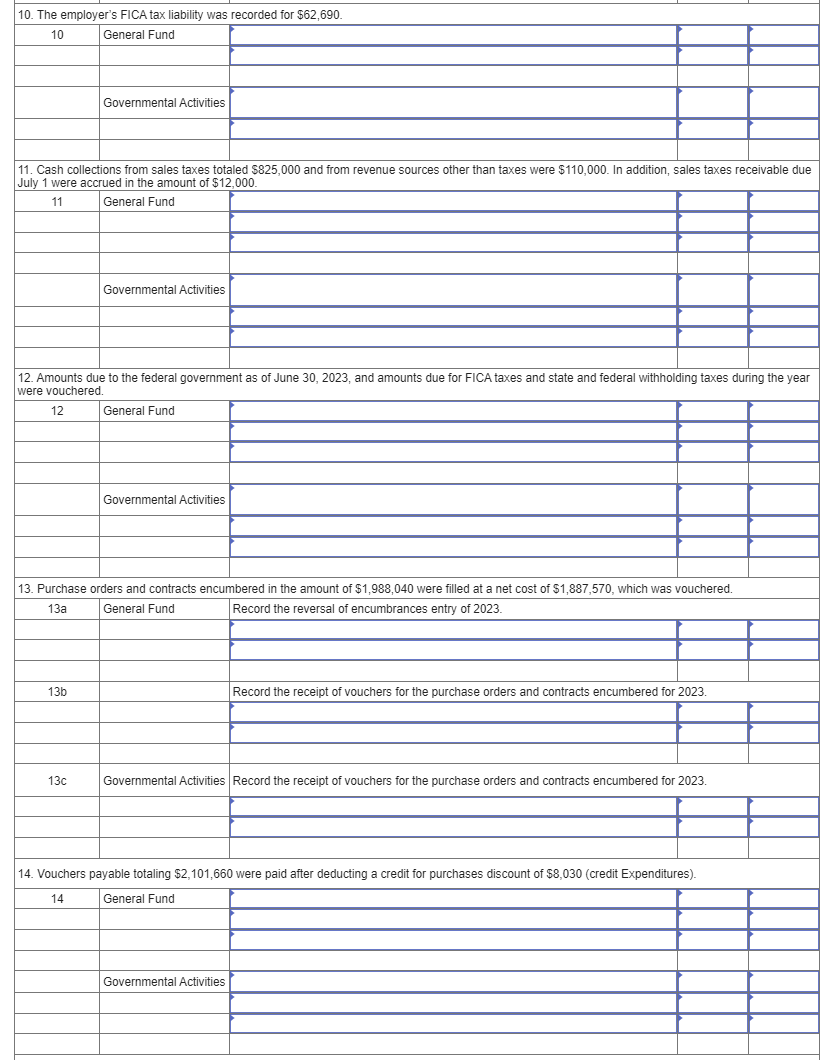

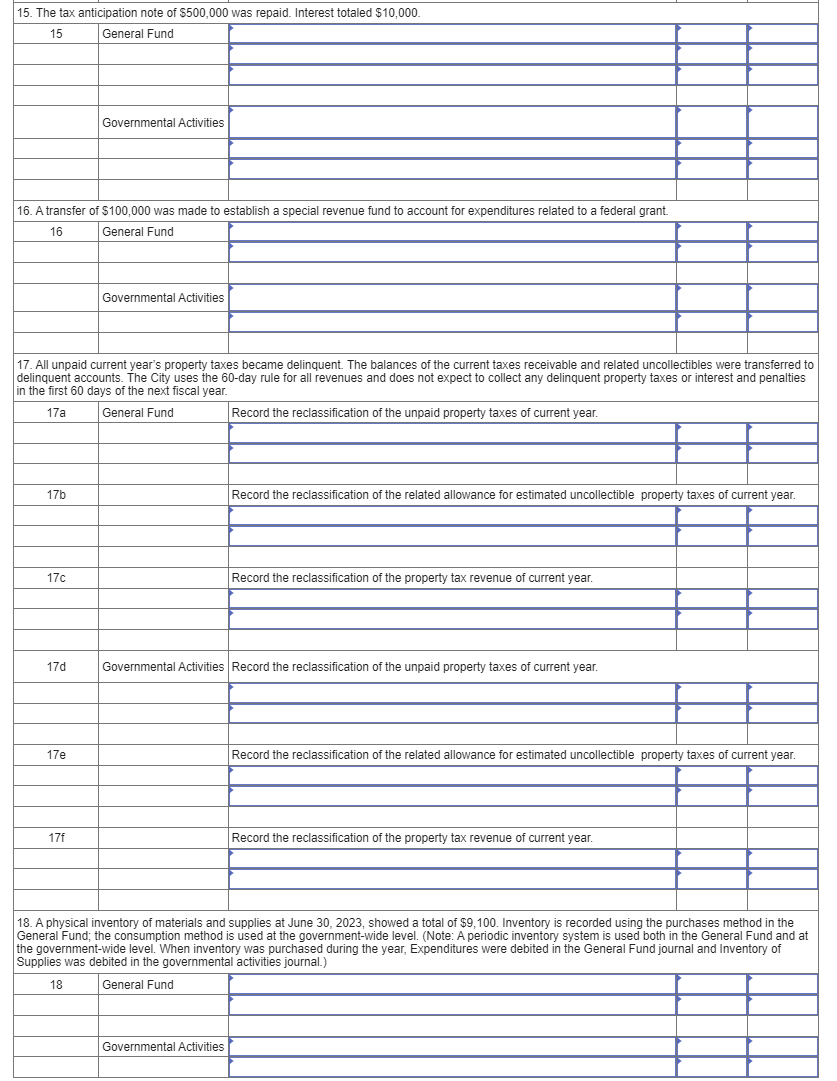

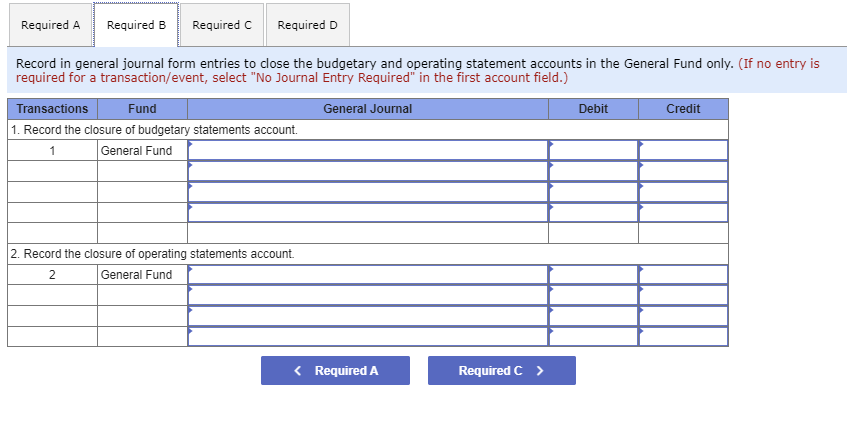

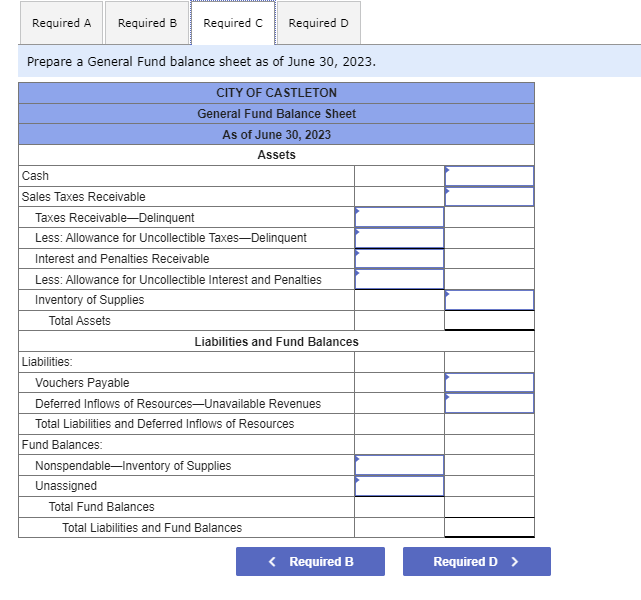

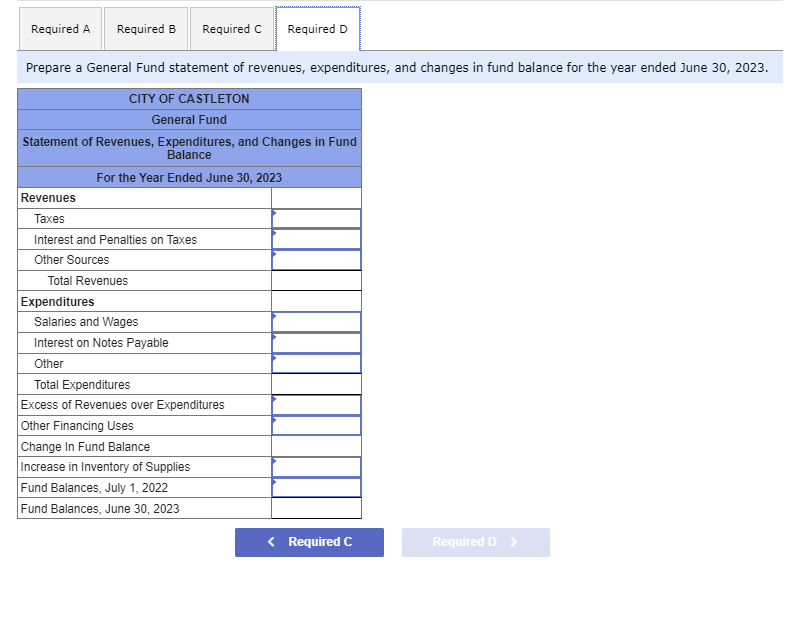

a. Record the effect of the following transactions on the General Fund and governmental activities for the year ended June 30, 2023. b. Record in general journal form entries to close the budgetary and operating statement accounts in the General Fund only. c. Prepare a General Fund balance sheet as of June 30, 2023. d. Prepare a General Fund statement of revenues, expenditures, and changes in fund balance for the year ended June 30, 2023. Complete this question by entering your answers in the tabs below. e of functional red. (If no 10. The employer's FICA tax liability was recorded for $62,690. 10 \begin{tabular}{|l|} \hline General Fund \\ \hline Governmental Activities \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} 11. Cash collections from sales taxes totaled $825,000 and from revenue sources other than taxes were $110,000. In addition, sales taxes receivable due July 1 were accrued in the amount of $12,000. Record in general journal form entries to close the budgetary and operating statement accounts in the General Fund only. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Prepare a General Fund balance sheet as of June 30. 2023. Prepare a General Fund statement of revenues, expenditures, and changes in fund balance for the year ended June 30, 2023. a. Record the effect of the following transactions on the General Fund and governmental activities for the year ended June 30, 2023. b. Record in general journal form entries to close the budgetary and operating statement accounts in the General Fund only. c. Prepare a General Fund balance sheet as of June 30, 2023. d. Prepare a General Fund statement of revenues, expenditures, and changes in fund balance for the year ended June 30, 2023. Complete this question by entering your answers in the tabs below. e of functional red. (If no 10. The employer's FICA tax liability was recorded for $62,690. 10 \begin{tabular}{|l|} \hline General Fund \\ \hline Governmental Activities \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} 11. Cash collections from sales taxes totaled $825,000 and from revenue sources other than taxes were $110,000. In addition, sales taxes receivable due July 1 were accrued in the amount of $12,000. Record in general journal form entries to close the budgetary and operating statement accounts in the General Fund only. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Prepare a General Fund balance sheet as of June 30. 2023. Prepare a General Fund statement of revenues, expenditures, and changes in fund balance for the year ended June 30, 2023

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started