Answered step by step

Verified Expert Solution

Question

1 Approved Answer

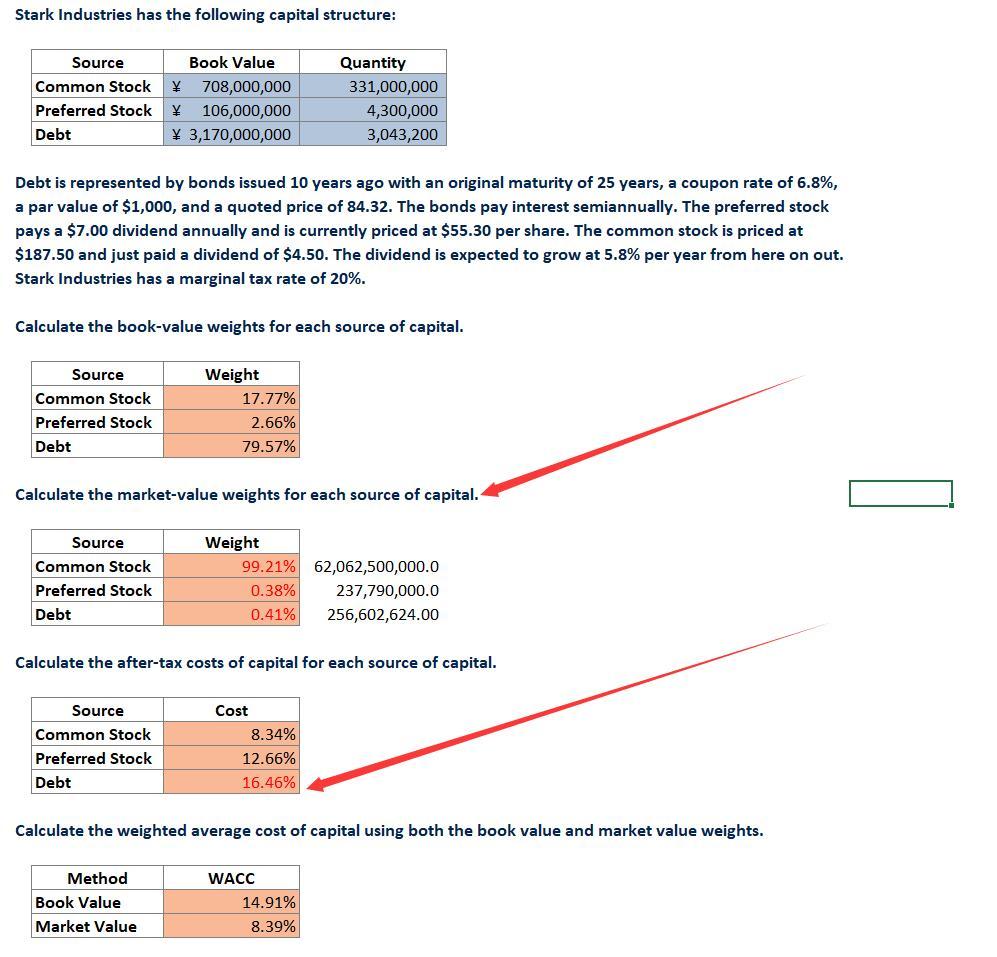

l can't get those right. l need the whole process on excel thank you. The red means wrong. Stark Industries has the following capital structure:

l can't get those right. l need the whole process on excel thank you. The red means wrong.

Stark Industries has the following capital structure: Source Common Stock Preferred Stock Debt Book Value \ 708,000,000 106,000,000 3,170,000,000 Quantity 331,000,000 4,300,000 3,043,200 Debt is represented by bonds issued 10 years ago with an original maturity of 25 years, a coupon rate of 6.8%, a par value of $1,000, and a quoted price of 84.32. The bonds pay interest semiannually. The preferred stock pays a $7.00 dividend annually and is currently priced at $55.30 per share. The common stock is priced at $187.50 and just paid a dividend of $4.50. The dividend is expected to grow at 5.8% per year from here on out. Stark Industries has a marginal tax rate of 20%. Calculate the book-value weights for each source of capital. Source Common Stock Preferred Stock Debt Weight 17.77% 2.66% 79.57% Calculate the market value weights for each source of capital. Source Common Stock Preferred Stock Debt Weight 99.21% 62,062,500,000.0 0.38% 237,790,000.0 0.41% 256,602,624.00 Calculate the after-tax costs of capital for each source of capital. Cost Source Common Stock Preferred Stock Debt 8.34% 12.66% 16.46% Calculate the weighted average cost of capital using both the book value and market value weights. Method Book Value Market Value WACC 14.91% 8.39%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started