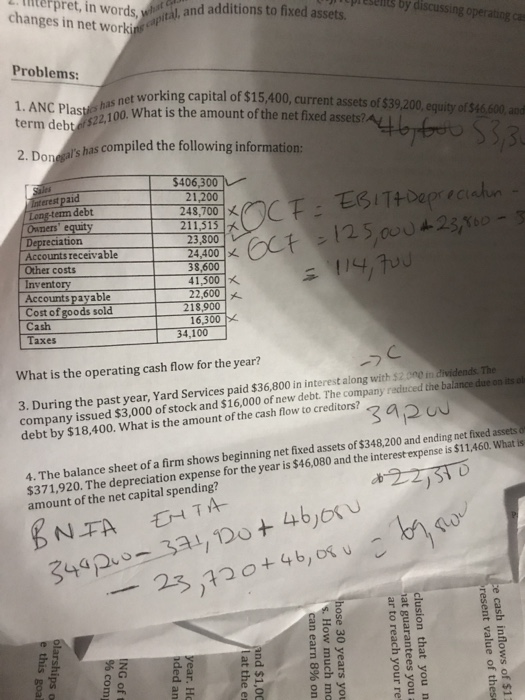

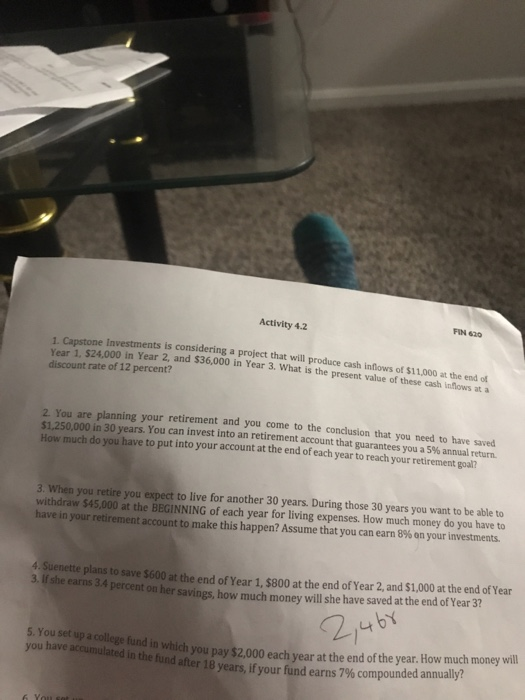

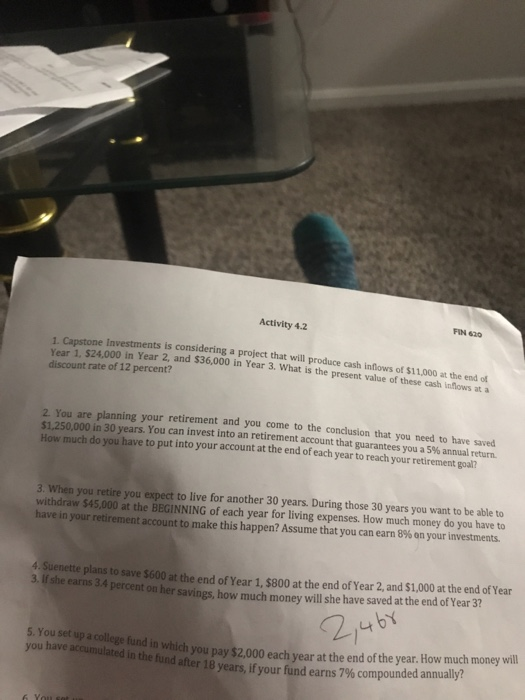

L. er changes in net worki pret, in words, wital, and additions to fixed assets. by Problems 1.ANC Plas 2100. What is the amount of the net fixed assets? 2. Dond al's has compiled the following information: net working capital of $15,400, current assets of $39,200 equity of $46,600, and 406,300 1,2 243,700 erest paid em debt Oaners' equity 211,515 z eciation 23,800 24,400 38,600 41,300 22,600 Accounts receivable Other costs Inventory Cr 125,0004 Accounts payable Cost of goods sold Cash Taxes 16,300 X 34,100 What is the operating cash flow for the year? 3. During the past year, Yard Services paid $36,800 in interest along with $2000 im dividends The company issued $3,000 of stock and $16,000 of new debt. The company reduced the balance due on its ol debt by $18,400. What is the amount of the cash flow to creditors? $371,920. The depreciation expense for the year is $46,080 and the interest expense is $11.460. What s amount of the net capital spending? 4. The balance sheet of a firm shows beginning net fixed assets of $348,200 and ending net fixed assets o 3440 FIN 620 Activity 4.2 1. Capstone Investments is considering a project that will produce cash inflows of $11,000 at the end of Year 1, S24,000 in Year 2, and $36,000 in Year 3. What is the present value of these cash inflows at a discount rate of 12 percent? 2 You are planning yo $1,250,000 in 30 years. You can invest into an retirement account that How much do you have to put into your account at the end of each year to reach your retirement go ur retirement and you come to the conclusion that you need to have saved guarantees you a 5% annual return. l? 3. When you retire you expect to live for another 30 years. During those 30 years you want to be able to withdraw $45,000 at the BEGINNING of each year for living expenses. How much money do you have to have in your retirement account to make this happen? Assume that you can earn 8% on your investments. 4. Suenette plans to save $600 at the end of Year 1, $800 at the end of Year 2, and $1,000 at the end of Year e arns 34 percent on her savings, how much money will she have saved at the end of Year 3? bt 5. You set up a college fund in whi you have accumulated in the fund ch you pay $2,000 each year at the end of the year. How much money will after 18 ye ars, ifyour fund earns 7% cornpounded annually