Answered step by step

Verified Expert Solution

Question

1 Approved Answer

L i. The following information is provided for Taqwa Bhd. 1. 2. 3. 4. Year ended 31 December 2018: The issued capital of Taqwa

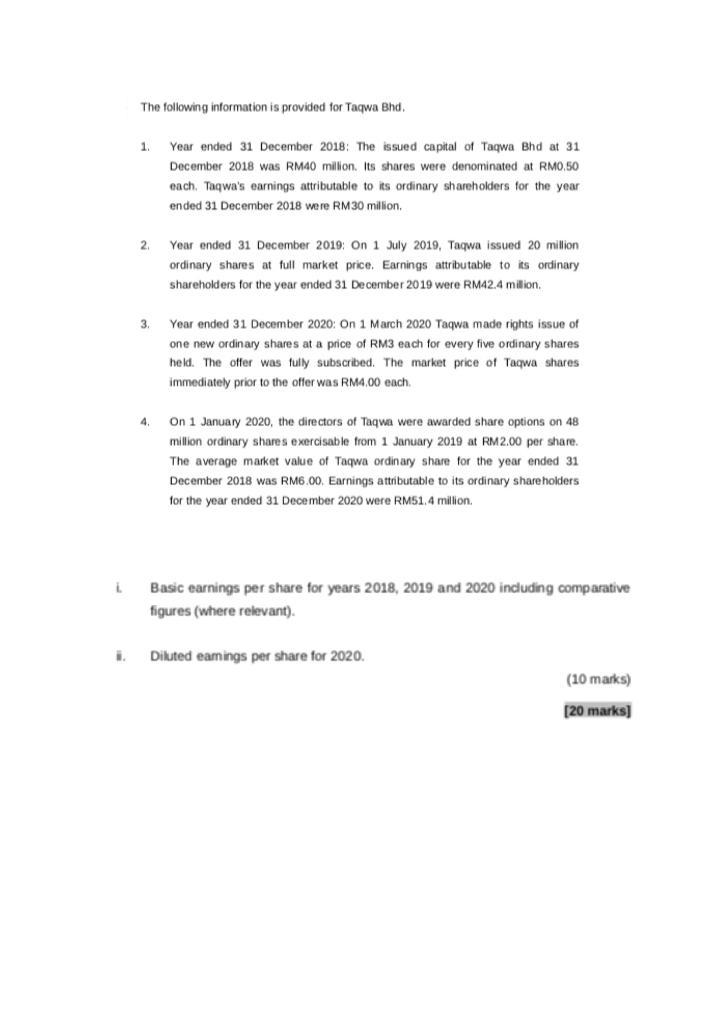

L i. The following information is provided for Taqwa Bhd. 1. 2. 3. 4. Year ended 31 December 2018: The issued capital of Taqwa Bhd at 31 December 2018 was RM40 million. Its shares were denominated at RM0.50 each. Taqwa's earnings attributable to its ordinary shareholders for the year ended 31 December 2018 were RM30 million. Year ended 31 December 2019: On 1 July 2019, Taqwa issued 20 million ordinary shares at full market price. Earnings attributable to its ordinary shareholders for the year ended 31 December 2019 were RM42.4 million. Year ended 31 December 2020: On 1 March 2020 Taqwa made rights issue of one new ordinary shares at a price of RM3 each for every five ordinary shares held. The offer was fully subscribed. The market price of Taqwa shares immediately prior to the offer was RM4.00 each. On 1 January 2020, the directors of Taqwa were awarded share options on 48 million ordinary shares exercisable from 1 January 2019 at RM2.00 per share. The market value of Taqwa ordinary share for the year ended 31 December 2018 was RM6.00. Earnings attributable to its ordinary shareholders for the year ended 31 December 2020 were RM51.4 million. Basic earnings per share for years 2018, 2019 and 2020 including comparative figures (where relevant). Diluted eamings per share for 2020. (10 marks) [20 marks]

Step by Step Solution

★★★★★

3.62 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Basic Earnings Per Share EPS for 2018 EPS Earnings Attributable to Ordinary Shareholders Weighte...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started