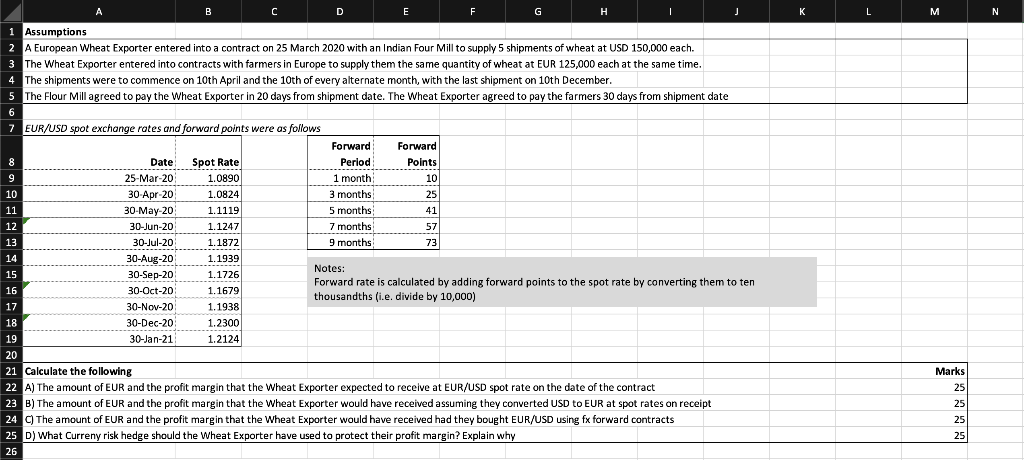

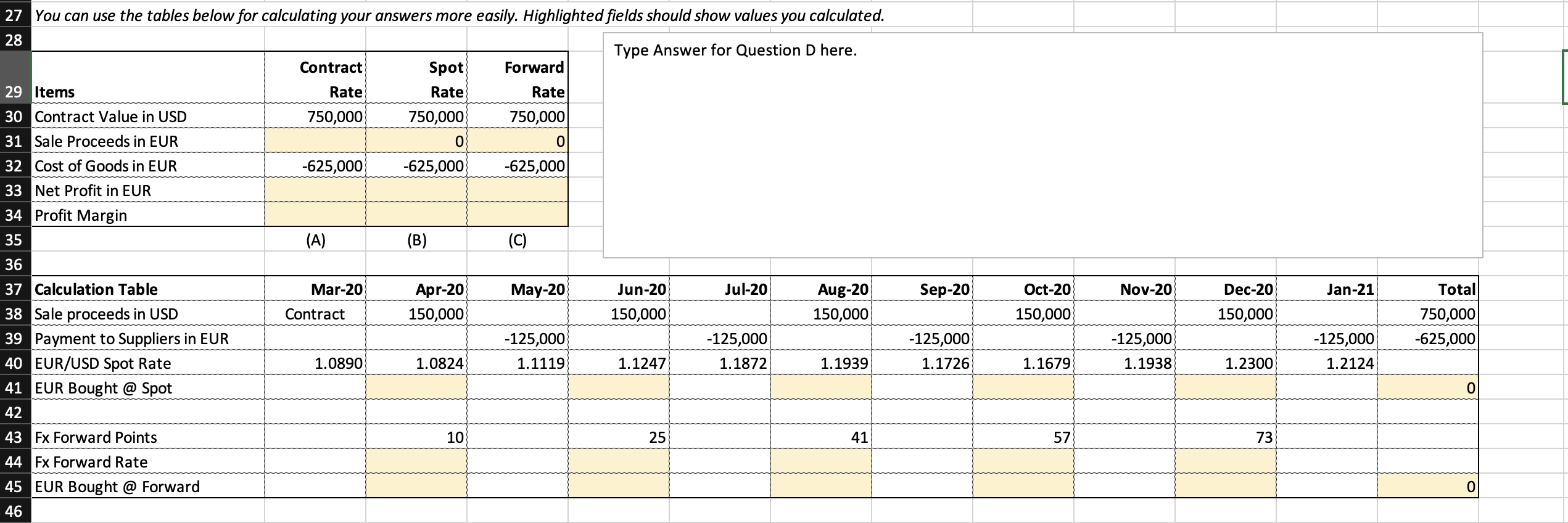

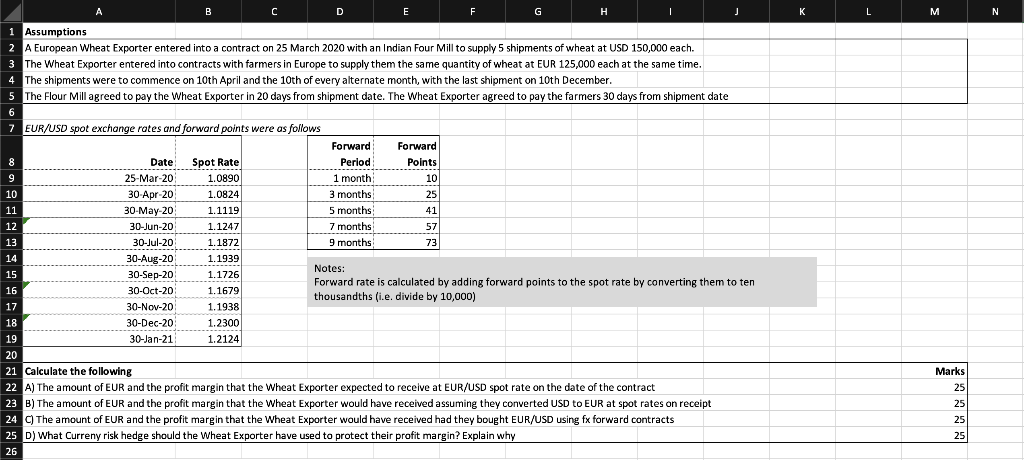

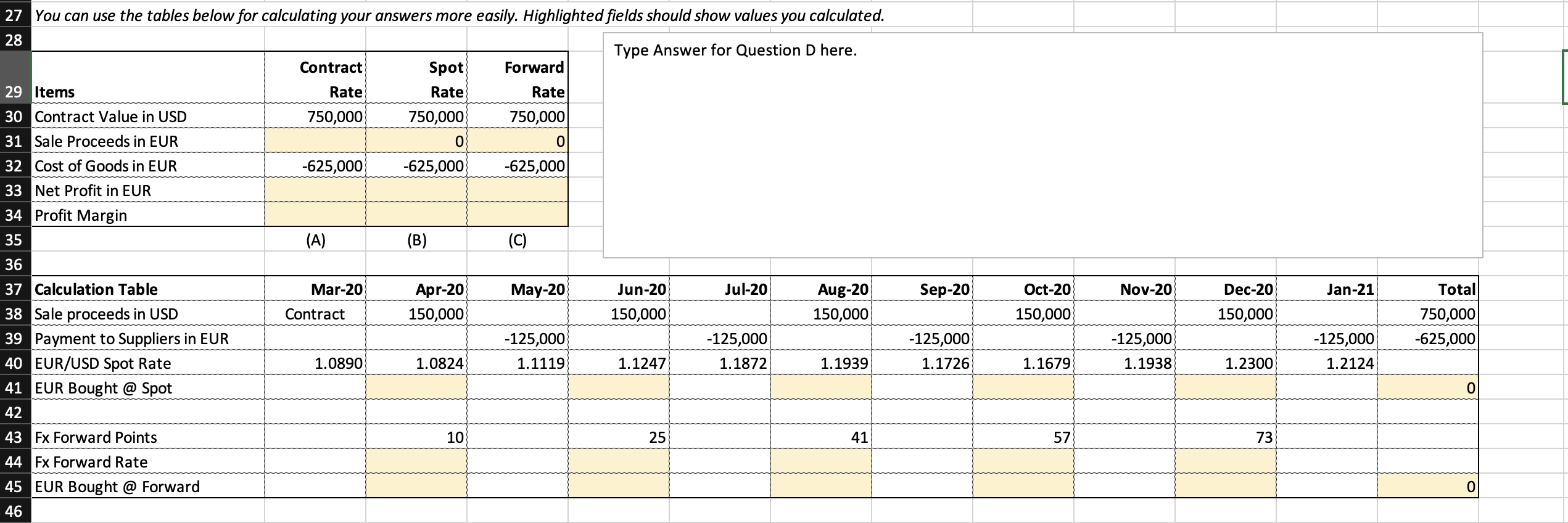

L . N A D E F G H J 1 Assumptions A European Wheat Exporter entered into a contract on 25 March 2020 with an Indian Four Mill to supply 5 shipments of wheat at USD 150,000 each. 3 The Wheat Exporter entered into contracts with farmers in Europe to supply them the same quantity of wheat at EUR 125,000 each at the same time. The shipments were to commence on 10th April and the 10th of every alternate month, with the last shipment on 10th December. 5 The Flour Mill agreed to pay the Wheat Exporter in 20 days from shipment date. The Wheat Exporter agreed to pay the farmers 30 days from shipment date 6 7 EUR/USD spot exchange rates and forward points were as follows Forward Forward 8 Date Spot Rate Period Points 9 25-Mar-20 1.0890 1 month 10 10 30 Apr 20 1.0824 3 months 25 499 11 30-May-20 1.1119 5 months 41 12 an 30-Jun-20 1.1247 7 months 57 13 30-Jul-20 1.1872 9 months 73 14 30-Aug-20 1.1939 ***** Notes: 15 30-Sep-20 1.1726 Forward rate is calculated by adding forward points to the spot rate by converting them to ten 16 30-Oct-20 1.1679 thousandths (ie divide by 10,000) 17 20 N 30-Nov-20 1.1938 18 30-Dec-20 1.2300 19 30-Jan-21 1.2124 20 21 Calculate the following 22 A) The amount of EUR and the profit margin that the Wheat Exporter expected to receive at EUR/USD spot rate on the date of the contract 23 B) The amount of EUR and the profit margin that the Wheat Exporter would have received assuming they converted USD to EUR at spot rates on receipt 24 ) The amount of EUR and the profit margin that the Wheat Exporter would have received had they bought EUR/USD using fx forward contracts 25 D) What Curreny risk hedge should the Wheat Exporter have used to protect their profit margin? Explain why 26 Marks 25 25 25 25 27 You can use the tables below for calculating your answers more easily. Highlighted fields should show values you calculated. 28 Type Answer for Question D here. Contract 29 Items Rate Spot Rate 750,000 30 Contract Value in USD 750,000 Forward Rate 750,000 0 -625,000 31 Sale Proceeds in EUR 0 32 Cost of Goods in EUR -625,000 -625,000 33 Net Profit in EUR 34 Profit Margin 35 (A) (B) (C) 36 May-20 Jul-20 Sep-20 Nov-20 Dec-20 Jan-21 Mar-20 Contract Apr-20 150,000 Jun-20 150,000 Aug-20 150,000 Oct-20 150,000 150,000 Total 750,000 -625,000 -125,000 1.1119 -125,000 1.1872 -125,000 1.1726 -125,000 1.1938 -125,000 1.2124 1.0890 1.0824 1.1247 1.1939 1.1679 1.2300 37 Calculation Table 38 Sale proceeds in USD 39 Payment to Suppliers in EUR 40 EUR/USD Spot Rate 41 EUR Bought @ Spot 42 43 Fx Forward Points 44 Fx Forward Rate 45 EUR Bought @ Forward 0 10 25 41 57 73 0 46 L . N A D E F G H J 1 Assumptions A European Wheat Exporter entered into a contract on 25 March 2020 with an Indian Four Mill to supply 5 shipments of wheat at USD 150,000 each. 3 The Wheat Exporter entered into contracts with farmers in Europe to supply them the same quantity of wheat at EUR 125,000 each at the same time. The shipments were to commence on 10th April and the 10th of every alternate month, with the last shipment on 10th December. 5 The Flour Mill agreed to pay the Wheat Exporter in 20 days from shipment date. The Wheat Exporter agreed to pay the farmers 30 days from shipment date 6 7 EUR/USD spot exchange rates and forward points were as follows Forward Forward 8 Date Spot Rate Period Points 9 25-Mar-20 1.0890 1 month 10 10 30 Apr 20 1.0824 3 months 25 499 11 30-May-20 1.1119 5 months 41 12 an 30-Jun-20 1.1247 7 months 57 13 30-Jul-20 1.1872 9 months 73 14 30-Aug-20 1.1939 ***** Notes: 15 30-Sep-20 1.1726 Forward rate is calculated by adding forward points to the spot rate by converting them to ten 16 30-Oct-20 1.1679 thousandths (ie divide by 10,000) 17 20 N 30-Nov-20 1.1938 18 30-Dec-20 1.2300 19 30-Jan-21 1.2124 20 21 Calculate the following 22 A) The amount of EUR and the profit margin that the Wheat Exporter expected to receive at EUR/USD spot rate on the date of the contract 23 B) The amount of EUR and the profit margin that the Wheat Exporter would have received assuming they converted USD to EUR at spot rates on receipt 24 ) The amount of EUR and the profit margin that the Wheat Exporter would have received had they bought EUR/USD using fx forward contracts 25 D) What Curreny risk hedge should the Wheat Exporter have used to protect their profit margin? Explain why 26 Marks 25 25 25 25 27 You can use the tables below for calculating your answers more easily. Highlighted fields should show values you calculated. 28 Type Answer for Question D here. Contract 29 Items Rate Spot Rate 750,000 30 Contract Value in USD 750,000 Forward Rate 750,000 0 -625,000 31 Sale Proceeds in EUR 0 32 Cost of Goods in EUR -625,000 -625,000 33 Net Profit in EUR 34 Profit Margin 35 (A) (B) (C) 36 May-20 Jul-20 Sep-20 Nov-20 Dec-20 Jan-21 Mar-20 Contract Apr-20 150,000 Jun-20 150,000 Aug-20 150,000 Oct-20 150,000 150,000 Total 750,000 -625,000 -125,000 1.1119 -125,000 1.1872 -125,000 1.1726 -125,000 1.1938 -125,000 1.2124 1.0890 1.0824 1.1247 1.1939 1.1679 1.2300 37 Calculation Table 38 Sale proceeds in USD 39 Payment to Suppliers in EUR 40 EUR/USD Spot Rate 41 EUR Bought @ Spot 42 43 Fx Forward Points 44 Fx Forward Rate 45 EUR Bought @ Forward 0 10 25 41 57 73 0 46