Answered step by step

Verified Expert Solution

Question

1 Approved Answer

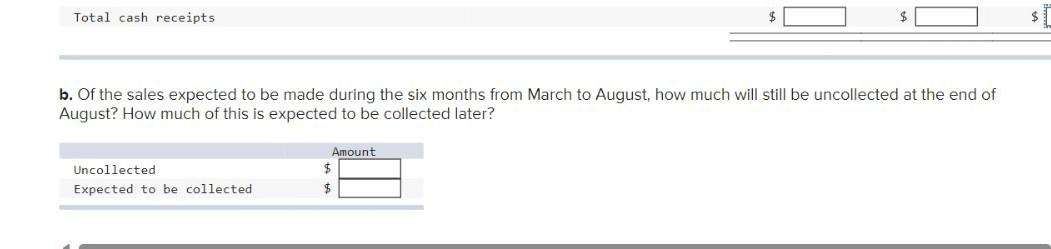

l Of the sales expected to be made during the six months from March to August, how much will still be uncollected at the end

l

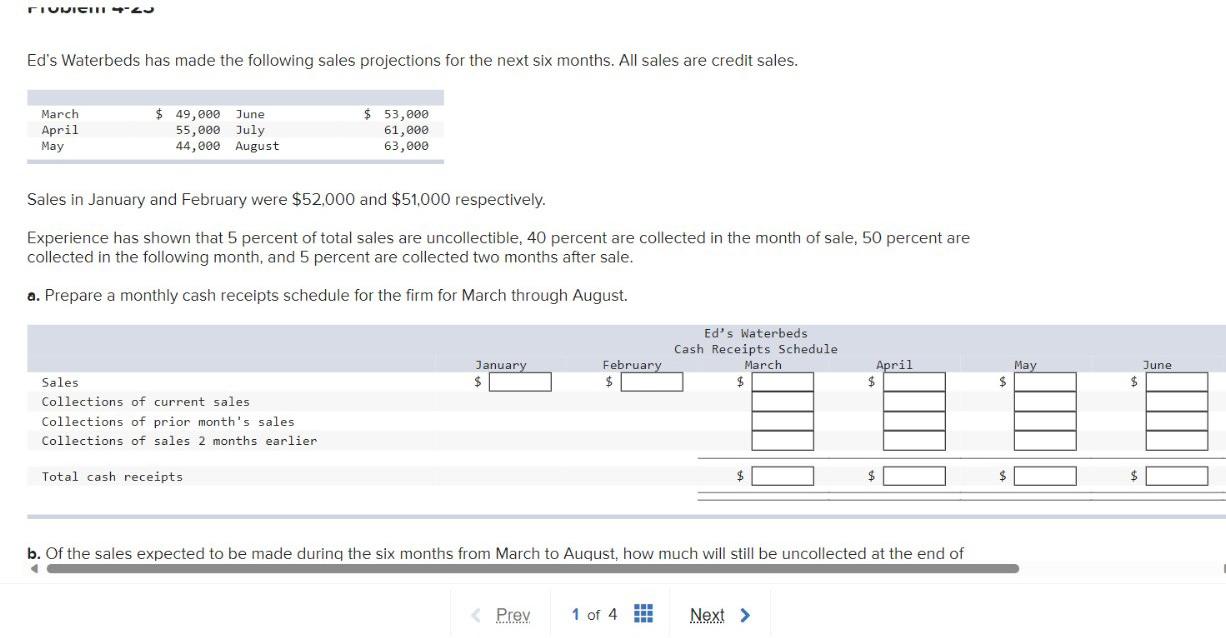

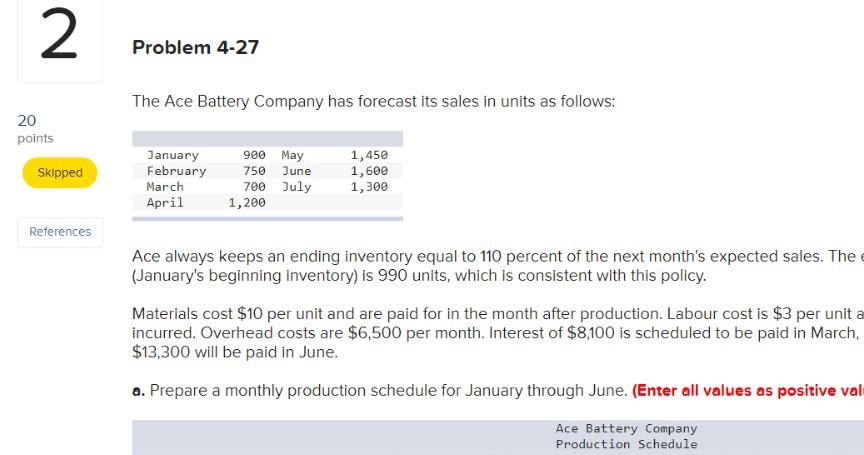

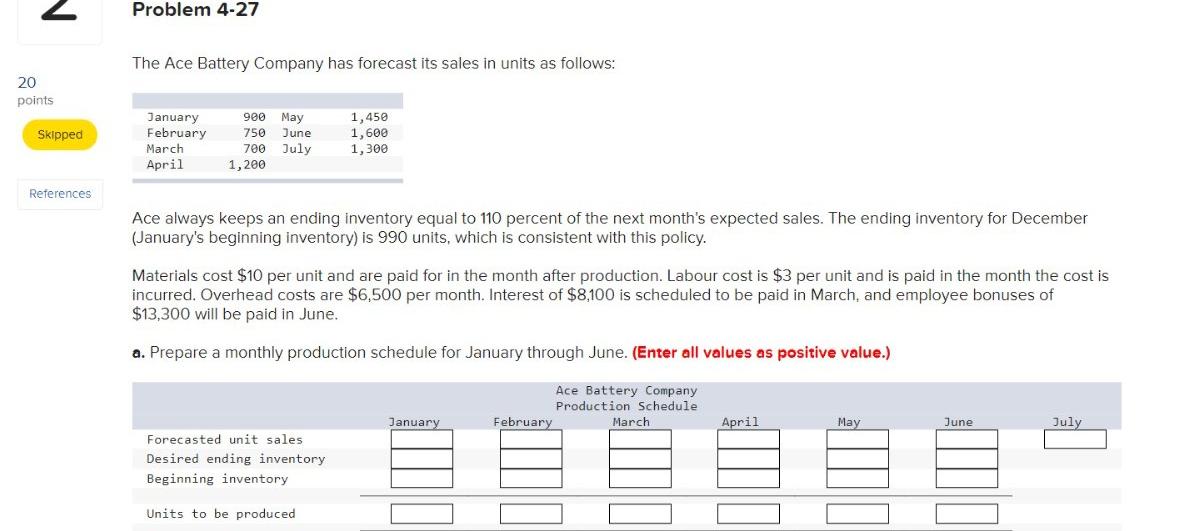

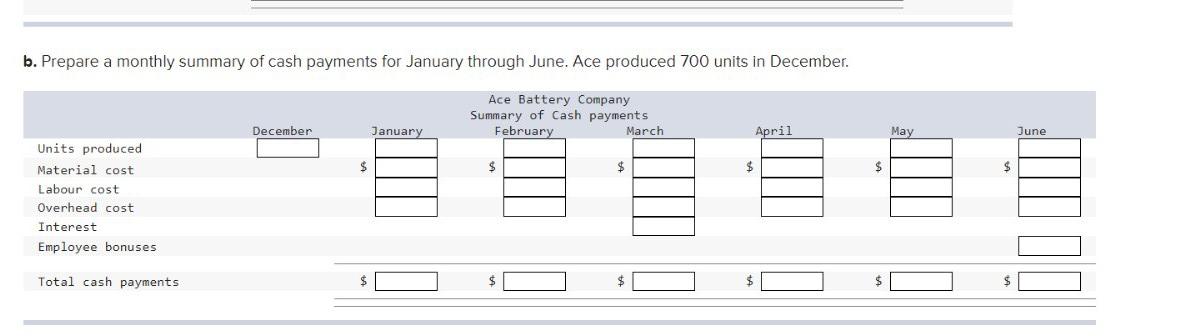

Of the sales expected to be made during the six months from March to August, how much will still be uncollected at the end of August? How much of this is expected to be collected later? b. Prepare a monthly summary of cash payments for January through June. Ace produced 700 units in December. Ed's Waterbeds has made the following sales projections for the next six months. All sales are credit sales. Sales in January and February were $52,000 and $51,000 respectively. Experience has shown that 5 percent of total sales are uncollectible, 40 percent are collected in the month of sale, 50 percent are collected in the following month, and 5 percent are collected two months after sale. a. Prepare a monthly cash receipts schedule for the firm for March through August. The Ace Battery Company has forecast its sales in units as follows: Ace always keeps an ending inventory equal to 110 percent of the next month's expected sales. The ending inventory for December (January's beginning inventory) is 990 units, which is consistent with this policy. Materials cost $10 per unit and are paid for in the month after production. Labour cost is $3 per unit and is paid in the month the cost is incurred. Overhead costs are $6,500 per month. Interest of $8,100 is scheduled to be paid in March, and employee bonuses of $13,300 will be paid in June. a. Prepare a monthly production schedule for January through June. (Enter all values as positive value.) The Ace Battery Company has forecast its sales in units as follows: Ace always keeps an ending inventory equal to 110 percent of the next month's expected sales. The (January's beginning inventory) is 990 units, which is consistent with this policy. Materials cost $10 per unit and are paid for in the month after production. Labour cost is $3 per unit incurred. Overhead costs are $6,500 per month. Interest of $8,100 is scheduled to be paid in March, $13,300 will be paid in June. a. Prepare a monthly production schedule for January through June. (Enter all values as positive val

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started