Answered step by step

Verified Expert Solution

Question

1 Approved Answer

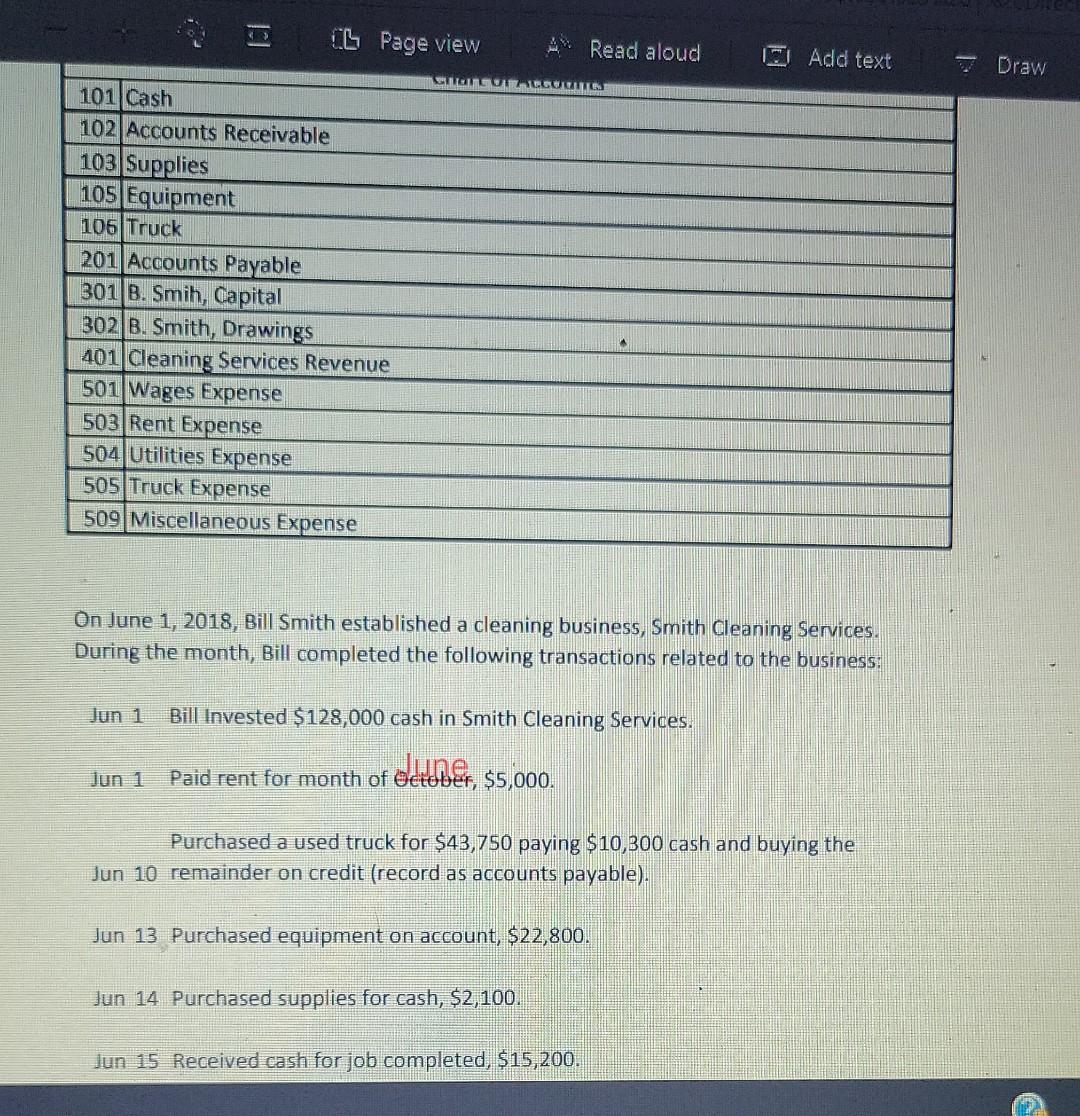

L Page view Read aloud Add text Draw SUCC 101 Cash 102 Accounts Receivable 103 Supplies 105 Equipment 106 Truck 201 Accounts Payable 301 B.

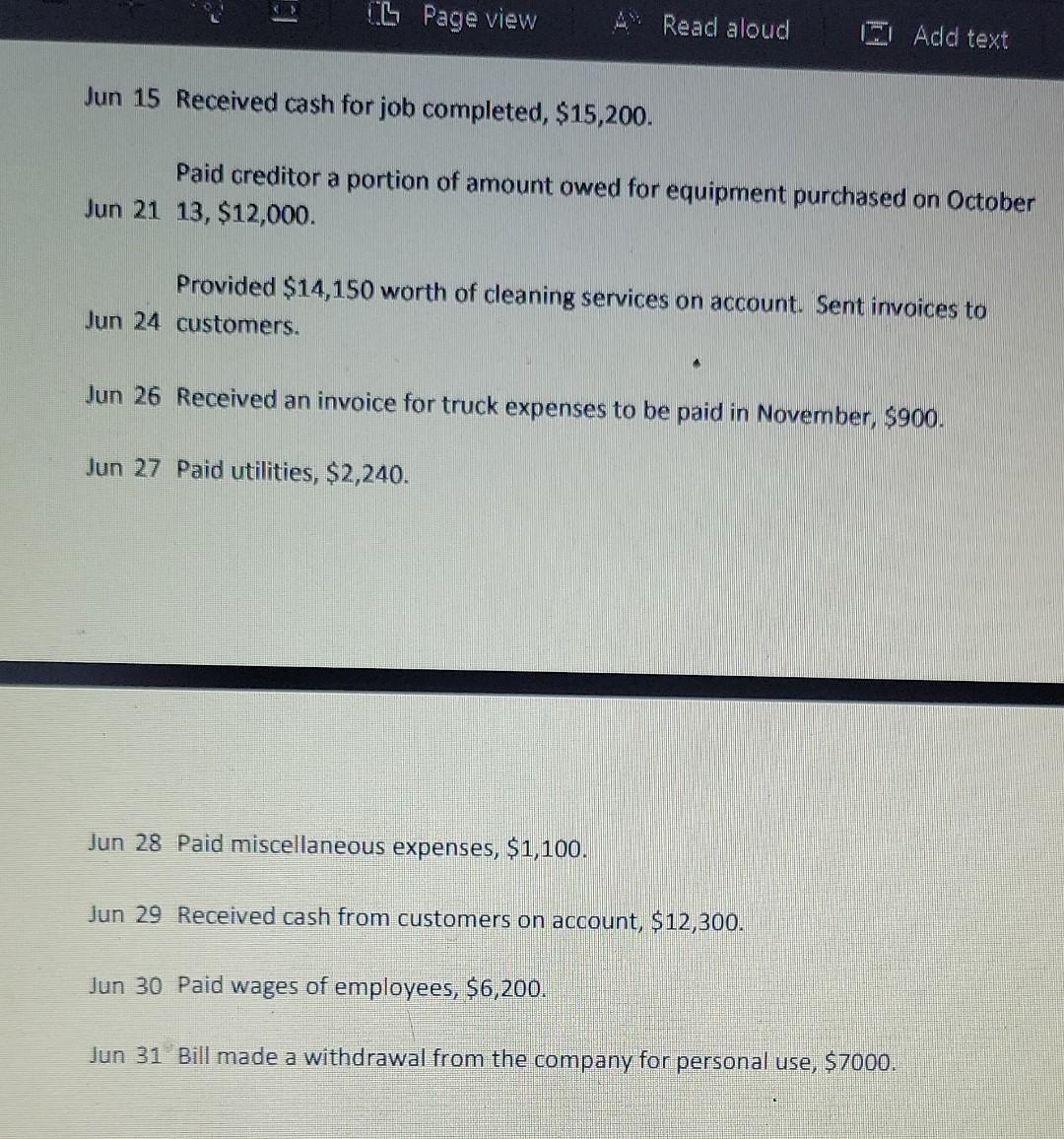

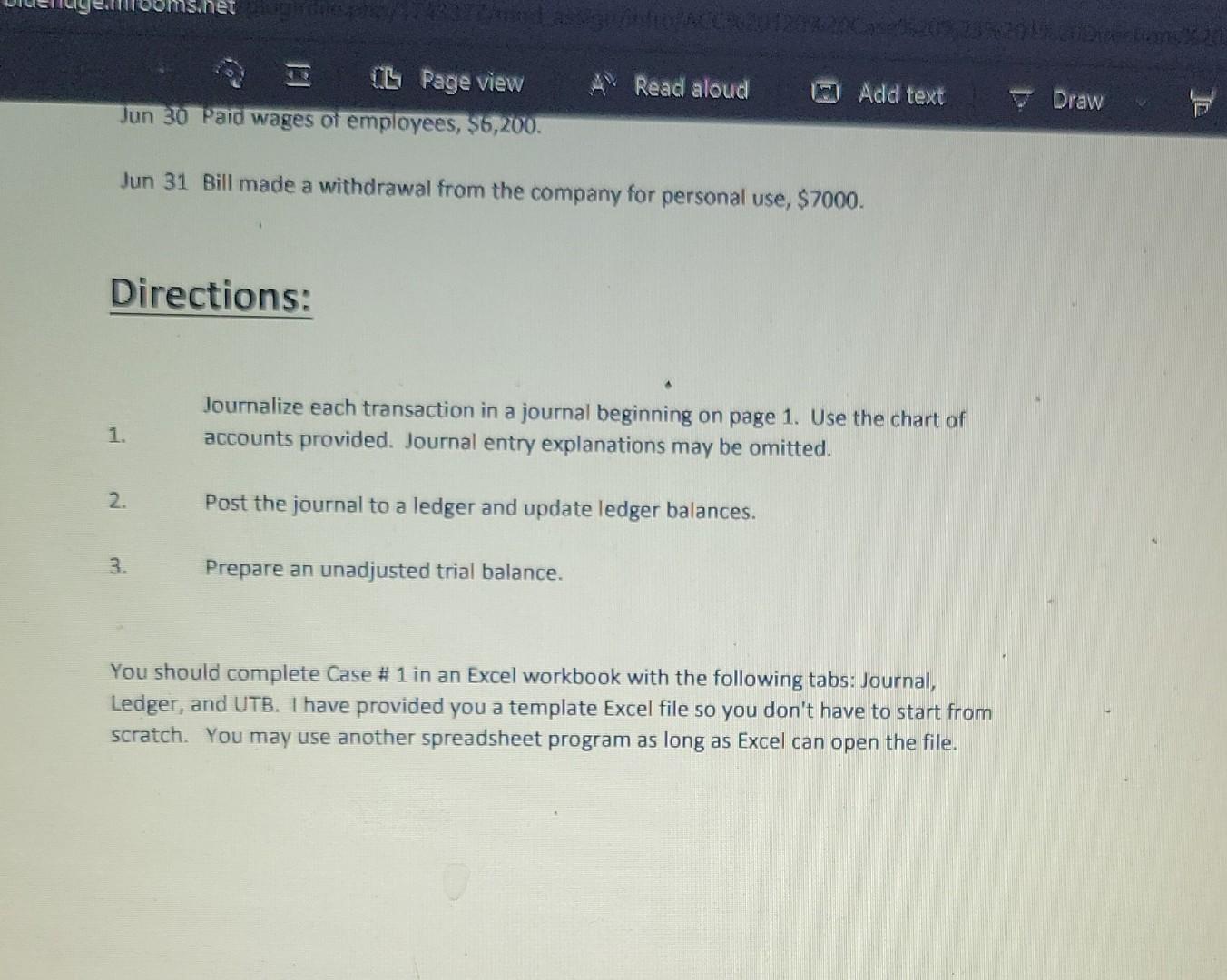

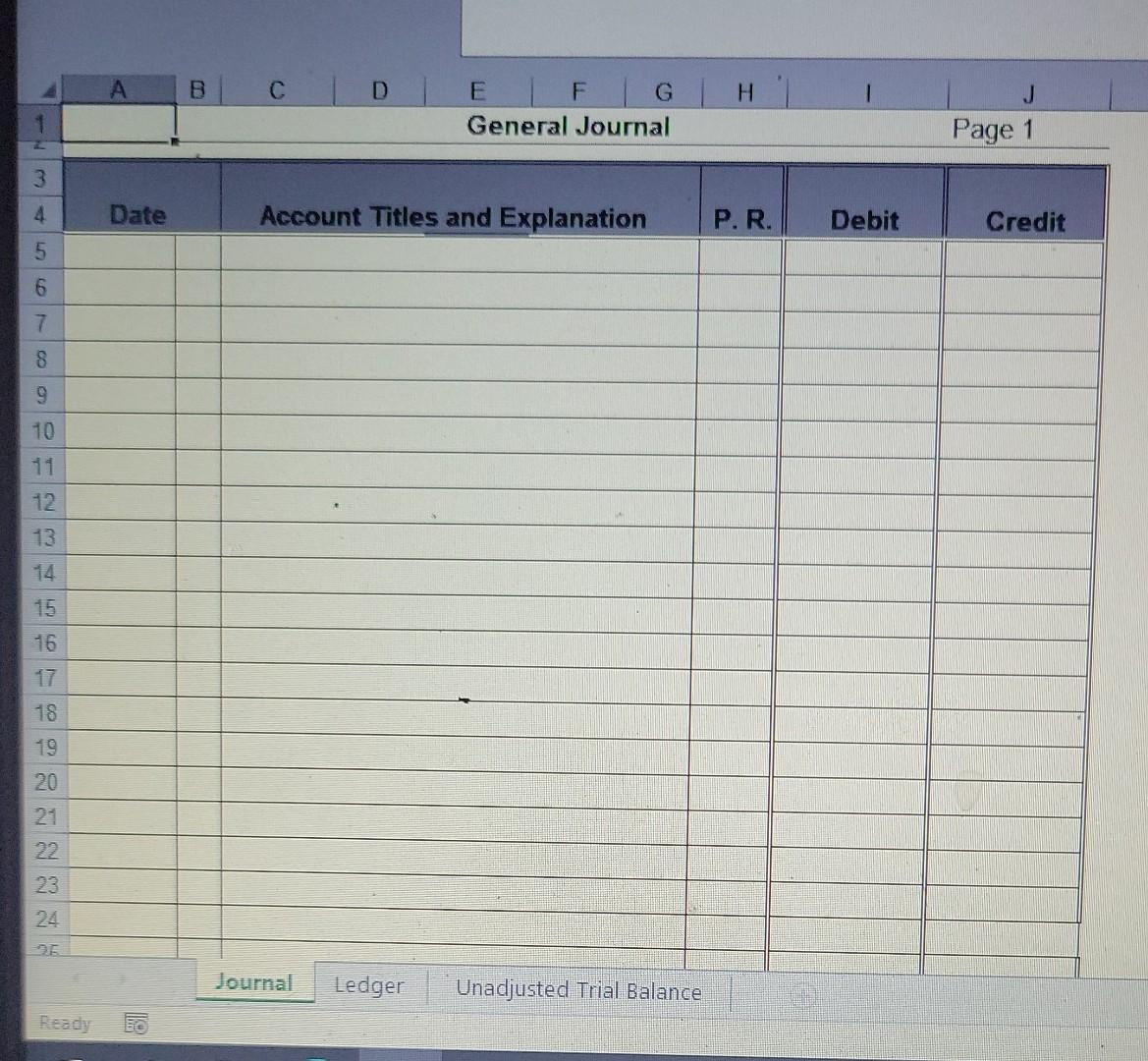

L Page view Read aloud Add text Draw SUCC 101 Cash 102 Accounts Receivable 103 Supplies 105 Equipment 106 Truck 201 Accounts Payable 301 B. Smih, Capital 302 B. Smith, Drawings 401 Cleaning Services Revenue 501 Wages Expense 503 Rent Expense 504 Utilities Expense 505 Truck Expense 509 Miscellaneous Expense On June 1, 2018, Bill Smith established a cleaning business, Smith Cleaning Services. During the month, Bill completed the following transactions related to the business: Jun 1 Bill Invested $128,000 cash in Smith Cleaning Services. jun 1 Paid rent for month of October, $5,000. Purchased a used truck for $43,750 paying $10,300 cash and buying the Jun 10 remainder on credit (record as acc unts payable) Jun 13 Purchased equipment on account, $22,800. Jun 14 Purchased supplies for cash, $2,100. Jun 15 Received cash for job completed, $15,200. L Page view Read aloud Add text Jun 15 Received cash for job completed, $15,200. Paid creditor a portion of amount owed for equipment purchased on October Jun 21 13, $12,000. Provided $14,150 worth of cleaning services on account. Sent invoices to Jun 24 customers. Jun 26 Received an invoice for truck expenses to be paid in November, $900. Jun 27 Paid utilities, $2,240. Jun 28 Paid miscellaneous expenses, $1,100. Jun 29 Received cash from customers on account, $12,300. Jun 30 Paid wages of employees, $6,200. Jun 31 Bill made a withdrawal from the company for personal use, $7000. ns.net ci L Page view Jun 30 Paid wages of employees, $6,200. Read aloud Add text Draw [ Jun 31 Bill made a withdrawal from the company for personal use, $ 7000. Directions: Journalize each transaction in a journal beginning on page 1. Use the chart of accounts provided. Journal entry explanations may be omitted. 1. 2. Post the journal to a ledger and update ledger balances. 3. Prepare an unadjusted trial balance. You should complete Case # 1 in an Excel workbook with the following tabs: Journal, Ledger, and UTB. I have provided you a template Excel file so you don't have to start from scratch. You may use another spreadsheet program as long as Excel can open the file. A BICIDI E F G H General Journal Page 1 3 4 Date Account Titles and Explanation P.R. Debit Credit 5 6 7 8 9 10 12 13 14 15 16 17 18 19 20 21 23 24 96 Journal Ledger Unadjusted Trial Balance Ready

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started