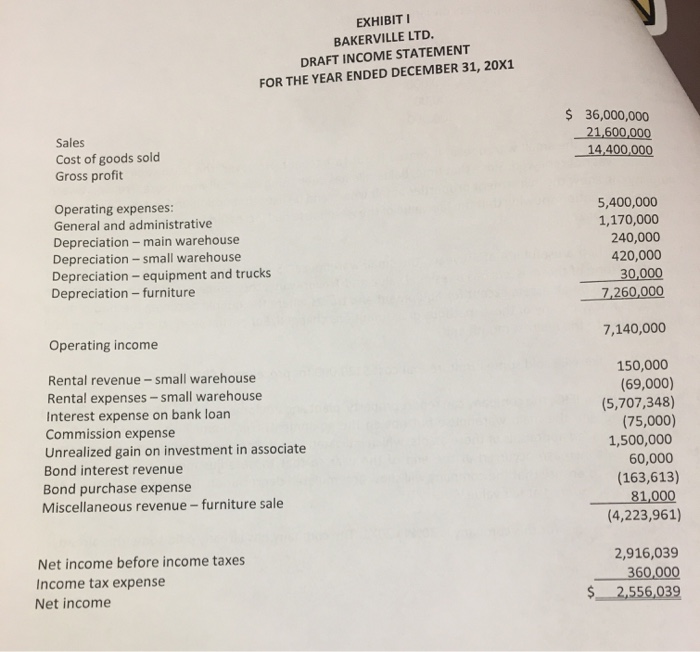

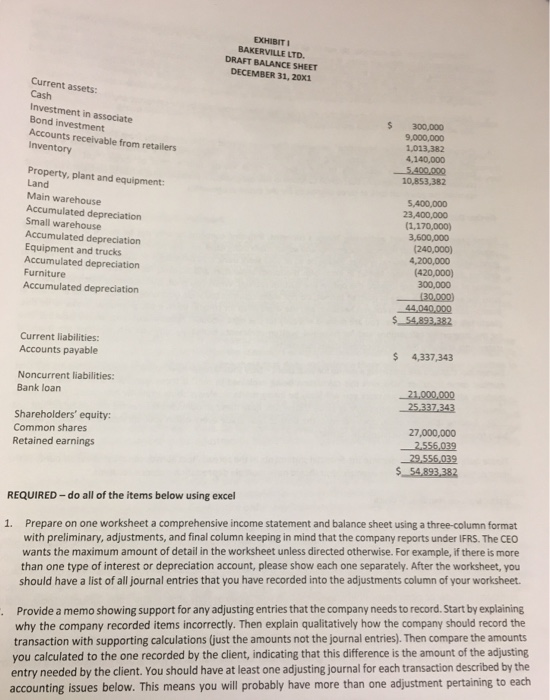

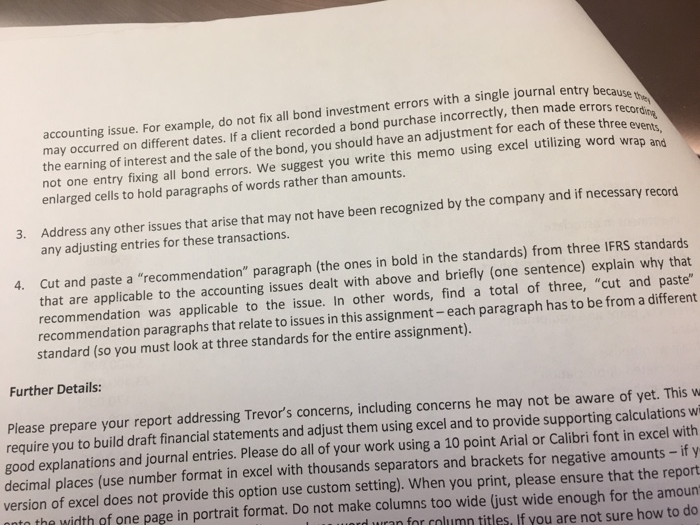

l PART ONE: an entrepreneur who incorporated Bakerville Ltd. in Canada in 20x1. The company (which term loan with a principal balance of $21,000,000. The loan bears interest at 4% per Trevor Carr was under IFRS), and obtained cash from a bank on Januar formed on January 1, 20x1 issued common shares to Trevor 20X1 with a 4-year requires 30 and Dec si each year and a requirement to maintain a current ratio of 1.5:1 or higher based on year-end company has made all of its loan payments on time. The company manufactures and erly blended loan payments consisting of both principal and interest on March 31, June 30, September ancial statements. The wholesales oilfield tools. Bakerville has a small th stated correctly because he and he is concerned that the draft financial statements t accounting staff that recorded transactions throughout the year. Trevor knows that cash is has done the bank reconciliation but he was unable to hire a professionally trained CFO hat his staff have prepared (Exhibit 1) may have errors. Trevor has hired you to correct any accounting errors made by his staff. He wants to showing the financial statement preliminary amounts, adjustments and receive from you a memo final balances along with the list of journal the company must make to "fix" the financial statements. He needs you to include in the memo, explanations entre nd numerical support for these adjustments including reasons why the draft financial statements were in error. H wants the maximum amount of detail in the financial statements. For example, if there is more than one type of interest or depreciation account, please show each one separately. More details on how to document your work are below Trevor has provided you with the following information: Bakerville has been using some of its excess cash to make investments during the year. Before Trevor started Bakerville, he did some consulting work for Edgemont Ltd., a publicly traded company. Edgemont is now one of Bakerville's biggest customers and the management of that company invited Bakerville to purchase some of its outstanding shares and agreed to put Trevor on their board of directors. Bakerville purchased 750,000 common shares of Edgemont on January 1, 20X1 when the shares were trading at $10 each. Brokers charged commissions on the purchase of these shares of $75,000. When Bakerville purchased its shares in Edgemont, that company had assets of $36,000,000 and liabilities of $20,000,000 on its balance sheet. At that time, the fair value of the assets was $6,000,000 higher than the amount shown on the balance sheet because the fair value of a building with a 20- year remaining life exceeded its carrying amount. By December 31, the shares were trading at $12 each. For the year ending December 31, 20X1 Edgemont reported net income of $3,000,000. On December 20, Edgemont declared an annual dividend of $0.60 per common share, payable on all of its 2,000,000 outstanding common shares in early 20x2. Bakerville also invested in 6-year bonds with a maturity value of $3,000,000 on July 1, 20x1. The bonds earn interes bond interest twice per year on June 30 and December 31 commencing in December 20X1. Bakerville plans to trade at stated rate of 4% on an annual basis and mature on June 30, 20X7 but the company receives cash relating to the these bonds actively. When Bakerville bought these bonds, interest rates in the market were at continued to fall until they were at 2% on December 31, On December 31, 20X1, Bakerville sold 60% of the immediately after receiving the interest for the period ending December 31. There were no commissions on th urchase or sale of these bonds and when the company sold these bonds, the accountant recorded no gain or n the sale but correctly debited cash for the proper amount of proceeds received. 3% and they bond The company purchased the following assets on January 1, 20x1 Land Main warehouse Small warehous Equipment and trucks Furniture 5,400,000 23,400,000 3,600,000 4,200,000 300,000 When Bakerville bought the small warehouse, it rented it out to a tenant. However, the lease exp 20X1 and the lease was not renewed. Since that time, Bakerville has been using the small ware that his company can show the investment properties at fair values and he likes that opti he ired on June 1, house. Trevor is aware on under IFRS. By year-end had objective information showing that the fair value of the warehouse had increased in value by 3% of its original cost near the end of 20X1 The main warehouse had a useful life of 20 years, the small warehouse 15 years, and the equipment, trucks and furniture 10 years. None of these assets has a residual value and Trevor wants the company to use the straight-line method of depreciation on all assets except for equipment and trucks where the double declining method is more applicable. He does not want any of these methods or assumptions changed. For partial years, the company should calculate depreciation to the nearest month end On October 2, 20X1, Bakerville sold some furniture that cost $120,000 for proceeds of $81,000 Trevor is aware that under IFRS, the company can report property, plant and equipment at their fair values. He would like to do this on land and the main warehouse but not on the equipment, trucks and furniture. At the end of December 20X1, he received appraisals of these assets, which indicated that their values were 6% greater than their original cost. All of this increase occurred at the end of the year so that these adjustments have no affect on depreciation. He wants to ensure that the company will show accumulated depreciation, if applicable, at the end of the year on the assets accounted at fair value The corporate income tax rate for this company is 30% in 20X1. The company has already paid some this already. EXHIBITI BAKERVILLE LTD DRAFT INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 20X1 Sales Cost of goods sold Gross proft 36,000,000 21,600,000 14400000 Operating expenses: General and administrative Depreciation - main warehouse Depreciation - small warehouse Depreciation- equipment and trucks Depreciation -furniture 5,400,000 1,170,000 240,000 420,000 7 260 Operating income 7,140,000 Rental revenue- small warehouse Rental expenses-small warehouse Interest expense on bank loan Commission expense Unrealized gain on investment in associate Bond interest revenue Bond purchase expense Miscellaneous revenue- furniture sale 150,000 (69,000) (5,707,348) (75,000) 1,500,000 60,000 (163,613) (4,223,961) Net income before income taxes Income tax expense Net income 2,916,039 360,000 $-2556,039 EXHIBIT BAKERVILLE LTD DRAFT BALANCE SHEET DECEMBER 31, 20x1 Current assets: Cash investment in associate Bond investment Accounts receivable from retailers Inventory $ 300,000 9,000,000 1,013,382 4,140,000 5400,000 10,853,382 Property, plant and equipment: Land Main warehouse Accumulated depreciation Small warehouse Accumulated depreciation Equipment and trucks Accumulated depreciation Furniture Accumulated depreciation 5,400,000 (1,170,000) 3,600,000 (240,000) 4,200,000 (420,000) 300,000 130.000) Current liabilities: Accounts payable 4,337,343 Noncurrent liabilities: Bank loan -21,000,000 25,337.343 Shareholders' equity: Common shares Retained earnings 27,000,000 2.556,039 S54,893,382 REQUIRED - do all of the items below using excel 1. Prepare on one worksheet a comprehensive income statement and balance sheet using a three-column format with preliminary, adjustments, and final column keeping in mind that the company reports under IFRS. The CEO wants the maximum amount of detail in the worksheet unless directed otherwise. For example, if there is more than one type of interest or depreciation account, please show each one separately. After the worksheet, you should have a list of all journal entries that you have recorded into the adjustments column of your worksheet. Provide a memo showing support for any adjusting entries that the company needs to record.Start by explaining why the company recorded items incorrectly. Then explain qualitatively how the company should record the transaction with supporting calculations (just the amounts not the journal entries). Then compare the amounts you calculated to the one recorded by the client, indicating that this difference is the amount of the adjusting entry needed by the client. You should have at least one adjusting journal for each transaction described by the accounting issues below. This means you will probably have more than one adjustment pertaining to each accounting issue. For example, do not fix all bond investment errors with a single journal entry because may occurred on different dates. If a client recorded a bond purchase incorrectly, then made eorsrc the earning of interest and the sale of the bond, you should have an adjustment for each of these three e not one entry fixing all bond errors. We suggest you write this memo using excel utilizing word wrap and enlarged cells to hold paragraphs of words rather than amounts. recor Address any other issues that arise that may not have been recognized by the company and if necessary record any adjusting entries for these transactions. 3. Cut and paste a "recommendation" paragraph (the ones in bold in the standards) from three IFRS standards that are applicable to the accounting issues dealt with above and briefly (one sentence) explain why that recommendation was applicable to the issue. In other words, find a total of recommendation paragraphs that relate to issues in this assignment-each paragraph has to be from a different standard (so you must look at three standards for the entire assignment). three, "cut and paste" Further Details: Please prepare your report addressing Trevor's concerns, including concerns he may not be aware of yet. This w require you to build draft financial statements and adjust them using excel and to provide supporting calculations wi good explanations and journal entries. Please do all of your work using a 10 point Arial or Calibri font in excel with decimal places (use number format in excel with thousands separators and brackets for negative amounts -if y version of excel does not provide this option use custom setting). When you print, please ensure that the report ta tha width of one page in portrait format. Do not make columns too wide (just wide enough for the amoun d uan for olumn titles. If you are not sure how to do l PART ONE: an entrepreneur who incorporated Bakerville Ltd. in Canada in 20x1. The company (which term loan with a principal balance of $21,000,000. The loan bears interest at 4% per Trevor Carr was under IFRS), and obtained cash from a bank on Januar formed on January 1, 20x1 issued common shares to Trevor 20X1 with a 4-year requires 30 and Dec si each year and a requirement to maintain a current ratio of 1.5:1 or higher based on year-end company has made all of its loan payments on time. The company manufactures and erly blended loan payments consisting of both principal and interest on March 31, June 30, September ancial statements. The wholesales oilfield tools. Bakerville has a small th stated correctly because he and he is concerned that the draft financial statements t accounting staff that recorded transactions throughout the year. Trevor knows that cash is has done the bank reconciliation but he was unable to hire a professionally trained CFO hat his staff have prepared (Exhibit 1) may have errors. Trevor has hired you to correct any accounting errors made by his staff. He wants to showing the financial statement preliminary amounts, adjustments and receive from you a memo final balances along with the list of journal the company must make to "fix" the financial statements. He needs you to include in the memo, explanations entre nd numerical support for these adjustments including reasons why the draft financial statements were in error. H wants the maximum amount of detail in the financial statements. For example, if there is more than one type of interest or depreciation account, please show each one separately. More details on how to document your work are below Trevor has provided you with the following information: Bakerville has been using some of its excess cash to make investments during the year. Before Trevor started Bakerville, he did some consulting work for Edgemont Ltd., a publicly traded company. Edgemont is now one of Bakerville's biggest customers and the management of that company invited Bakerville to purchase some of its outstanding shares and agreed to put Trevor on their board of directors. Bakerville purchased 750,000 common shares of Edgemont on January 1, 20X1 when the shares were trading at $10 each. Brokers charged commissions on the purchase of these shares of $75,000. When Bakerville purchased its shares in Edgemont, that company had assets of $36,000,000 and liabilities of $20,000,000 on its balance sheet. At that time, the fair value of the assets was $6,000,000 higher than the amount shown on the balance sheet because the fair value of a building with a 20- year remaining life exceeded its carrying amount. By December 31, the shares were trading at $12 each. For the year ending December 31, 20X1 Edgemont reported net income of $3,000,000. On December 20, Edgemont declared an annual dividend of $0.60 per common share, payable on all of its 2,000,000 outstanding common shares in early 20x2. Bakerville also invested in 6-year bonds with a maturity value of $3,000,000 on July 1, 20x1. The bonds earn interes bond interest twice per year on June 30 and December 31 commencing in December 20X1. Bakerville plans to trade at stated rate of 4% on an annual basis and mature on June 30, 20X7 but the company receives cash relating to the these bonds actively. When Bakerville bought these bonds, interest rates in the market were at continued to fall until they were at 2% on December 31, On December 31, 20X1, Bakerville sold 60% of the immediately after receiving the interest for the period ending December 31. There were no commissions on th urchase or sale of these bonds and when the company sold these bonds, the accountant recorded no gain or n the sale but correctly debited cash for the proper amount of proceeds received. 3% and they bond The company purchased the following assets on January 1, 20x1 Land Main warehouse Small warehous Equipment and trucks Furniture 5,400,000 23,400,000 3,600,000 4,200,000 300,000 When Bakerville bought the small warehouse, it rented it out to a tenant. However, the lease exp 20X1 and the lease was not renewed. Since that time, Bakerville has been using the small ware that his company can show the investment properties at fair values and he likes that opti he ired on June 1, house. Trevor is aware on under IFRS. By year-end had objective information showing that the fair value of the warehouse had increased in value by 3% of its original cost near the end of 20X1 The main warehouse had a useful life of 20 years, the small warehouse 15 years, and the equipment, trucks and furniture 10 years. None of these assets has a residual value and Trevor wants the company to use the straight-line method of depreciation on all assets except for equipment and trucks where the double declining method is more applicable. He does not want any of these methods or assumptions changed. For partial years, the company should calculate depreciation to the nearest month end On October 2, 20X1, Bakerville sold some furniture that cost $120,000 for proceeds of $81,000 Trevor is aware that under IFRS, the company can report property, plant and equipment at their fair values. He would like to do this on land and the main warehouse but not on the equipment, trucks and furniture. At the end of December 20X1, he received appraisals of these assets, which indicated that their values were 6% greater than their original cost. All of this increase occurred at the end of the year so that these adjustments have no affect on depreciation. He wants to ensure that the company will show accumulated depreciation, if applicable, at the end of the year on the assets accounted at fair value The corporate income tax rate for this company is 30% in 20X1. The company has already paid some this already. EXHIBITI BAKERVILLE LTD DRAFT INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 20X1 Sales Cost of goods sold Gross proft 36,000,000 21,600,000 14400000 Operating expenses: General and administrative Depreciation - main warehouse Depreciation - small warehouse Depreciation- equipment and trucks Depreciation -furniture 5,400,000 1,170,000 240,000 420,000 7 260 Operating income 7,140,000 Rental revenue- small warehouse Rental expenses-small warehouse Interest expense on bank loan Commission expense Unrealized gain on investment in associate Bond interest revenue Bond purchase expense Miscellaneous revenue- furniture sale 150,000 (69,000) (5,707,348) (75,000) 1,500,000 60,000 (163,613) (4,223,961) Net income before income taxes Income tax expense Net income 2,916,039 360,000 $-2556,039 EXHIBIT BAKERVILLE LTD DRAFT BALANCE SHEET DECEMBER 31, 20x1 Current assets: Cash investment in associate Bond investment Accounts receivable from retailers Inventory $ 300,000 9,000,000 1,013,382 4,140,000 5400,000 10,853,382 Property, plant and equipment: Land Main warehouse Accumulated depreciation Small warehouse Accumulated depreciation Equipment and trucks Accumulated depreciation Furniture Accumulated depreciation 5,400,000 (1,170,000) 3,600,000 (240,000) 4,200,000 (420,000) 300,000 130.000) Current liabilities: Accounts payable 4,337,343 Noncurrent liabilities: Bank loan -21,000,000 25,337.343 Shareholders' equity: Common shares Retained earnings 27,000,000 2.556,039 S54,893,382 REQUIRED - do all of the items below using excel 1. Prepare on one worksheet a comprehensive income statement and balance sheet using a three-column format with preliminary, adjustments, and final column keeping in mind that the company reports under IFRS. The CEO wants the maximum amount of detail in the worksheet unless directed otherwise. For example, if there is more than one type of interest or depreciation account, please show each one separately. After the worksheet, you should have a list of all journal entries that you have recorded into the adjustments column of your worksheet. Provide a memo showing support for any adjusting entries that the company needs to record.Start by explaining why the company recorded items incorrectly. Then explain qualitatively how the company should record the transaction with supporting calculations (just the amounts not the journal entries). Then compare the amounts you calculated to the one recorded by the client, indicating that this difference is the amount of the adjusting entry needed by the client. You should have at least one adjusting journal for each transaction described by the accounting issues below. This means you will probably have more than one adjustment pertaining to each accounting issue. For example, do not fix all bond investment errors with a single journal entry because may occurred on different dates. If a client recorded a bond purchase incorrectly, then made eorsrc the earning of interest and the sale of the bond, you should have an adjustment for each of these three e not one entry fixing all bond errors. We suggest you write this memo using excel utilizing word wrap and enlarged cells to hold paragraphs of words rather than amounts. recor Address any other issues that arise that may not have been recognized by the company and if necessary record any adjusting entries for these transactions. 3. Cut and paste a "recommendation" paragraph (the ones in bold in the standards) from three IFRS standards that are applicable to the accounting issues dealt with above and briefly (one sentence) explain why that recommendation was applicable to the issue. In other words, find a total of recommendation paragraphs that relate to issues in this assignment-each paragraph has to be from a different standard (so you must look at three standards for the entire assignment). three, "cut and paste" Further Details: Please prepare your report addressing Trevor's concerns, including concerns he may not be aware of yet. This w require you to build draft financial statements and adjust them using excel and to provide supporting calculations wi good explanations and journal entries. Please do all of your work using a 10 point Arial or Calibri font in excel with decimal places (use number format in excel with thousands separators and brackets for negative amounts -if y version of excel does not provide this option use custom setting). When you print, please ensure that the report ta tha width of one page in portrait format. Do not make columns too wide (just wide enough for the amoun d uan for olumn titles. If you are not sure how to do