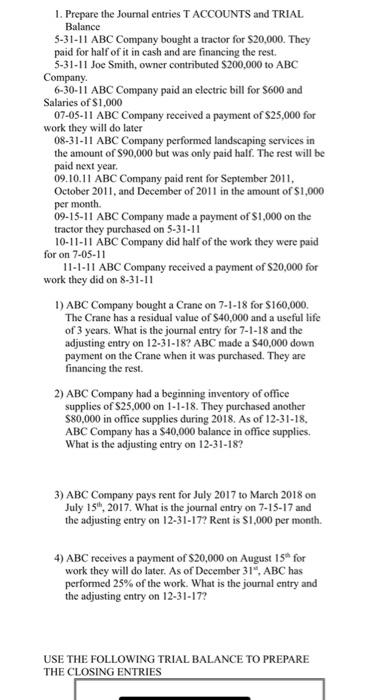

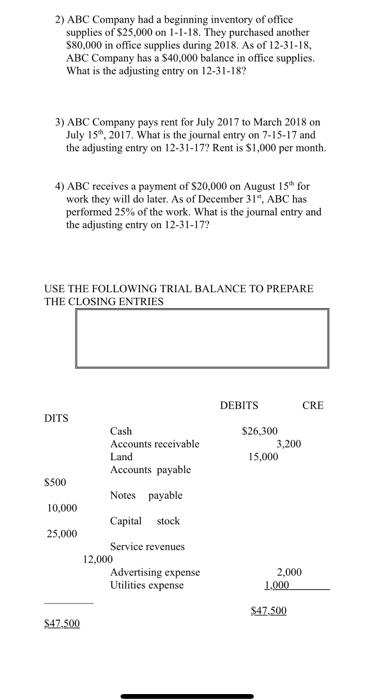

L. Prepare the Journal entries TACCOUNTS and TRIAL Balance 5-31-11 ABC Company bought a tractor for $20,000. They paid for half of it in cash and are financing the rest. 5-31-11 Joe Smith, owner contributed $200,000 to ABC Company 6-30-11 ABC Company paid an electric bill for $600 and Salaries of $1,000 07-05-11 ABC Company received a payment of S25,000 for work they will do later 08-31-11 ABC Company performed landscaping services in the amount of $90,000 but was only paid half. The rest will be paid next year. 09.10.11 ABC Company paid rent for September 2011, October 2011, and December of 2011 in the amount of $1,000 per month 09-15-11 ABC Company made a payment of $1,000 on the tractor they purchased on 5-31-11 10-11-11 ABC Company did half of the work they were paid for on 7-05-11 11-1-11 ABC Company received a payment of S20,000 for work they did on 8-31-11 1) ABC Company bought a Crane on 7-1-18 for $160,000. The Crane has a residual value of $40,000 and a useful life of 3 years. What is the journal entry for 7-1-18 and the adjusting entry on 12-31-18? ABC made a S40,000 down payment on the Crane when it was purchased. They are financing the rest. 2) ABC Company had a beginning inventory of office supplies of S25,000 on 1-1-18. They purchased another $80,000 in office supplies during 2018. As of 12-31-18. ABC Company has a $40,000 balance in office supplies. What is the adjusting entry on 12-31-18? 3) ABC Company pays rent for July 2017 to March 2018 on July 15, 2017. What is the journal entry on 7-15-17 and the adjusting entry on 12-31-17? Rent is $1,000 per month. 4) ABC receives a payment of S20,000 on August 15" for work they will do later. As of December 31", ABC has performed 25% of the work. What is the journal entry and the adjusting entry on 12-31-17? USE THE FOLLOWING TRIAL BALANCE TO PREPARE THE CLOSING ENTRIES 2) ABC Company had a beginning inventory of office supplies of $25,000 on 1-1-18. They purchased another $80,000 in office supplies during 2018. As of 12-31-18, ABC Company has a $40,000 balance in office supplies. What is the adjusting entry on 12-31-18? 3) ABC Company pays rent for July 2017 to March 2018 on July 15, 2017. What is the journal entry on 7-15-17 and the adjusting entry on 12-31-17? Rent is $1,000 per month. 4) ABC receives a payment of S20,000 on August 15" for work they will do later. As of December 31", ABC has performed 25% of the work. What is the journal entry and the adjusting entry on 12-31-17? USE THE FOLLOWING TRIAL BALANCE TO PREPARE THE CLOSING ENTRIES DEBITS CRE DITS S26,300 3,200 15,000 S500 10.000 Cash Accounts receivable Land Accounts payable Notes payable Capital stock Service revenues 12,000 Advertising expense Utilities expense 25,000 2,000 1.000 $47.500 $47.500