Answered step by step

Verified Expert Solution

Question

1 Approved Answer

l ule glving cost per ton. hthe first year. (Show computations by 7-Adjustment of Depreciable Base. A truck was acquired on July 1, 2015, at

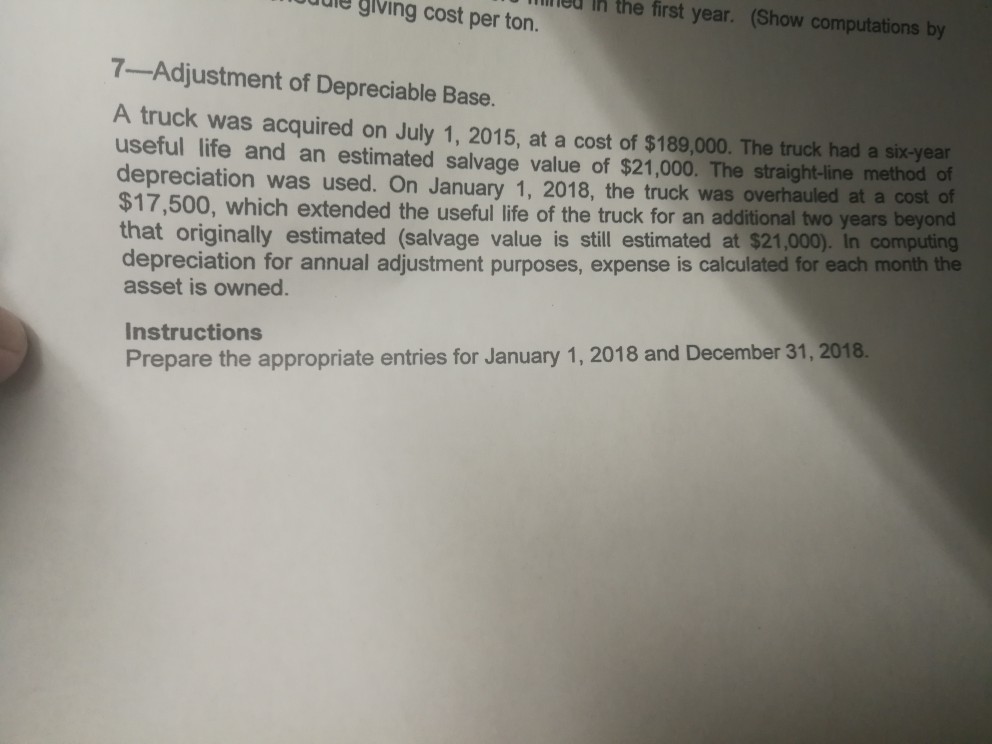

l ule glving cost per ton. hthe first year. (Show computations by 7-Adjustment of Depreciable Base. A truck was acquired on July 1, 2015, at a cost of $189,000. The truck had a six-year useful life and an estimated salvage value of $21,000. The straight-line method of depreciation was used. On January 1, 2018, the truck was overhauled at a cost of $17,500, which extended the useful life of the truck for an additional two years beyond that originally estimated (salvage value is still estimated at $21,000). In computing depreciation for annual adjustment purposes, expense is calculated for each month the asset is owned. Instructions Prepare the appropriate entries for January 1, 2018 and December 31, 2018

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started