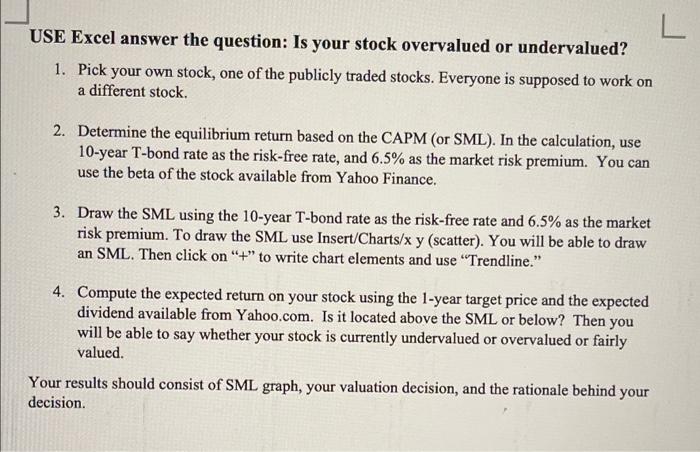

L USE Excel answer the question: Is your stock overvalued or undervalued? 1. Pick your own stock, one of the publicly traded stocks. Everyone is supposed to work on a different stock. 2. Determine the equilibrium return based on the CAPM (or SML). In the calculation, use 10-year T-bond rate as the risk-free rate, and 6.5% as the market risk premium. You can use the beta of the stock available from Yahoo Finance. 3. Draw the SML using the 10-year T-bond rate as the risk-free rate and 6.5% as the market risk premium. To draw the SML use Insert/Charts/x y (scatter). You will be able to draw an SML. Then click on "P" to write chart elements and use "Trendline." 4. Compute the expected return on your stock using the 1-year target price and the expected dividend available from Yahoo.com. Is it located above the SML or below? Then you will be able to say whether your stock is currently undervalued or overvalued or fairly valued. Your results should consist of SML graph, your valuation decision, and the rationale behind your decision L USE Excel answer the question: Is your stock overvalued or undervalued? 1. Pick your own stock, one of the publicly traded stocks. Everyone is supposed to work on a different stock. 2. Determine the equilibrium return based on the CAPM (or SML). In the calculation, use 10-year T-bond rate as the risk-free rate, and 6.5% as the market risk premium. You can use the beta of the stock available from Yahoo Finance. 3. Draw the SML using the 10-year T-bond rate as the risk-free rate and 6.5% as the market risk premium. To draw the SML use Insert/Charts/x y (scatter). You will be able to draw an SML. Then click on "P" to write chart elements and use "Trendline." 4. Compute the expected return on your stock using the 1-year target price and the expected dividend available from Yahoo.com. Is it located above the SML or below? Then you will be able to say whether your stock is currently undervalued or overvalued or fairly valued. Your results should consist of SML graph, your valuation decision, and the rationale behind your decision