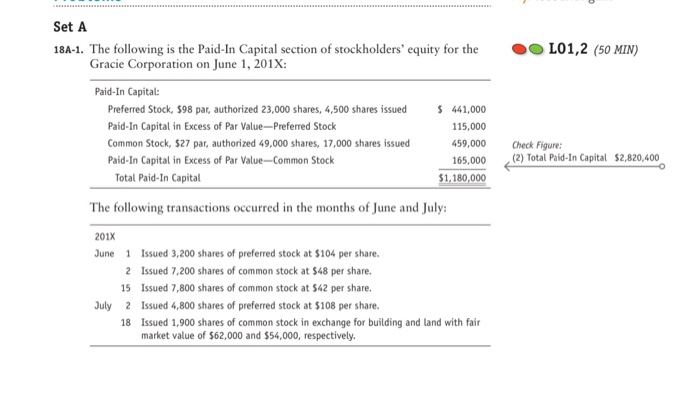

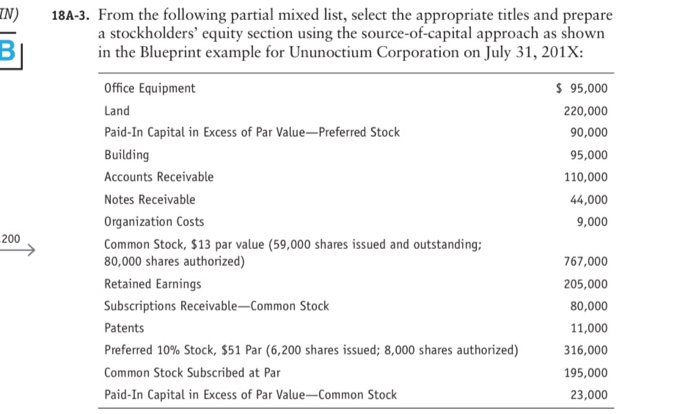

L01,2 (50 MIN) Set A 18A-1. The following is the Paid In Capital section of stockholders' equity for the Gracie Corporation on June 1, 2018: Paid-In Capital: Preferred Stock. $98 par, authorized 23,000 shares, 4,500 shares issued $ 441,000 Paid-In Capital in Excess of Par Value Preferred Stock 115,000 Common Stock, $27 par, authorized 49,000 shares, 17,000 shares issued 459,000 Paid-In Capital in Excess of Par Value-Common Stock 165,000 Total Paid-In Capital $1,180,000 Check Figure (2) Total Paid-In Capital $2,820,400 The following transactions occurred in the months of June and July: 2018 June 1 Issued 3,200 shares of preferred stock at $104 per share. 2 Issued 7,200 shares of common stock at $48 per share. 15 Issued 7,800 shares of common stock at $42 per share. July 2 Issued 4,800 shares of preferred stock at $108 per share. 18 Issued 1,900 shares of common stock in exchange for building and land with fair market value of $62,000 and $54,000, respectively. ZN) BI 18A-3. From the following partial mixed list, select the appropriate titles and prepare a stockholders' equity section using the source-of-capital approach as shown in the Blueprint example for Ununoctium Corporation on July 31, 2018: $ 95,000 220,000 90,000 95,000 110,000 44,000 9,000 200 Office Equipment Land Paid-In Capital in Excess of Par ValuePreferred Stock Building Accounts Receivable Notes Receivable Organization Costs Common Stock, $13 par value (59,000 shares issued and outstanding; 80,000 shares authorized) Retained Earnings Subscriptions Receivable-Common Stock Patents Preferred 10% Stock, $51 Par (6,200 shares issued; 8,000 shares authorized) Common Stock Subscribed at Par Paid In Capital in Excess of Par Value-Common Stock 767,000 205,000 80,000 11,000 316,000 195,000 23,000 L01,2 (50 MIN) Set A 18A-1. The following is the Paid In Capital section of stockholders' equity for the Gracie Corporation on June 1, 2018: Paid-In Capital: Preferred Stock. $98 par, authorized 23,000 shares, 4,500 shares issued $ 441,000 Paid-In Capital in Excess of Par Value Preferred Stock 115,000 Common Stock, $27 par, authorized 49,000 shares, 17,000 shares issued 459,000 Paid-In Capital in Excess of Par Value-Common Stock 165,000 Total Paid-In Capital $1,180,000 Check Figure (2) Total Paid-In Capital $2,820,400 The following transactions occurred in the months of June and July: 2018 June 1 Issued 3,200 shares of preferred stock at $104 per share. 2 Issued 7,200 shares of common stock at $48 per share. 15 Issued 7,800 shares of common stock at $42 per share. July 2 Issued 4,800 shares of preferred stock at $108 per share. 18 Issued 1,900 shares of common stock in exchange for building and land with fair market value of $62,000 and $54,000, respectively. ZN) BI 18A-3. From the following partial mixed list, select the appropriate titles and prepare a stockholders' equity section using the source-of-capital approach as shown in the Blueprint example for Ununoctium Corporation on July 31, 2018: $ 95,000 220,000 90,000 95,000 110,000 44,000 9,000 200 Office Equipment Land Paid-In Capital in Excess of Par ValuePreferred Stock Building Accounts Receivable Notes Receivable Organization Costs Common Stock, $13 par value (59,000 shares issued and outstanding; 80,000 shares authorized) Retained Earnings Subscriptions Receivable-Common Stock Patents Preferred 10% Stock, $51 Par (6,200 shares issued; 8,000 shares authorized) Common Stock Subscribed at Par Paid In Capital in Excess of Par Value-Common Stock 767,000 205,000 80,000 11,000 316,000 195,000 23,000