Answered step by step

Verified Expert Solution

Question

1 Approved Answer

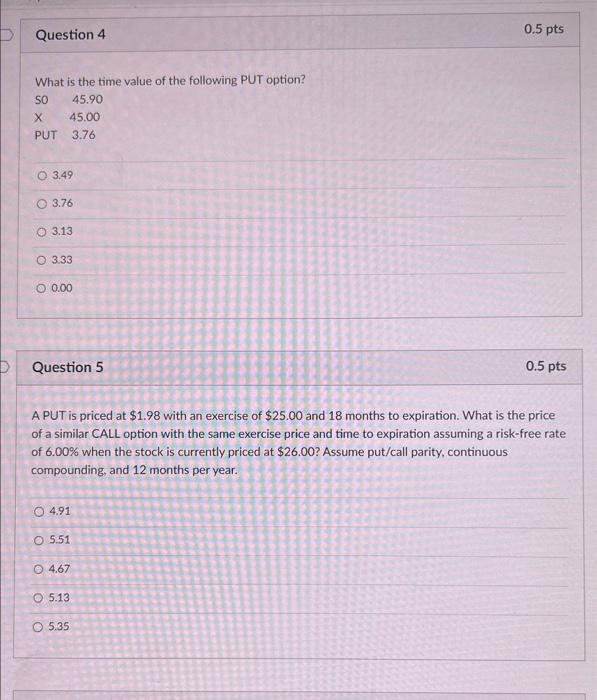

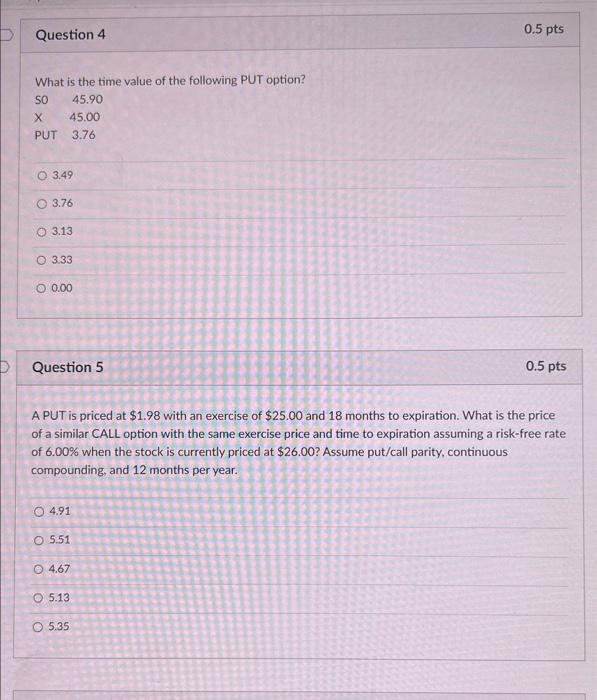

L15 What is the time value of the following PUT option? SOXPUT45.9045.003.76 3.49 3.76 3.13 3.33 0.00 Question 5 0.5pts A PUT is priced at

L15

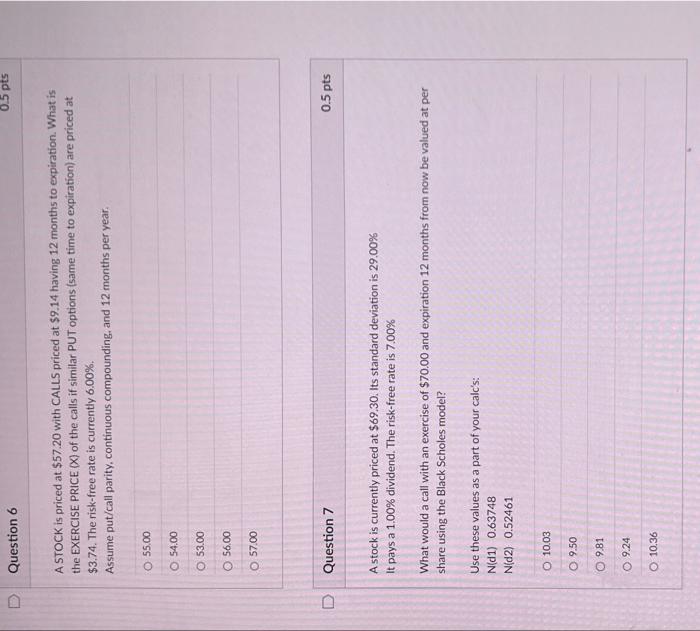

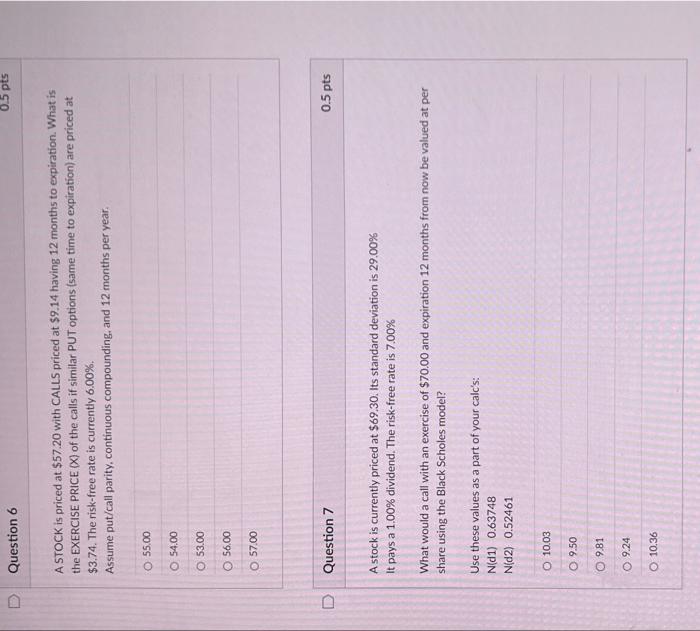

What is the time value of the following PUT option? SOXPUT45.9045.003.76 3.49 3.76 3.13 3.33 0.00 Question 5 0.5pts A PUT is priced at $1.98 with an exercise of $25.00 and 18 months to expiration. What is the price of a similar CALL option with the same exercise price and time to expiration assuming a risk-free rate of 6.00% when the stock is currently priced at $26.00 ? Assume put/call parity, continuous compounding, and 12 months per year. 4.91 5.51 4.67 5.13 5.35 A STOCK is priced at $57.20 with CALLS priced at $9.14 having 12 months to expiration. What is the EXERCISE PRICE (X) of the calls if similar PUT options (same time to expiration) are priced at $3,74. The risk-free rate is currently 6.00%. Assume put/call parity, continuous compounding, and 12 months per year. 55.00 54.00 53.00 56.00 57.00 Question 7 0.5pts A stock is currently priced at $69.30. Its standard deviation is 29.00% It pays a 1.00% dividend. The risk-free rate is 7.00% What would a call with an exercise of $70.00 and expiration 12 months from now be valued at per share using the Black Scholes model? Use these values as a part of your calc's: N (d1) 0.63748 N(d2)0.52461 10.03 9.50 9.81 9.24 10.36

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started