Answered step by step

Verified Expert Solution

Question

1 Approved Answer

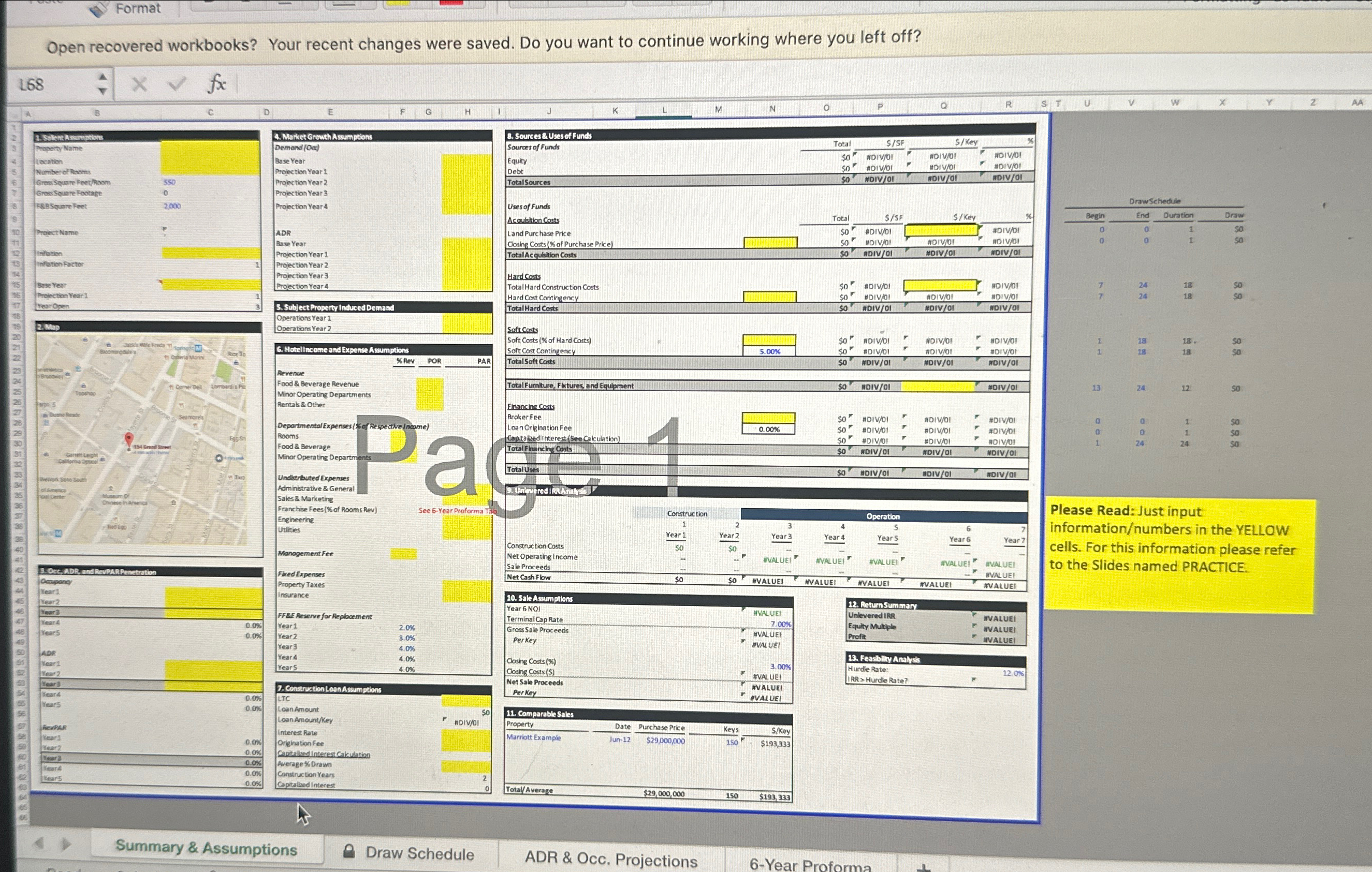

L68 Format Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? B 1. Sallent Assumptions

L68 Format Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? B 1. Sallent Assumptions Property Name Location Xvfx D E 4. Market Growth Assumptions Demand (Oad) F G H J 8. Sources & Uses of Funds Sources of Funds Base Year Projection Year 1 Projection Year 4 Equity Debt Total Sources Uses of Funds Acquisition Costs Number of Rooms Gress Square Feet/Room 550 Projection Year 2 Gross Square Footage 0 Projection Year 3 F&B Square Feet 2,000 Project Name Inflation 13 Inflation Factor 15 Bese Year 16 Projection Year 1 Year Open ADR Base Year Projection Year 1 Projection Year 2 Projection Year 3 Projection Year 4 5. Subject Property Induced Demand Operations Year 1 K L M N O P O R ST U W Y 2 AA Land Purchase Price Closing Costs (% of Purchase Price) Total Acquisition Costs Hard Costs Total Hard Construction Costs Hard Cost Contingency Total Hard Costs Soft Costs Operations Year 2 Soft Costs (% of Hard Costs) 2. Map Soft Cost Contingency Jack's Wife Freda Spring M 6. Hotel income and Expense Assumptions Bloomingdale's Ruce To %Rev POR PAR Total Soft Costs 11 Osteria Apri Topshop arpo Dunne Reade Broome Become St Revenue Total Furniture, Fixtures, and Equipment Food & Beverage Revenue Comer Dell Lombardi's Piz Gerrett Leight California Optical Work Soho South of Amence Seemare's Egg Sh 154 Grand Street 93WD Museum Of al Cente Chinese In Amenca Minor Operating Departments Rentals & Other Departmental Expenses (% of Respective Income) Rooms Food & Beverage Loan Origination Fee Capitalized interest (See Calculation) Total Financing Costs Pace Minor Operating Departments Undistributed Expenses Administrative & General Sales & Marketing Franchise Fees (% of Rooms Rev) Engineering Utilities See 6-Year Proforma Tab Total Uses 9. Unlevered IRIAnalysk Financing Costs Broker Fee Red Ego Management Fee 3. Occ, ADR, and RevPAR Penetration Occupancy Year1 45 Year 2 46 Year 3 Year 4 Years ADR Year1 Fixed Expenses Property Taxes Insurance FF&E Reserve for Replacement 0.0% Year 1 2.0% 0.0% Year 2 3.0% Year 3 4.0% Year 4 4.0% Year 5 4.0% Year 2 Year 3 7. Construction Loan Assumptions Year 4 0.0% LTC Year 5 0.0% Loan Amount Loan Amount/Key RevPAR Interest Rate Yearl 0.0% Origination Fee Year 2 0.0% Capitalized Interest Calculation Year 3 0.0% Average % Drawn Year Years 0.0% Construction Years 0.0% Capitalized Interest Summary & Assumptions Total $/SF $/Key % $0 " #DIV/01 $0 #DIV/01 $0 #DIV/01 #DIV/01 - P #DIV/OI #DIV/01 #DIV/01 #DIV/O! #DIV/01 Total $/SF $/Key $0 #DIV/01 $0 #DIV/01 #DIV/01 #DIV/O! #DIV/O! Begin 0 Draw Schedule End Duration Draw 0 1 0 I $0 189 So #DIV/01 #DIV/01 #DIV/01 #DIV/O! So so #DIV/O! #DIV/01 #DIV/OI #DIV/01 #DIV/01 #DIV/01 #DIV/01 7 7 == 24 18 24 18 99 $0 F NDIV/OI #DIV/O! #DIV/O! 1 18 5.00% So #DIV/01 #DIV/01 #DIV/01 1 18 18. 18 $0 $0 #DIV/01 #DIV/01 #DIV/01 $0 #DIV/01 #DIV/01 13 24 24 12 $0 F #DIV/01 0.00% So #DIV/01 $0 So #DIV/01 #DIV/01 F #DIV/01 #DIV/01 #DIV/01 #DIV/01 [ F #DIV/01 #DIV/OI #DIV/01 NDIV/01 0 0 1 24 21 119 700 24 $0 899 $0 $0 #DIV/01 #DIV/01 #DIV/01 Construction 1 Operation 2 5 6 Year 1 Construction Costs 50 Year 2 $0 Year 3 Year 4 Year 5 Year 6 Year 7 Net Operating Income #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! Sale Proceeds #VALUE! Net Cash Flow So $0 #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! 12. Return Summary 10. Sale Assumptions Year 6 NOI Terminal Cap Rate Gross Sale Proceeds Per Key Closing Costs (%) Closing Costs ($) #VALUE! 7.00% Unlevered IRR Equity Multiple VALUEI #VALUE #VALUE! Profit #VALUE! F #VALUE! 13. Feasibility Analysis 3.00% Hurdle Rate: 12.0% F #VALUE! IRR>Hurdle Rate? #VALUE! #VALUE! Net Sale Proceeds Per Key $0 #DIV/01 11. Comparable Sales Property Marriott Example Jun-12 Date Purchase Price $29,000,000 Keys 150 S/Key $193,333 0 Total/Average $29,000,000 150 $193,333 Draw Schedule ADR & Occ. Projections 6-Year Proforma Please Read: Just input information/numbers in the YELLOW cells. For this information please refer to the Slides named PRACTICE.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started