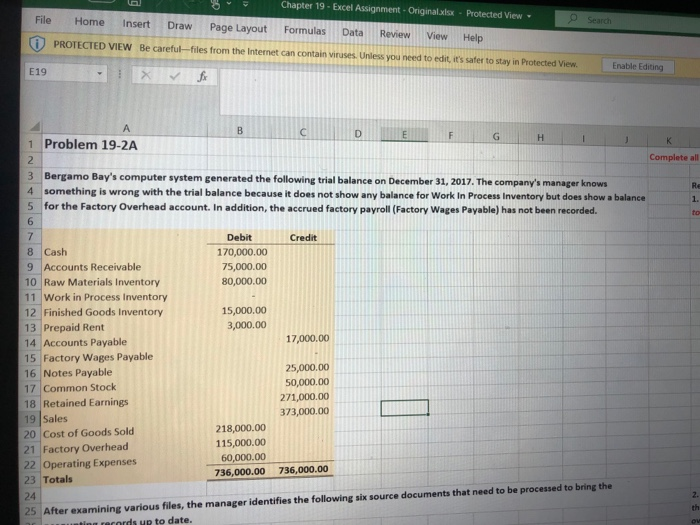

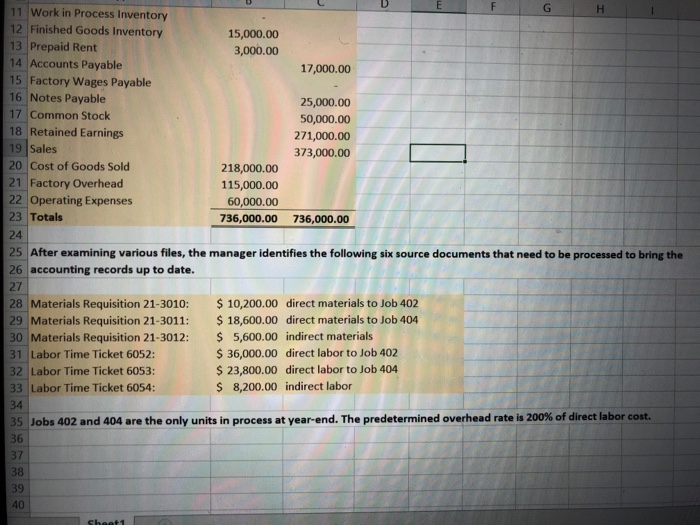

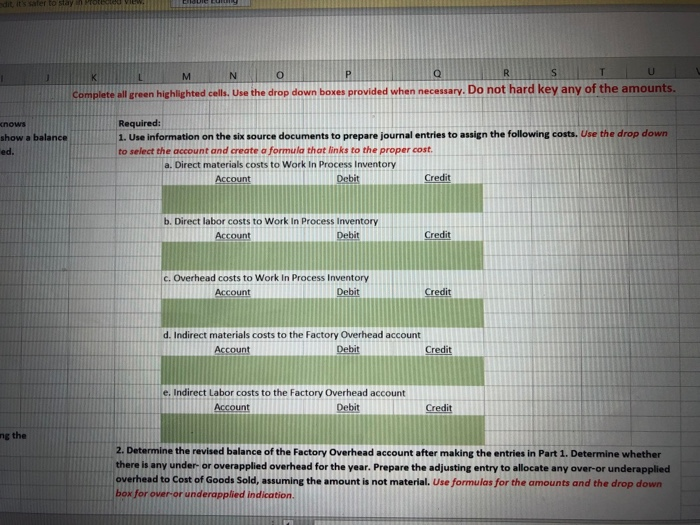

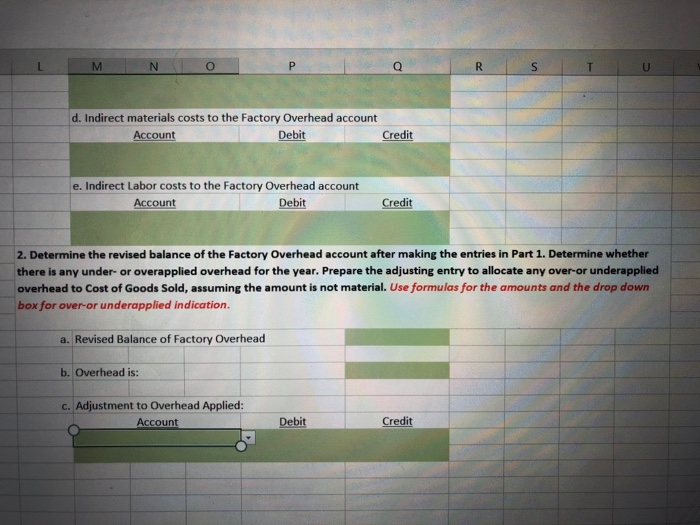

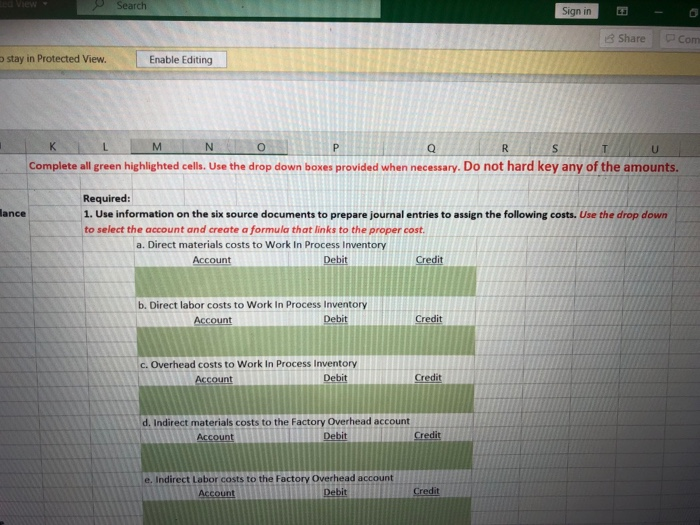

la 8 Chapter 19- Excel Assignment - Original.xlsx - Protected View - Search File Home Insert Draw Page Layout Formulas Data Review View Help CU PROTECTED VIEW Be careful--files from the Internet can contain viruses. Unless you need to edit it safe to stay in Protected View Enable Editing E19 1 Problem 19-2A Complete all 3 4 5 Bergamo Bay's computer system generated the following trial balance on December 31, 2017. The company's manager knows something is wrong with the trial balance because it does not show any balance for Work In Process Inventory but does show a balance for the Factory Overhead account. In addition, the accrued factory payroll (Factory Wages Payable) has not been recorded. LOCO Credit Debit 170,000.00 75,000.00 80,000.00 15,000.00 3,000.00 17,000.00 8 Cash 9 Accounts Receivable 10 Raw Materials Inventory 11 Work in Process Inventory 12 Finished Goods Inventory 13 Prepaid Rent 14 Accounts Payable 15 Factory Wages Payable 16 Notes Payable 17 Common Stock 18 Retained Earnings 19 Sales 20 Cost of Goods Sold 21 Factory Overhead 22 Operating Expenses 23 Totals 25,000.00 50,000.00 271,000.00 373,000.00 218,000.00 115,000.00 60,000.00 736,000.00 736,000.00 25 After examining various files, the manager identifies the following six source documents that need to be processed to bring the unting records up to date. D G H 15,000.00 3,000.00 17,000.00 11 Work in Process Inventory 12 Finished Goods Inventory 13 Prepaid Rent 14 Accounts Payable 15 Factory Wages Payable 16 Notes Payable 17 Common Stock 18 Retained Earnings 19 Sales 20 Cost of Goods Sold 21 Factory Overhead 22 Operating Expenses 23 Totals 25,000.00 50,000.00 271,000.00 373,000.00 218,000.00 115,000.00 60,000.00 736,000.00 736,000.00 25 After examining various files, the manager identifies the following six source documents that need to be processed to bring the 26 accounting records up to date. 28 Materials Requisition 21-3010: 29 Materials Requisition 21-3011: 30 Materials Requisition 21-3012: 31 Labor Time Ticket 6052: 32 Labor Time Ticket 6053: 33 Labor Time Ticket 6054: $10,200.00 direct materials to Job 402 $ 18,600.00 direct materials to Job 404 $ 5,600.00 indirect materials $ 36,000.00 direct labor to Job 402 $ 23,800.00 direct labor to Job 404 $ 8,200.00 indirect labor 35 Jobs 402 and 404 are the only units in process at year-end. The predetermined overhead rate is 200% of direct labor cost. Edit, it safer to stay in Pote Complete all green highlighted cells. Use the drop down boxes provided when necessary. Do not hard key any of the amounts. Knows show a balance ed. Required: 1. Use Information on the six source documents to prepare journal entries to assign the following costs. Use the drop down to select the account and create a formula thot links to the proper cost a. Direct materials costs to Work In Process Inventory Debit Credit b. Direct labor costs to Work In Process Inventory Account Debit c. Overhead costs to Work In Process Inventory Account Debit Credit d. Indirect materials costs to the Factory Overhead account Account Debit Credit e. Indirect Labor costs to the Factory Overhead account Account Debit Credit ne the 2. Determine the revised balance of the Factory Overhead account after making the entries in Part 1. Determine whether there is any under or overapplied overhead for the year. Prepare the adjusting entry to allocate any over-or underapplied overhead to Cost of Goods Sold, assuming the amount is not material. Use formulas for the amounts and the drop down box for over-or underapplied indication. L M N O P Q R ITu d. Indirect materials costs to the Factory Overhead account Account Debit Credit e. Indirect Labor costs to the Factory Overhead account Account Debit Credit 2. Determine the revised balance of the Factory Overhead account after making the entries in Part 1. Determine whether there is any under- or overapplied overhead for the year. Prepare the adjusting entry to allocate any over-or underapplied overhead to Cost of Goods Sold, assuming the amount is not material. Use formulas for the amounts and the drop down box for over-or underapplied indication. a. Revised Balance of Factory Overhead b. Overhead is: c. Adjustment to Overhead Applied: Account Debit Credit U Search Sign in - 0 com Share stay in Protected View. Enable Editing K L M N O Complete all green highlighted cells. Use the drop down boxes provided when necessary. Do not hard key any of the amounts. lance Required: 1. Use information on the six source documents to prepare journal entries to assign the following costs. Use the drop down to select the account and create a formula that links to the proper cost. a. Direct materials costs to Work In Process Inventory Account Credit Debit b. Direct labor costs to Work In Process Inventory Account Debit Credit c. Overhead costs to Work In Process Inventory Account Debit Credit d. Indirect materials costs to the Factory Overhead account Account Debit Credit e. Indirect Labor costs to the Factory Overhead account Account Debit Credit