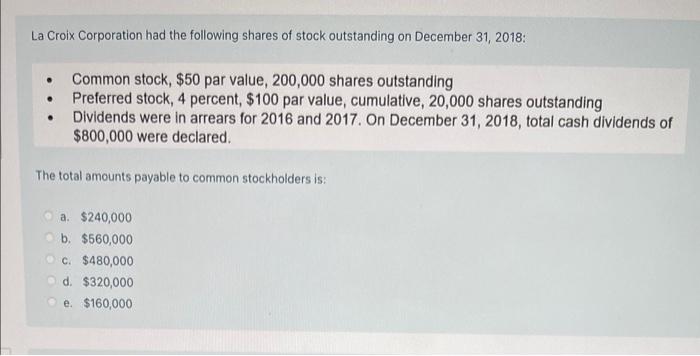

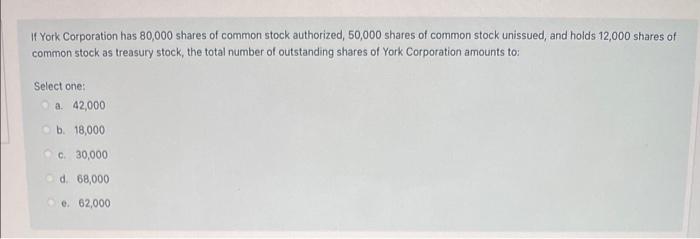

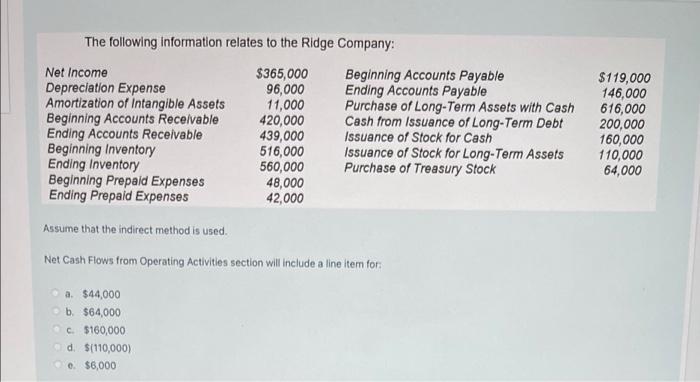

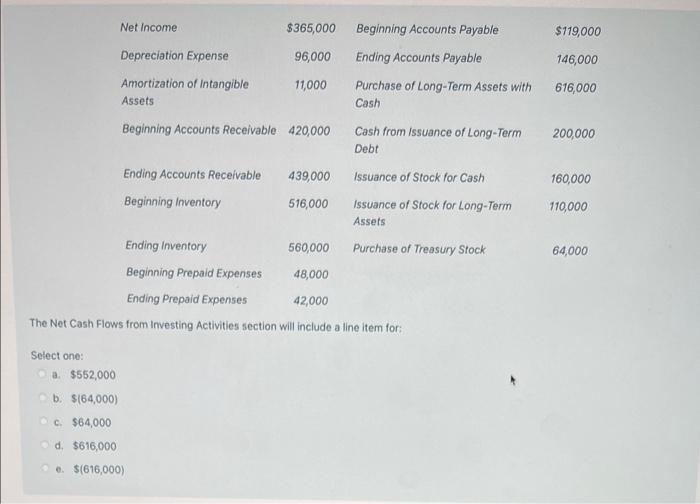

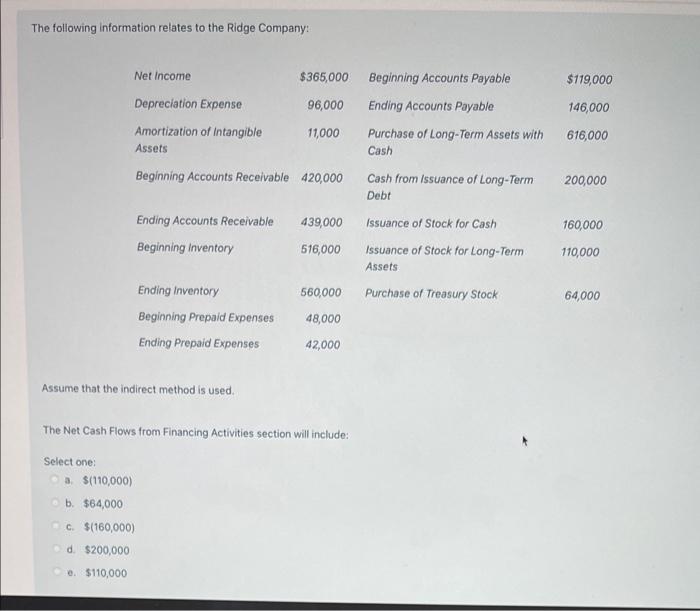

La Croix Corporation had the following shares of stock outstanding on December 31, 2018: . Common stock, $50 par value, 200,000 shares outstanding Preferred stock, 4 percent, $100 par value, cumulative, 20,000 shares outstanding Dividends were in arrears for 2016 and 2017. On December 31, 2018, total cash dividends of $800,000 were declared. The total amounts payable to common stockholders is: a. $240,000 b. $560,000 c. $480,000 d. $320,000 e $160,000 If York Corporation has 80,000 shares of common stock authorized, 50,000 shares of common stock unissued, and holds 12,000 shares of common stock as treasury stock, the total number of outstanding shares of York Corporation amounts to: Select one: a. 42,000 b. 18,000 c. 30,000 d. 68,000 e. 62,000 The following information relates to the Ridge Company: Net Income $365,000 Beginning Accounts Payable Depreciation Expense 96,000 Ending Accounts Payable Amortization of Intangible Assets 11,000 Purchase of Long-Term Assets with Cash Beginning Accounts Receivable 420,000 Cash from Issuance of Long-Term Debt Ending Accounts Receivable 439,000 Issuance of Stock for Cash Beginning Inventory 516,000 Issuance of Stock for Long-Term Assets Ending Inventory 560,000 Purchase of Treasury Stock Beginning Prepaid Expenses 48,000 Ending Prepaid Expenses 42,000 $119,000 146,000 616,000 200,000 160,000 110,000 64,000 Assume that the indirect method is used. Net Cash Flows from Operating Activities section will include a line item for: a $44,000 b. $64,000 c. $160,000 d$(110,000) $6,000 Net Income $365,000 Beginning Accounts Payable $119,000 96,000 Ending Accounts Payable 146,000 Depreciation Expense Amortization of Intangible Assets 11,000 Purchase of Long-Term Assets with Cash 616,000 Beginning Accounts Receivable 420,000 200,000 439,000 Cash from Issuance of Long-Term Debt Issuance of Stock for Cash Issuance of Stock for Long-Term Assets Ending Accounts Receivable Beginning Inventory 160,000 516,000 110,000 64,000 Ending Inventory 560,000 Purchase of Treasury Stock Beginning Prepaid Expenses 48,000 Ending Prepaid Expenses 42,000 The Net Cash Flows from Investing Activities section will include a line item for: Select one: a. $552,000 b. $164,000) c. $64,000 d $616,000 . $(616,000) The following information relates to the Ridge Company: $119,000 146,000 616,000 200,000 Net Income $365,000 Beginning Accounts Payable Depreciation Expense 96,000 Ending Accounts Payable Amortization of Intangible 11,000 Purchase of Long-Term Assets with Assets Cash Beginning Accounts Receivable 420,000 Cash from Issuance of Long-Term Debt Ending Accounts Receivable 439,000 Issuance of Stock for Cash Beginning inventory 516,000 Issuance of Stock for Long-Term Assets Ending Inventory 560,000 Purchase of Treasury Stock Beginning Prepaid Expenses 48,000 Ending Prepaid Expenses 42,000 160,000 110,000 64,000 Assume that the indirect method is used. The Net Cash Flows from Financing Activities section will include: Select one: a $(110,000) b. $64,000 c. $(160,000) d $200,000 $110,000