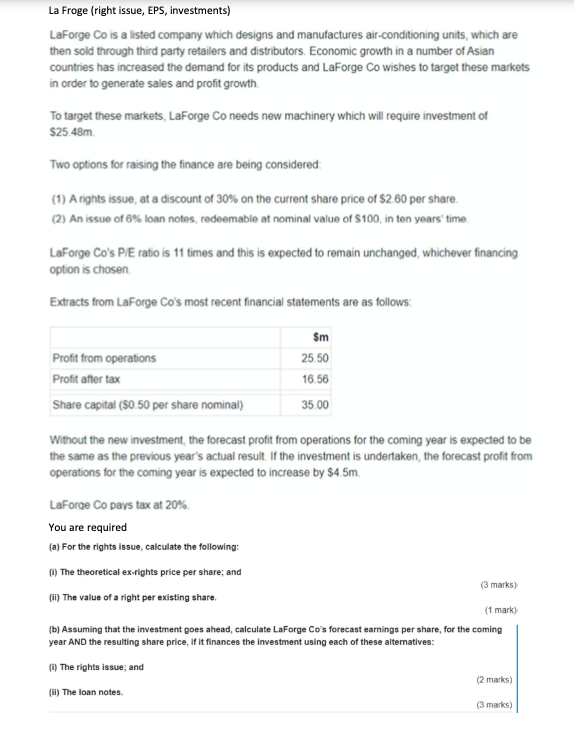

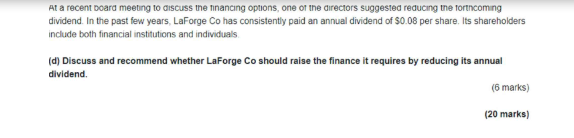

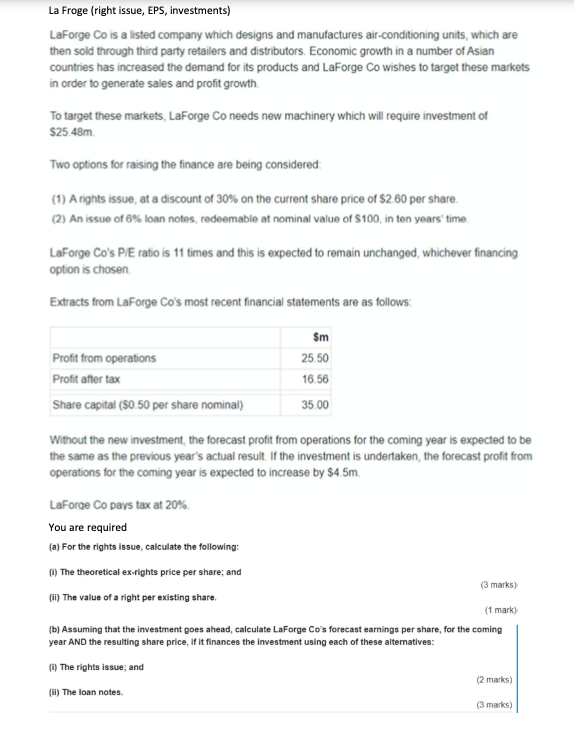

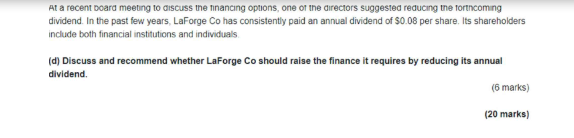

La Froge (right issue, EPS, investments) LaForge Co is a listed company which designs and manufactures air-conditioning units, which are then sold through third party retailers and distributors. Economic growth in a number of Asian countries has increased the demand for its products and LaForge Co wishes to target these markets in order to generate sales and profit growth. To target these markets, LaForge Co needs new machinery which will require investment of $25.48m Two options for raising the finance are being considered: (1) A rights issue, at a discount of 30% on the current share price of $2.60 per share. (2) An issue of 6% loan notes, redeemable at nominal value of S100, in ten years' time. LaForge Co's PE ratio is 11 times and this is expected to remain unchanged, whichever financing option is chosen Extracts from LaForge Co's most recent financial statements are as follows: Sm Profit from operations 25.50 Profit after tax 16.56 Share capital (0.50 per share nominal) 35.00 Without the new investment, the forecast profit from operations for the coming year is expected to be the same as the previous year's actual result. If the investment is undertaken, the forecast profit from operations for the coming year is expected to increase by $4.5m. LaForge Co pays tax at 20% You are required (a) For the rights issue, calculate the following: 1) The theoretical ex-rights price per share, and C) The value of a right per existing share. (1 mark) (b) Assuming that the investment goes ahead, calculate LaForge Co's forecast earnings per share, for the coming year AND the resulting share price, if it finances the investment using each of these alternatives: (1) The rights issue, and (2 marks) (i) The loan notes (3 marks) (3 marks) At a recent board meeting to discuss the financing options, one of the directors suggested reducing the forthcoming dividend. In the past few years, LaForge Co has consistently paid an annual dividend of $0.08 per share. Its Shareholders include both financial institutions and individuals (d) Discuss and recommend whether LaForge Co should raise the finance it requires by reducing its annual dividend. (6 marks) (20 marks)