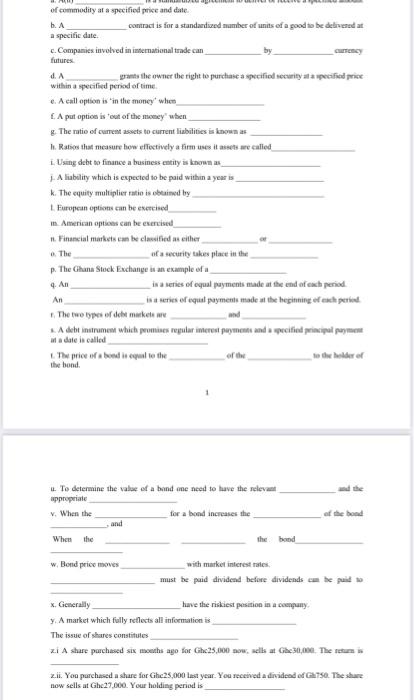

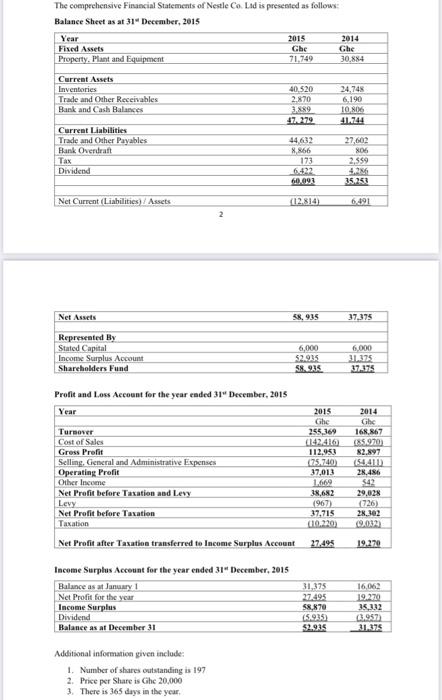

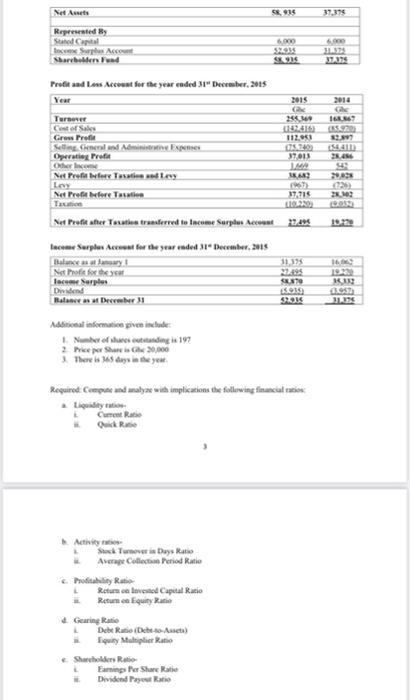

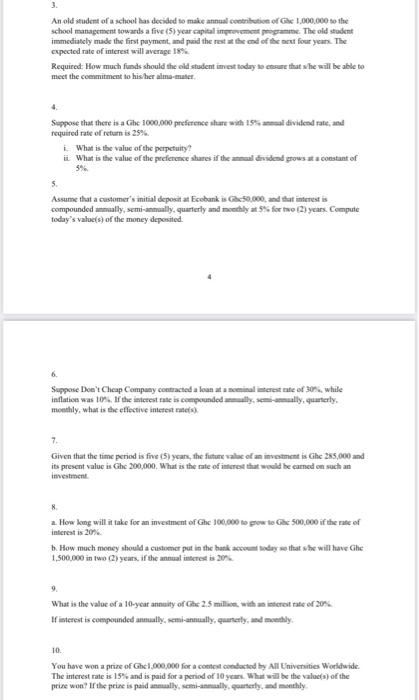

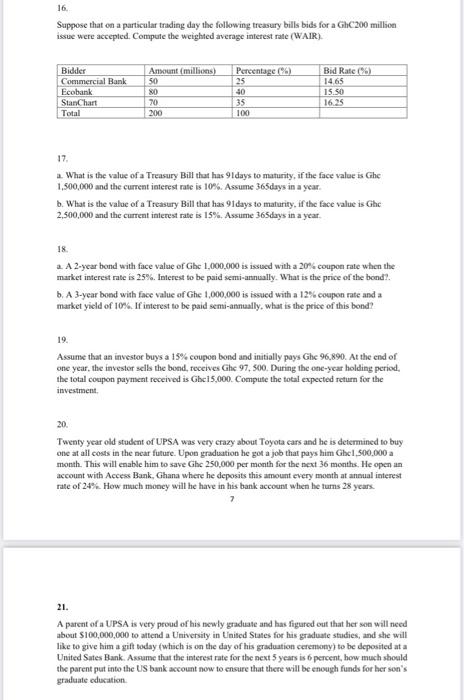

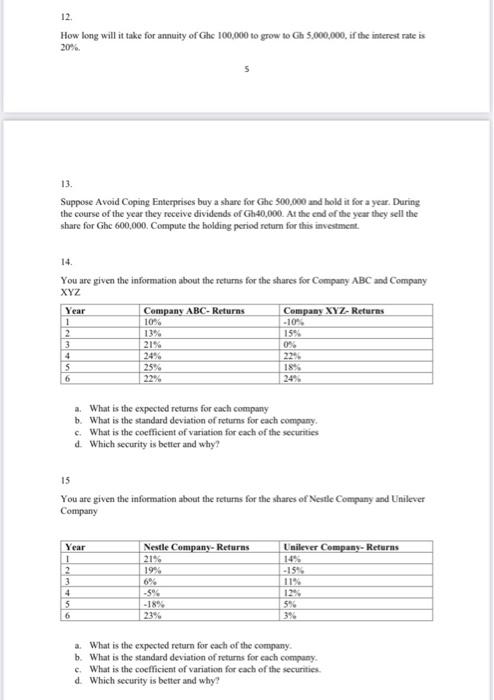

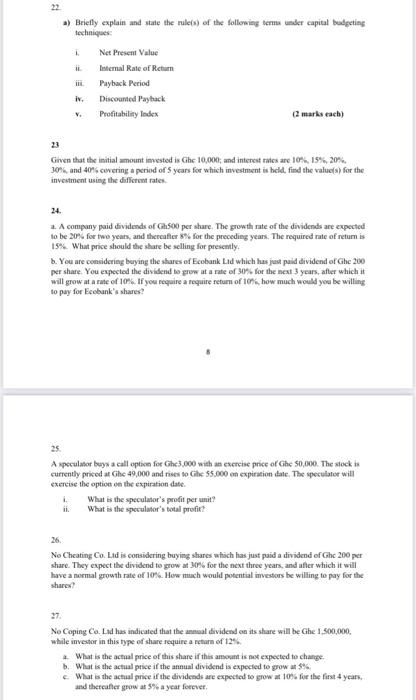

LA of commodity at a specified price and date. b. A contract is for a standardized mamber of units of a good to be delivered at a specific date c. Companies involved in international trade can futures prants the owner the right to purchase a specified security in a specified price within a specified period of time c. A call option is in the money when LA put option is out of the money when g. The ratio of current assets to current liabilities is known as I. Rates that measure how effectively a firm uses it assets are called 1. Using debt to finance a business entity is known as 1. Aliability which is expected to be paid within a year is k. The equity multiplier ratio is obtained by European options can be exercise in American options can be exercise 11. Financial markets can be classified as either of a security takes place in the p. The Ghana Stock Exchange is an example of a 4. An in a series of equal payments made at the end of each period An in a series of equal payment made it the heginning of each period The two types of det marketer and A debt instrumen which promises ropular interest payment and a specified principal payment Madale is called The price of bond in equal to the to the folder of the bond The To determine the value of a band me need to have the relevant appropriate v. When the for a bond increases the and When the the band of the bond w Bond price moves with market interest rates must be paid dividend before dividends can be paid to X. Generally have the riskiest position is a company y. A market which fully reflects all information is The issue of shares constitutes zi A share parchased six months ago for Ghc25,000 now. dat he30,000. There is z.it. You purchased a share for Chc25,000 last year. You received a dividend of G750. The share now sells at Ghc27.000. Your holding period is The comprehensive Financial Statements of Nestle Co. Lid is presented as follows: Balance Sheet as at 31 December, 2015 Year 2015 2014 Fixed Assets Ghe Property. Plant and Equipment 71.749 30,884 Ghc Current Assets Inventories Trade and Other Receivables Bank and Cash Balances 40.520 2.870 3.889 47.279 24.748 6.190 10 NG 41.7244 Current Liabilities Trade and Other Payables Bank Overdraft Tax Dividend 44.632 8.866 173 6422 27,602 806 2,959 4.26 35.251 Net Current Liabilities)/ Assets (12.816) 6491 2 Net Assets 58,935 37.375 Represented By Stated Capital Income Surplus Account Shareholders Fund 6,000 52.935 58.935 6.000 11.375 374375 Profit and Loss Account for the year eaded 31 December, 2015 Year Turnover Cost of Sales Gross Profit Selling, General and Administrative Expenses Operating Profit Other Income Net Profit before Taxation and Levy Levy Net Profit before Taxation Taxation Net Profit after Taxation transferred to Income Surplus Account 2015 Ghe 255,369 1142416 112,951 (75,740 37,013 1669 38,682 1967 37.715 010.220) 2014 Ghc 168.867 $5.970 82.897 154411 28.486 $42 29,028 26 28,302 0.032) 27,495 19.270 Income Surplus Account for the year ended 31 December, 2015 Balance as at January 1 Net Profit for the year Income Surplus Dividend Balance as at December 31 31,375 27.495 $8,870 15.925 $2.935 16,062 19.229 35,0.12 6.9572 31.375 Additional information given include: 1. Number of shares outstanding is 197 2. Price per Share is Ghc 20,000 3. There is 365 days in the year 9914 37.375 Net Auto Represented By Sud Capital Ince Sur Account 6000 2935 Profit and Les Account for the year ended 31 December 2015 2015 Turner Cost of Sales Grow Profil Cel mes Operating Profit Other Net Prewfer Taxation walay Ley Net Profit before Twin 25419 1182510 112.53 05.14 37013 che 19 52 12.7 all INS 9 29 17219 102 1929 Net Prefieather Toate transferred to Income Surplus Account Income Surple Access for the year ended December, Balance 113 Net Profit for the 2285 lace Surple Ded SONS Batanes Dreher SKOS 16 KN 0050 Additional informatie en include 2 Pieprise 30,000 There is 45 days in the yea Required: Compass und malyae with implications the following financial manis Liquidity Current Ratio Ouick Ratio Activity Suws Days Ratio Average Collection Period Ratio c. Polity Returveted Caputal Ratio Returns Equity & Gearing Rate Debt Ratio (De Act) Equity Multiplier Ratio Shareholders Rio Faminer Share Rate Dividend layout Ratio An old student of a school has decided to make anual contribution of G 1.000.000 to the school management towards a five (5) year capital inement programme. The old student immediately made the first payment, and paid the rest at the end of the next four years. The expected rate of interest will average 18% Required. How much funds should the old student imest today to ensure that she will be able to meet the commitment to his her almamater Suppose that there is a Che 1000,000 preference share with 15% anual dividend rate, and required rate of return is 25% What is the value of the perpetuity! i What is the value of the preference shares if the dividend grows at constant of 59 Assume that a customer's initial depositat Ecobank as Gax 50,000and that interestis compounded ammually, semi-ammually, quarterly and metaly at 5% for two (2) years. Compute today's value(s) of the money deposited Suppose Don't Cheap Company contracted a loan ateina interest rate of 30%, while inflation was 10%. If the interest rate is comprendedly, sci- cally, quarterly monthly, what is the effective interest rates) Given that the time period is five (5) years, the future value of an invamment is Che 255,000 and its present value is Ghc 200,000. What is the rate of interest that would be comedon such an investment 2. How long will at take for an investment of Ghe 100,000 to pow to G500,000 if the rate of interestis 20% b. How much money should a customer put in the bank account today so that she will have Chic 1,500,000 in two (2) years, if the annual interestis 20% 9 What is the value of a 10-year annuity of G: 2,5 milice, with an interest rate of 2016 If interest is compounded annually, semi-annually, quarterly, and monthly 10. You have won a prize of Gh1,000,000 for a contest contacted by All Universities Worldwide The interest rate is 19% and is paid for a period of 10 year. What will be the values of the prize won' If the prize is paid annually, semi-annually, quarterly, and monthly 16 Suppose that on a particular trading day the following treasury bills bids for a GhC200 million issue were accepted. Compute the weighted average interest rate (WAIR) Bidder Commercial Bank Ecobank StanChart Total Amount (millions) 50 80 70 200 Percentage (6) 25 40 35 100 Bid Rate(%) 1465 15.50 16.25 17. What is the value of a Treasury Bill that has 91days to maturity, if the face value is Ghe 1,500,000 and the current interest rate is 10%. Assume 365days in a year b. What is the value of a Treasury Bill that has 91days to maturity. If the face value is Ghe 2,500,000 and the current interest rate is 15% Assume 365days in a year 18 2. A 2-year bond with face value of Ghe 1,000.000 is issued with a 20% coupon rate when the market interest rate is 25%. Interest to be paid semi-annually. What is the price of the bond? b. A 3-year bond with face value of Ghe 1,000,000 is issued with a 12% coupon rate and a market yield of 10%. If interest to be paid semi-annually. what is the price of this bond? 19. Assume that an investor buys a 15% coupon bond and initially pays Ghc 96,890. At the end of one year, the investor sells the bond, receives Ghe 97,500. During the one-year holding period. the total coupon payment received is Gh15,000. Compute the total expected return for the investment 20. Twenty year old student of UPSA was very crazy about Toyota cars and he is determined to buy Otte at all costs in the near future. Upon graduation he got a job that pays him Ghe 1.500.000 a month. This will enable him to save Ghc 250,000 per month for the next 36 months. He open an account with Access Bank, Ghana where he deposits this amount every month at annual interest rate of 24%. How much money will he have in his bank account when he turns 28 years 7 21. A parent of a UPSA is very proud of his newly graduate and has figured out that her son will need about $100,000,000 to attend a University in United States for his graduate studies, and she will like to give him a gift today (which is on the day of his graduation ceremony) to be deposited at a United Sates Bank. Assume that the interest rate for the next 5 years is 6 percent, how much should the parent put into the US bank account now to ensure that there will be enough funds for her son's graduate education 12 How long will it take for annuity of Ghe 100,000 to grow to Gh 5,000,000, if the interest rate is 20% 13. Suppose Avoid Coping Enterprises buy a share for Ghe 500.000 and hold it for a year. During the course of the year they receive dividends of Gh40,000. At the end of the year they sell the share for Ghc 600,000, Compute the holding period return for this investment You are given the information about the returns for the shares for Company ABC and Company XYZ Year 1 2 3 4 5 6 Company ABC- Returns 10% 13% 21% 24 25% 22% Company XYZ- Returns -10% 15% 0% 229 18% a. What is the expected returns for each company b. What is the standard deviation of returns for each company 6. What is the coefficient of variation for each of the securities Which security is better and why? 15 You are given the information about the returns for the shares of Nestle Company and Unilever Company Year 1 2 3 4 5 6 Nestle Company - Returns 21% 19% 6% -5% -18% 23% Unilever Company - Returns 14% -15% 11% 596 3% a. What is the expected return for each of the company b. What is the standard deviation of returns for each company c. What is the coefficient of variation for cach of the securities d. Which security is better and why? 22 ) Briefly explain and state the rule(s) of the following terms under capital budgeting techniques Net Present Value Internal Rate of Return Payback Period iv. Discounted Payback Profitability Index (2 marks each) 23 Given that the initial amount invested in Ghe 10,000, and interest rates are 10% 15% 20% 30% and 40% covering a period of years for which investment is held find the value for the investment using the different rates 24. . A company paid dividends of G500 per share. The growth rate of the dividends are expected to be 20% for two years, and thereafter 8% for the preceding years. The required rate of retumis 15% What price should the share be selling for presently b. You are considering buying the shares of Ecobank Lad which has just paid dividend of Ghe 200 per share. You expected the dividend to grow at a rate of 30% for the next 3 years, after which it will grow at a rate of 10%. If you require a require retum of 10 how much would you be willing to pay for Ecobank's shares? 25 A speculator buy a call option for Ghe3,000 with an exercise price of Ghe 50,000. The stock to currently priced at Ghe 49,000 and rises to be 55.000 en expiration date. The speculator will exercise the option on the expiration date What is the speculator's profit per unit? What is the speculator's total profit? 26. No Cheating Co. Ltd is considering buying shares which has just paid a dividend of Ghc 200 per share. They expect the dividend to grow at 30% for the next three years, and after which it will have a normal growth rate of 10% How much would potential investors be willing to pay for the share? No Coping Co. Ltd has indicated that the annual dividend on its share will be Ghe 1.500,000. while investor in this type of share require a return of 125 What is the actual price of this share if this amount is not expected to change. b. What is the actual price if the annual dividend is expected to grow $% What is the actual price if the dividends are expected to grow at 10% for the first 4 years. and thercafter grow at 5% a year forever