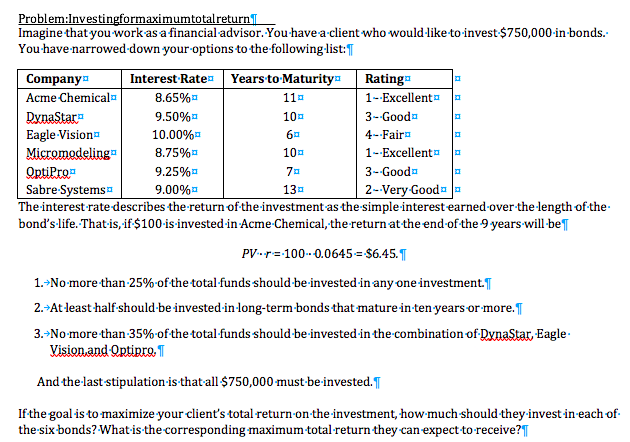

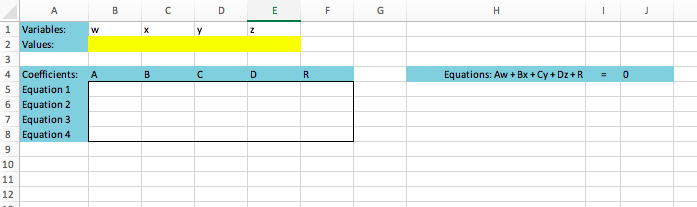

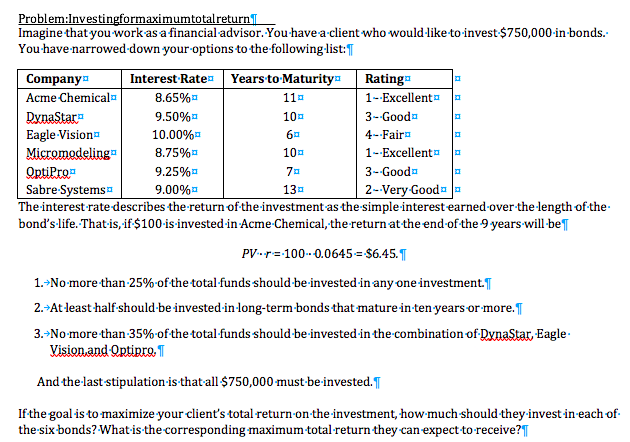

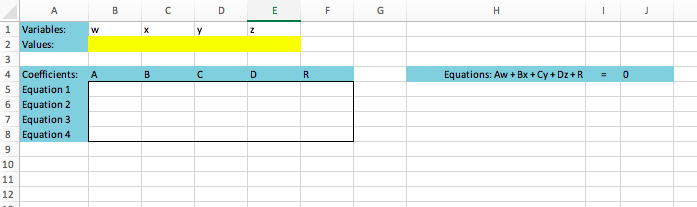

La Problem:Investingformaximumtotalreturn Imagine that you work as a financial advisor. You have a client who would like to invest $750,000-in-bonds. You have narrowed down your options to the following list: Company Interest Ratea Years to-Maturitya Ratinge Acme Chemicals 8.65% 110 1 - Excellent DynaStara 9.50% 100 3-Goode Eagle Vision 10.00% 60 4- Fairs Micromodeling 8.75% 100 1--Excellent OptiPro 9.25% 70 3-Goods Sabre Systems 9.00% 13 2- Very Good The-interest-rate describes the return of the investment as the-simple-interest earned-over-the-length of the bond's life. That is, if $100-is-invested-in-Acme Chemical, the return at the end of the 9 years will be PV-r=-100---0.0645= $6.45. T 1.-No-more-than-25%-of the total funds should-be-invested in any one investment. 2. At least half-should-be invested-in-long-term-bonds that mature in ten years or more. I 3.-No more than 35%-of the total funds should-be-invested in the combination of Dynastar, Eagle Visionand-Optipro. 1 And the-last-stipulation is that all $750,000 must-be-invested. T If the goal is to maximize your client's total return on the investment, how-much should they-invest in-each of the-six bonds? What is the corresponding maximum total return they can expect to receive? B D E F G H - w X Y Z B D R Equations: Aw + Bx + Cy+Dz+R 0 1 Variables: 2 Values: 3 4 Coefficients: 5 Equation 1 6 Equation 2 7 Equation 3 8 Equation 4 9 10 11 12 La Problem:Investingformaximumtotalreturn Imagine that you work as a financial advisor. You have a client who would like to invest $750,000-in-bonds. You have narrowed down your options to the following list: Company Interest Ratea Years to-Maturitya Ratinge Acme Chemicals 8.65% 110 1 - Excellent DynaStara 9.50% 100 3-Goode Eagle Vision 10.00% 60 4- Fairs Micromodeling 8.75% 100 1--Excellent OptiPro 9.25% 70 3-Goods Sabre Systems 9.00% 13 2- Very Good The-interest-rate describes the return of the investment as the-simple-interest earned-over-the-length of the bond's life. That is, if $100-is-invested-in-Acme Chemical, the return at the end of the 9 years will be PV-r=-100---0.0645= $6.45. T 1.-No-more-than-25%-of the total funds should-be-invested in any one investment. 2. At least half-should-be invested-in-long-term-bonds that mature in ten years or more. I 3.-No more than 35%-of the total funds should-be-invested in the combination of Dynastar, Eagle Visionand-Optipro. 1 And the-last-stipulation is that all $750,000 must-be-invested. T If the goal is to maximize your client's total return on the investment, how-much should they-invest in-each of the-six bonds? What is the corresponding maximum total return they can expect to receive? B D E F G H - w X Y Z B D R Equations: Aw + Bx + Cy+Dz+R 0 1 Variables: 2 Values: 3 4 Coefficients: 5 Equation 1 6 Equation 2 7 Equation 3 8 Equation 4 9 10 11 12