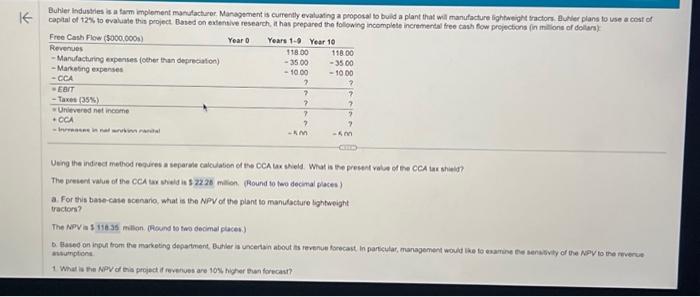

LAB 9 question 13

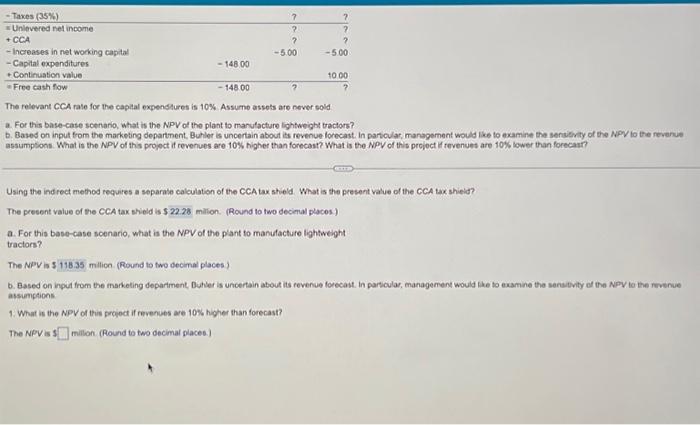

Help with b. 1.

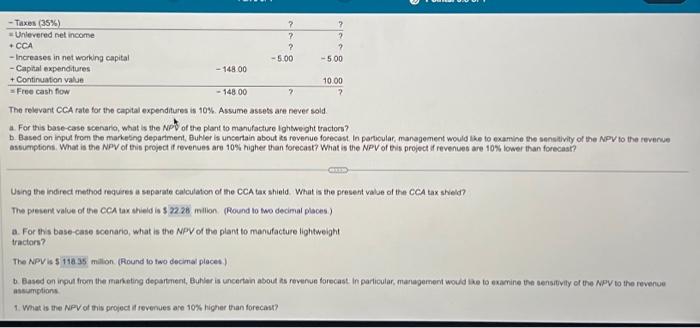

a. For this base-case scenario, what is the NPV of the plant to manulacture bighweight tracton? antumptions 1. What is the NPV of this proipd it revenues ave 10 s, higner Bun forncast? The relevant CCA rate for the capital expenditures is 10%. Assume assets are never sold. a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight tractors? b. Based on input from the markesing department, Bubler is unsertain about ks rovenue forecast in particular, mansgement would the to examine the sansalvily of the NPV to the reverue assumptions. What is the NPV of this project if revenues are 10% higher than forecast? What is the NPV of eis project if revenues are 10 s. lower than forecast? Using the indired method requires a separate calcutation of the CCA tax shield. What is the present value of the CCA tax shield? The patecent value of the CCA tar shield is $22.28. million. (Round to two decimal places.) a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight tractors? The NPV is 5 millon. (Round io two decimal pleces) b. Based on input from the manating departenent, Buhler is uncertain about ts revenue forecast in particular, management would ixe to examine the sensitily of the NPV to the revenue assumptions. 1. What is the NPV of this project if revenues are 10% higher than forecast? The relevant CCA rate for the capital expenditures is 10%. Assume assets are never sold a. For this base-case scenario, what is the NPV of the plant to manutacture lightweight tractors? b. Based on input from the marketing department. Buhler is uncertain about is revenue forecast. in partocular, management would like to examine the senaibuty of the NPV to the revenue assumptons. What is the NPV of this propect if revenues are 10% higher than forecast? What is the NPV of this prejoct if revenues are 10% lower than forecas? Using the indrect method requires a separabe calculation of the CCA tax shield. What is the present vilue of the CCA tax shieid? The present value of the CCA tax shield is: milion. (Round to two decienal places) a. For this base-case sconario, what is the NPV of the plant to manulacture lightweight tractors? The NPV is 5 milion (Round to two decimal placess) assumptions. 1. What is the NPV of this projoct if revenues are 10% higher than forecast? The NPV is 1 millon. (Round to two decimal places.)