Answered step by step

Verified Expert Solution

Question

1 Approved Answer

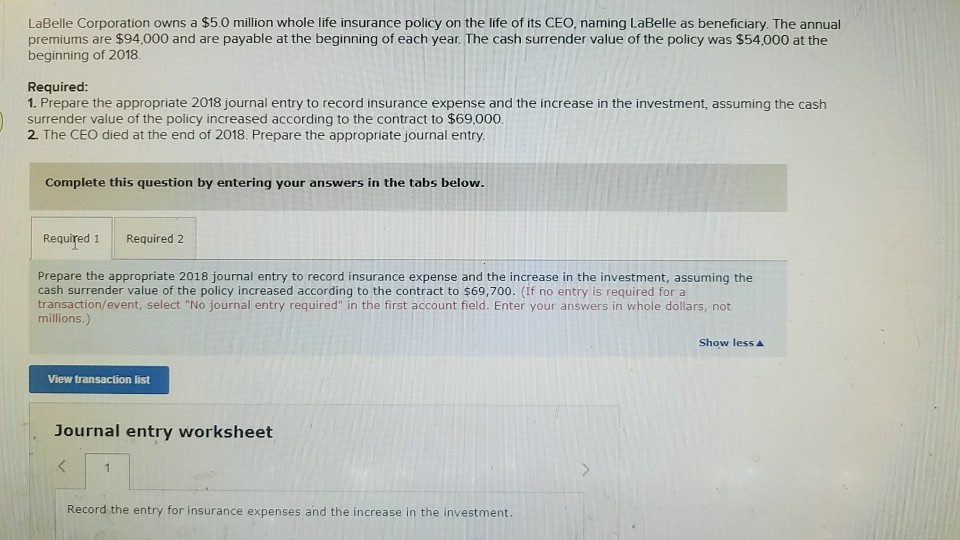

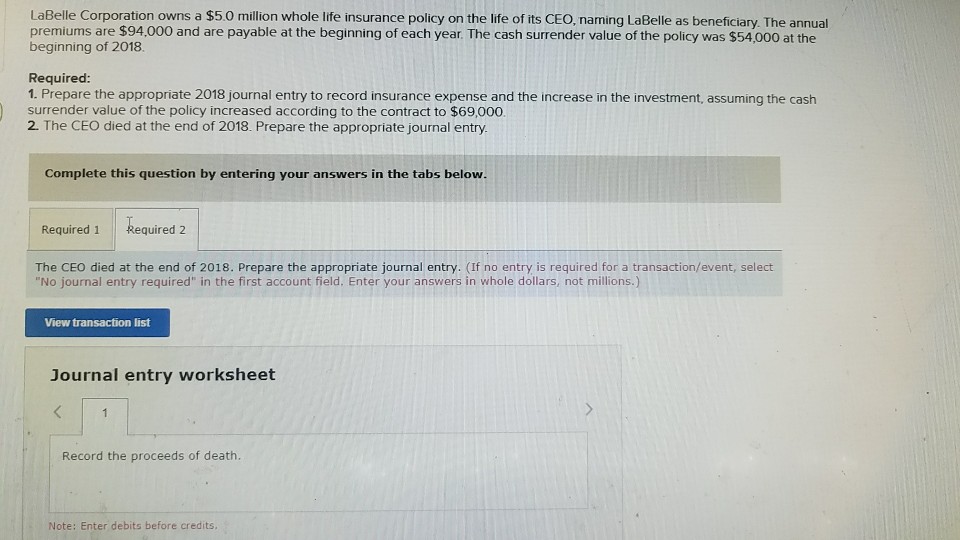

LaBelle Corporation owns a $5.0 million whole life insurance policy on the life of its CEO, naming LaBelle as beneficiary. The annual premiums are $94,000

LaBelle Corporation owns a $5.0 million whole life insurance policy on the life of its CEO, naming LaBelle as beneficiary. The annual premiums are $94,000 and are payable at the beginning of each year. The cash surrender value of the policy was $54,000 at the beginning of 2018 Required 1. Prepare the appropriate 2018 journal entry to record insurance expense and the increase in the investment, assuming the cash surrender value of the policy increased according to the contract to $69,000 2. The CEO died at the end of 2018. Prepare the appropriate journal entry. Complete this question by entering your answers in the tabs below Required 1 Required 2 Prepare the appropriate 2018 journal entry to record insurance expense and the increase in the investment, assuming the cash surrender value of the policy increased according to the contract to $69,700. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars, not millions.) Show lessA View transaction list Journal entry worksheet Record the entry for insurance expenses and the increase in the investment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started