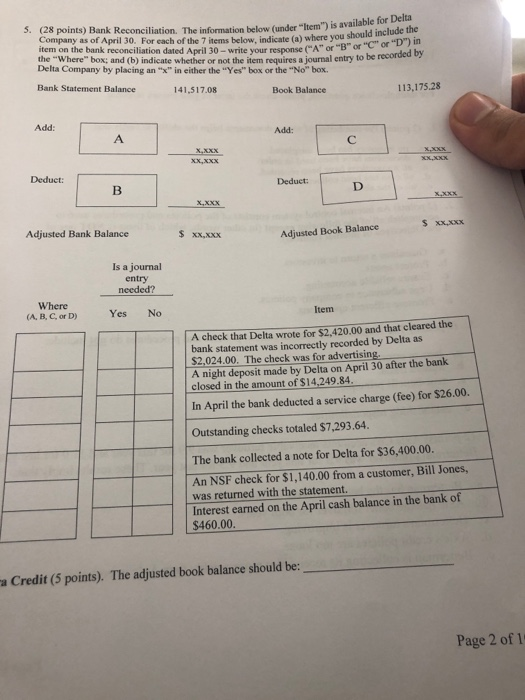

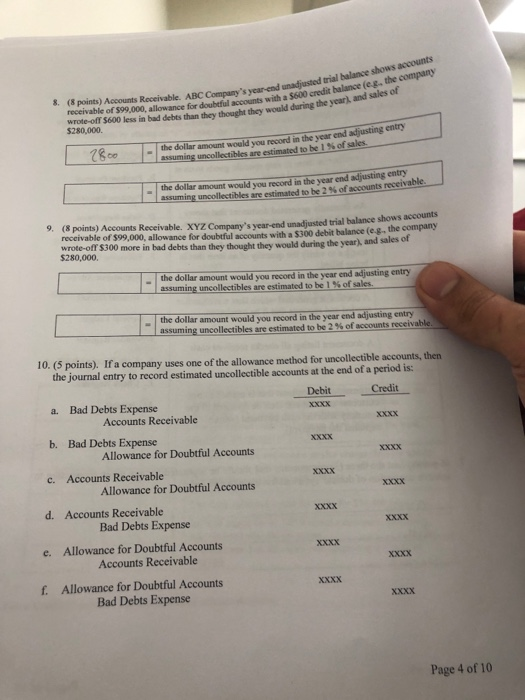

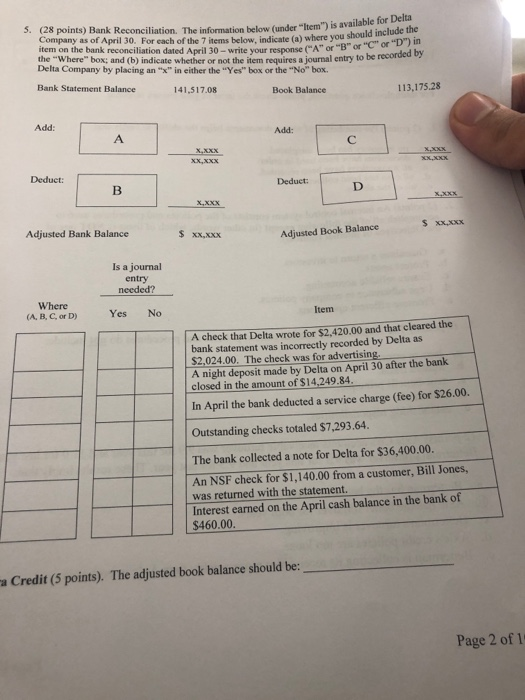

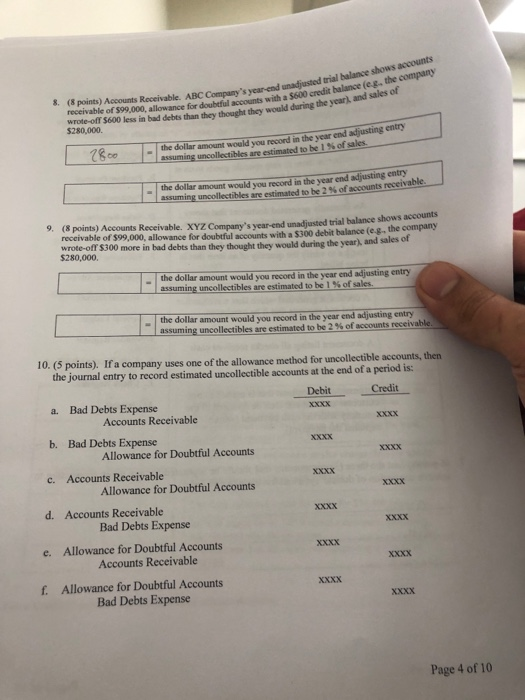

lable for Delta should include the 5. (28 points) Bank Reconciliation. The information below (under "Item") is ava Company as of April 30. For each of the 7 items below, indicate (a) where you s " or item on the bank reconciliation dated April 30-write your response ("A"or- the "Where" box; and (b) indicate whether or not the item requires a journal entry to Delta Company by placing an "x" in either the "Yes" box or the "No" box. be recorded by Bank Statement Balance 141,517.08 Book Balance 113,175.28 Add: Add: Deduct: Deduet: Adjusted Bank Balance S xx,xxx S xx,xxx Adjusted Book Balance Is a journal entry needed? Where (A, B, C, or D) Yes No Item A check that Delta wrote for $2.420.00 and that cleared the bank statement was incorrectly recorded by Delta as $2,024.00. The check was for advertising A night deposit made by Delta on April 30 after the bank closed in the amount of $14,249.84. In April the bank deducted a service charge (fee) for $26.00. Outstanding checks totaled $7,293.64. The bank collected a note for Delta for $36,400.00. An NSF check for $1,140.00 from a customer, Bill Jones, was returned with the statement. Interest earned on the April cash balance in the bank of $460.00 a Credit (5 points). The adjusted book balance should be Page 2 of 1 trial balance sih the company credit halance (eg receivable of $99,000, allowance for doubtful accounts with a $600 credit balance (e 5280,00s in bad debts than they thought they would during the yeark $280,000. 8. (8 points) Accounts Receivable. ABC Company's year-end and sales of Coothe dollar amount would you record in the year end adjusting entry the dollar amount would you record in the year end adjusting entry assuming uncollectibles are estimated to be 2 % of accounts 9. (8 points) Accounts Receivable. XYZ Company's year-end unadjusted trial balance shows accounts receivable of $99,000, allowance for doubtful accounts with a $300 debit balance (eg. the compty more in bad debts than they thought they would during the year), and sales of $280,000. the dollar amount would you record in the year end adjusting entry I assuming uncollectibles are estimated to be l % of sales. the dollar amount would you record in the year end adjusting entry lassuminguncollectibles are estimated to be 2 % of accounts receivable 10. (5 points). If a company uses one of the allowance method for uncollectible accounts, then the journal entry to record estimated uncollectible accounts at the end of a period is: a. Bad Debts Expense b. Bad Debts Expense Debit Credit Accounts Receivable Allowance for Doubtful Accounts c. Accounts Receivable Allowance for Doubtful Accounts d. Accounts Receivable Bad Debts Expense xxxX Allowance for Doubtful Accounts Accounts Receivable e. XxxX XxxX f. Allowance for Doubtful Accounts XxxX Bad Debts Expense Page 4 of 10