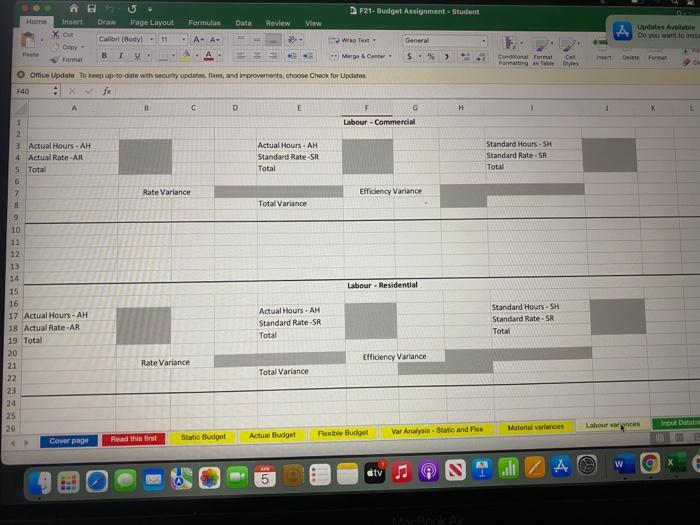

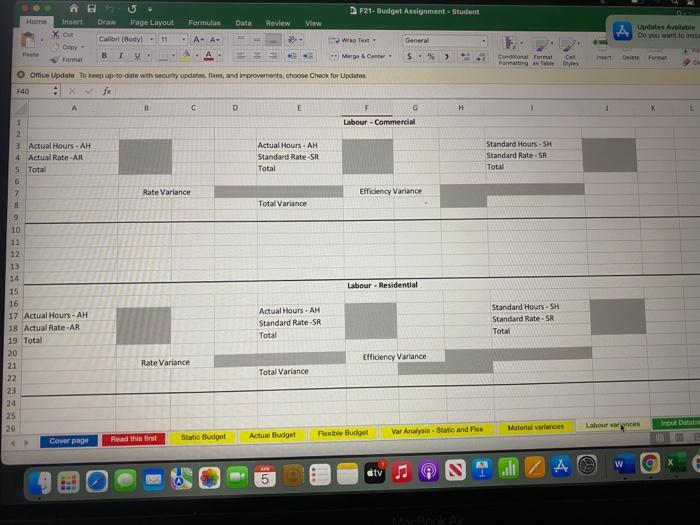

labour variance calculations of cosmos cleaning services and method of calculation with working notes

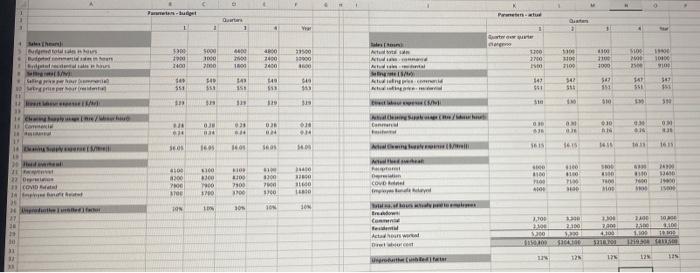

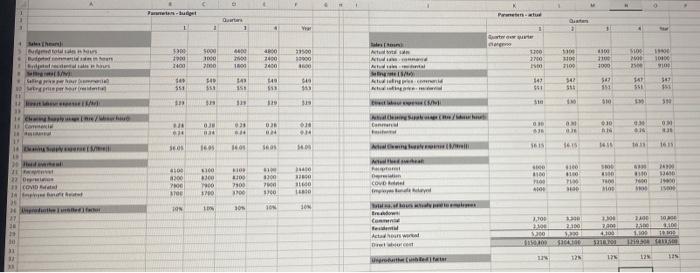

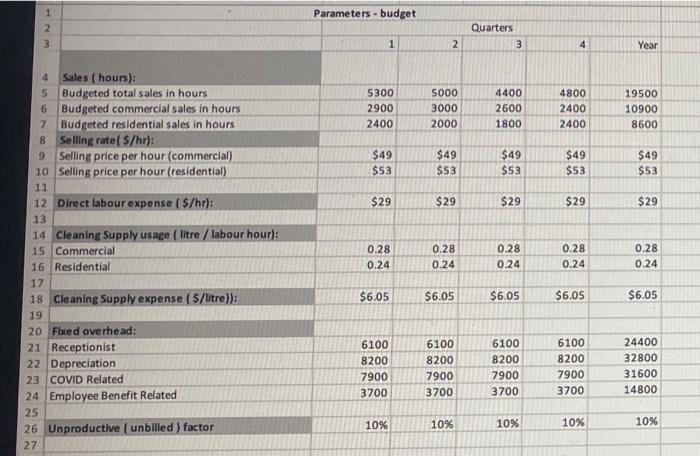

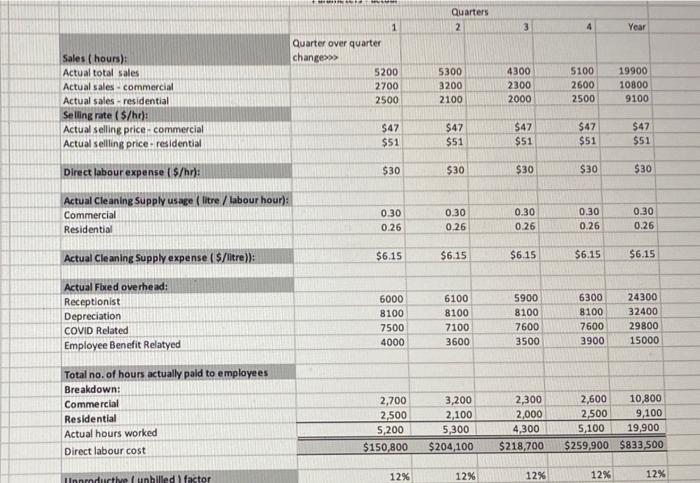

F21-Budget Assignment - Student Formulas Data Review View Updates Alable Home inser Xon Cury- Draw Page Layout Calibr (Body B T A A- A- Test General Format Merge Center %) Ca urmat Format De Format es Office Update To keep up to date with only updates. Thes, and improvements, choose Check for Updates F40 Xfx A B D E F 1 Labour - Commercial 3 Actual Hours -AH 4 Actual Rate -AR 5 Total Actual Hours -AH Standard Rate-SR Total Standard Hours-SH Standard Rate.SR Total 6 Rate Variance Efficiency Variance 7 8 Total Variance 9 10 11 12 13 14 Labour - Residential IS Actual Hours - AH Standard Rate-SR Total Standard Hours - SH Standard Rate SR Total Efficiency Variance 16 17 Actual Hours-AH 18 Actual Rate -AR 19 Total 20 21 22 23 24 25 26 Rate Variance Total Variance Material Varlandes Labour vores rout Data Static Var Analysis Static and Flex get Read this first Actual Budget Flexible Budget Cover page ..li W ZA 5 Stv MacBook 1 det Porner Quran Q 2 TO Vw 3 lai | re| 009 OP S000 1000 2000 100 53000 WEIN FIN 1700 210 2400 W MORE 100 10 3000 re 1000 1400 DOS DOVE 00 Adal 7100 bois Sim MENE TAV no 11 DID 149 147 Alu 542 $42 sen 551 31 149 150 ESS 193 5 155 15 155 14 190 3:15 SRT T! DIE 50 13 1 h Car / HO Gm 00 or 10 14 ON ro PER 10 HD re . BE 3603 1615 1611 14 140 1605 Seos 109 629 1410 10 10 si 300 100 100 1 300 TE 06 8100 110 cort PAN 0001 1000 2 COND Imp 7100 det 1 110 1300 19 HEPH 10 30 10 SON COVER ng .. tre C Actado Drew 2.100 E ort BO 10 2-100 1 $200 100 100 21. OB 1.100 19 LA 14 SHAH DE TE TE be NIE 123 123 SE Parameters budget 1 2 3 Quarters 3 1 2 4 Year 4 5300 2900 2400 5000 3000 2000 4400 2600 1800 4800 2400 2400 19500 10900 8600 $49 $53 $49 $53 $49 $53 $49 $53 $49 $53 $29 $29 $29 $29 $29 Sales (hours): 5 Budgeted total sales in hours 6 Budgeted commercial sales in hours 7 Budgeted residential sales in hours 8 Selling rate S/hr): 9 Selling price per hour (commercial) 10 Selling price per hour (residential) 11 12 Direct labour expense ( S/hr): 13 14 Cleaning Supply usage (litre / labour hour): 15 Commercial 16 Residential 17 18 Cleaning Supply expense (S/litre)); 19 20 Fixed overhead: 21 Receptionist 22 Depreciation 23 COVID Related 24 Employee Benefit Related 25 26 Unproductive (unbilled) factor 27 0.28 0.24 0.28 0.24 0.28 0.24 0.28 0.24 0.28 0.24 $6.05 $6.05 $6.05 $6.05 $6.05 6100 8200 7900 3700 6100 8200 7900 3700 6100 8200 7900 3700 6100 8200 7900 3700 24400 32800 31600 14800 10% 10% 10% 10% 10% Quarters 2 3 4 Year 1 Quarter over quarter change>>> 5200 2700 2500 5100 Sales ( hours): Actual total sales Actual sales commercial Actual sales - residential Selling rate (/hr): Actual selling price-commercial Actual selling price residential 5300 3200 2100 4300 2300 2000 2600 2500 19900 10800 9100 $47 $51 $47 $51 $47 $51 $47 $51 $47 $51 Direct labour expense S/hr): $30 $30 $30 $30 $30 Actual Cleaning Supply usage (litre / labour hour): Commercial Residential 0.30 0.26 0.30 0.26 0.30 0.26 0.30 0.26 0.30 0.26 Actual Cleaning Supply expense (S/litre)); $6.15 $6.15 $6.15 $6.15 $6.15 Actual Fixed overhead: Receptionist Depreciation COVID Related Employee Benefit Related 6000 8100 7500 4000 6100 8100 7100 3600 5900 8100 7600 3500 6300 8100 7600 3900 24300 32400 29800 15000 Total no. of hours actually paid to employees Breakdown: Commercial Residential Actual hours worked Direct labour cost 2,700 2,500 5,200 $150,800 3,200 2,100 5,300 $204,100 2,300 2,000 4,300 $218,700 2,600 10,800 2,500 9,100 5,100 19,900 $259,900 $833,500 12% 12% Tinnendurtive unbilled) factor 12% 12% 12%