Answered step by step

Verified Expert Solution

Question

1 Approved Answer

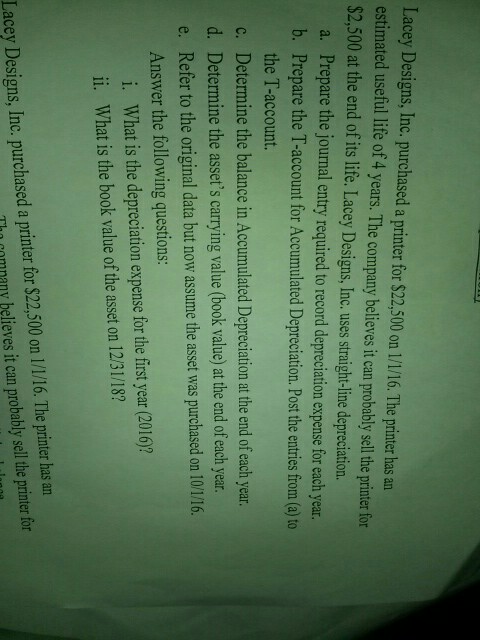

Lacey Designs, Inc. purchased a printer for $22, 500 on 1/1/16. The printer has an estimated useful life of 4 years. The company believes it

Lacey Designs, Inc. purchased a printer for $22, 500 on 1/1/16. The printer has an estimated useful life of 4 years. The company believes it can probably sell the printer for $2, 500 at the end of its life. Lacey Designs, Inc. uses straight-line depreciation. a. Prepare the journal entry required to record depreciation expense For each year. b. Prepare the T-account for Accumulated Depreciation. Post the entries from (a) to the T-account. c. Determine the balance in Accumulated Depreciation at the end of each year. d. Determine the asset's earning value (book value) at the end of each year. e. Refer to the original data but now assume the asset was purchased on 10/116. Answer the following questions: i. What is the depreciation expense for the first year (2016)? ii. What is the book value of the asset on 12/31/18

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started