Question

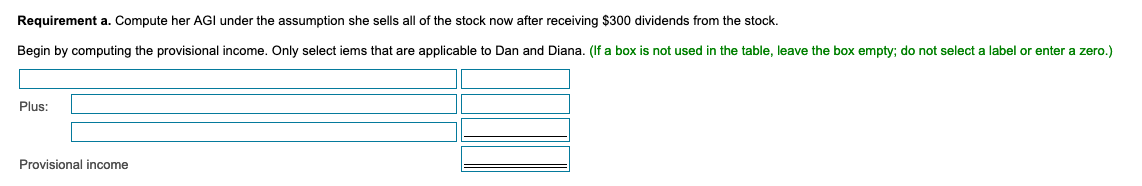

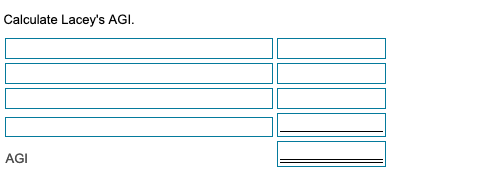

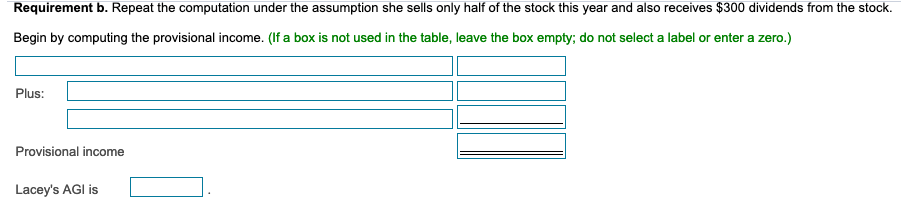

Lacey is a 69-year-old single individual who receives a taxable pension of $ 10,500 per year and Social Security benefits of $ 3,200. Lacey is

Lacey is a 69-year-old single individual who receives a taxable pension of $ 10,500 per year and Social Security benefits of $ 3,200. Lacey is considering the possibility of selling stock she has owned for years and using the funds to purchase a summer home. She will realize a gain of $ 25,100when she sells the stock, which has been paying $ 300 of dividends each year. Lacey says her brother recommended that she sell half of the stock this year and half next year because selling all of the stock at once would affect the tax treatment of her Social Security benefits.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started