Answered step by step

Verified Expert Solution

Question

1 Approved Answer

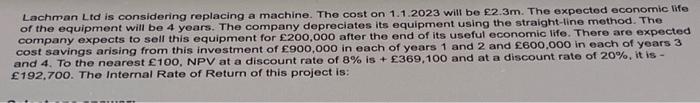

Lachman Ltd is considering replacing a machine. The cost on 1.1.2023 will be 2.3m. The expected economic life of the equipment will be 4 years.

Lachman Ltd is considering replacing a machine. The cost on 1.1.2023 will be 2.3m. The expected economic life of the equipment will be 4 years. The company depreciates its equipment using the straight-line method. The company expects to sell this equipment for 200,000 after the end of its useful economic life. There are expected cost savings arising from this investment of 900,000 in each of years 1 and 2 and 600,000 in each of years 3 and 4. To the nearest 100, NPV at a discount rate of 8% is + 369,100 and at a discount rate of 20%, it is - 192,700. The Internal Rate of Return of this project is:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started