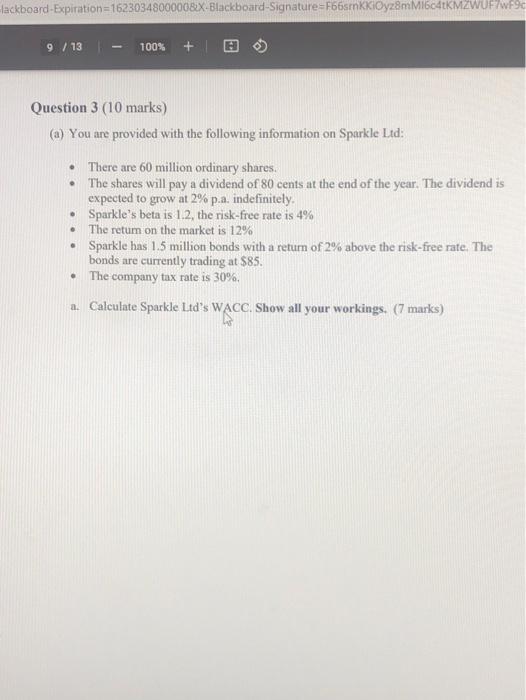

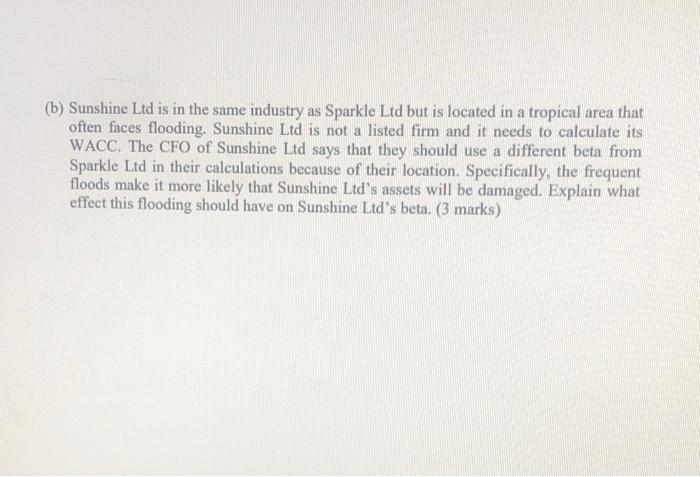

lackboard-Expiration=16230348000008X Blackboard-Signature=F66srnkiOyz8mM16KMZWUF7wF90 9 / 13 100% + Question 3 (10 marks) (a) You are provided with the following information on Sparkle Ltd: There are 60 million ordinary shares. The shares will pay a dividend of 80 cents at the end of the year. The dividend is expected to grow at 2% p.a. indefinitely Sparkle's beta is 1.2, the risk-free rate is 4% Sparkle has 1.5 million bonds with a return of 2% above the risk-free rate. The bonds are currently trading at $85. The company tax rate is 30% The retum on the market is 12% . 2. Calculate Sparkle Ltd's Wace. Show all your workings. (7 marks) (b) Sunshine Ltd is in the same industry as Sparkle Ltd but is located in a tropical area that often faces flooding. Sunshine Ltd is not a listed firm and it needs to calculate its WACC. The CFO of Sunshine Ltd says that they should use a different beta from Sparkle Ltd in their calculations because of their location. Specifically, the frequent floods make it more likely that Sunshine Ltd's assets will be damaged. Explain what effect this flooding should have on Sunshine Ltd's beta. (3 marks) lackboard-Expiration=16230348000008X Blackboard-Signature=F66srnkiOyz8mM16KMZWUF7wF90 9 / 13 100% + Question 3 (10 marks) (a) You are provided with the following information on Sparkle Ltd: There are 60 million ordinary shares. The shares will pay a dividend of 80 cents at the end of the year. The dividend is expected to grow at 2% p.a. indefinitely Sparkle's beta is 1.2, the risk-free rate is 4% Sparkle has 1.5 million bonds with a return of 2% above the risk-free rate. The bonds are currently trading at $85. The company tax rate is 30% The retum on the market is 12% . 2. Calculate Sparkle Ltd's Wace. Show all your workings. (7 marks) (b) Sunshine Ltd is in the same industry as Sparkle Ltd but is located in a tropical area that often faces flooding. Sunshine Ltd is not a listed firm and it needs to calculate its WACC. The CFO of Sunshine Ltd says that they should use a different beta from Sparkle Ltd in their calculations because of their location. Specifically, the frequent floods make it more likely that Sunshine Ltd's assets will be damaged. Explain what effect this flooding should have on Sunshine Ltd's beta