Answered step by step

Verified Expert Solution

Question

1 Approved Answer

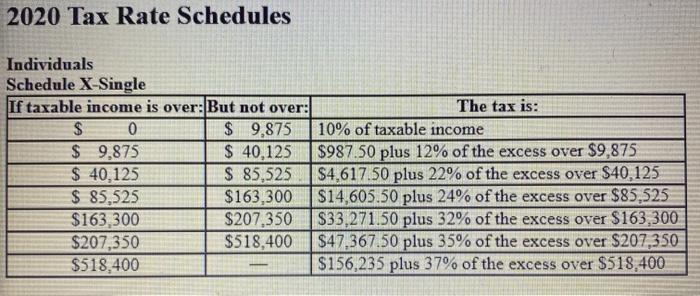

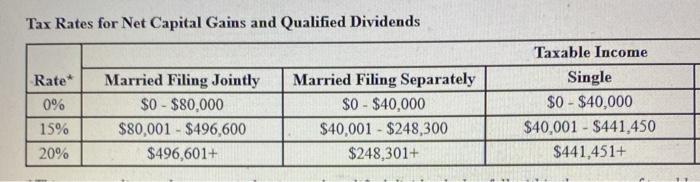

Lacy is a single taxpayer. In 2020, her taxable income is $45,000. what is her tax liability in each of the following alternative situations? b.

Lacy is a single taxpayer. In 2020, her taxable income is $45,000. what is her tax liability in each of the following alternative situations?

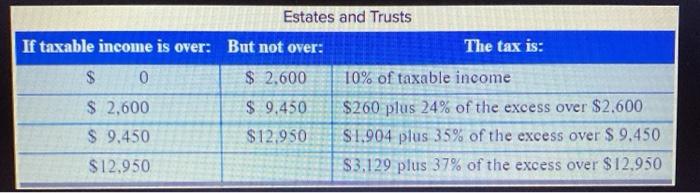

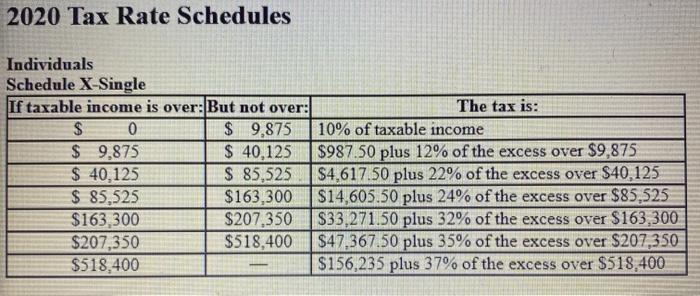

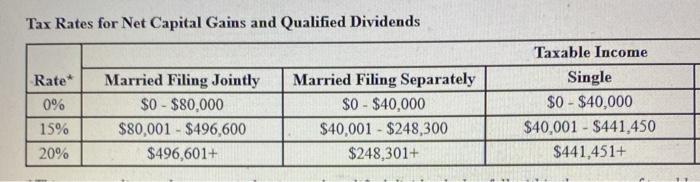

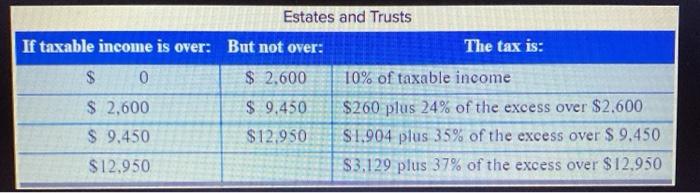

2020 Tax Rate Schedules Individuals Schedule X-Single If taxable income is over:But not over: The tax is: $ 0 $ 9,875 10% of taxable income $ 9,875 $ 40,125 $987.50 plus 12% of the excess over $9,875 $ 40,125 $ 85,525 $4,617.50 plus 22% of the excess over $40,125 $ 85,525 $163,300 $14,605,50 plus 24% of the excess over $85,525 $163,300 $207,350 $33,271.50 plus 32% of the excess over $163,300 $207,350 $518,400 $47,367.50 plus 35% of the excess over $207,350 $518,400 $156,235 plus 37% of the excess over $518,400 Tax Rates for Net Capital Gains and Qualified Dividends Rate* 0% 15% 20% Married Filing Jointly $0 - $80,000 $80,001 - $496,600 $496,601+ Married Filing Separately $0 - $40,000 $40,001 - $248,300 $248,301+ Taxable Income Single $0 - $40,000 $40,001 - $441,450 $441,451+ Estates and Trusts If taxable income is over: But not over: The tax is: $ 0 $. 2.600 10% of taxable income $ 2,600 $ 9,450 $260 plus 24% of the excess over $2.600 $ 9.450 $12.950 $1,904 plus 35% of the excess over $ 9.450 $12.950 $3,129 plus 37% of the excess over $12.950 b. Her $45,000 of taxable income includes $4,000 of qualified dividends.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started