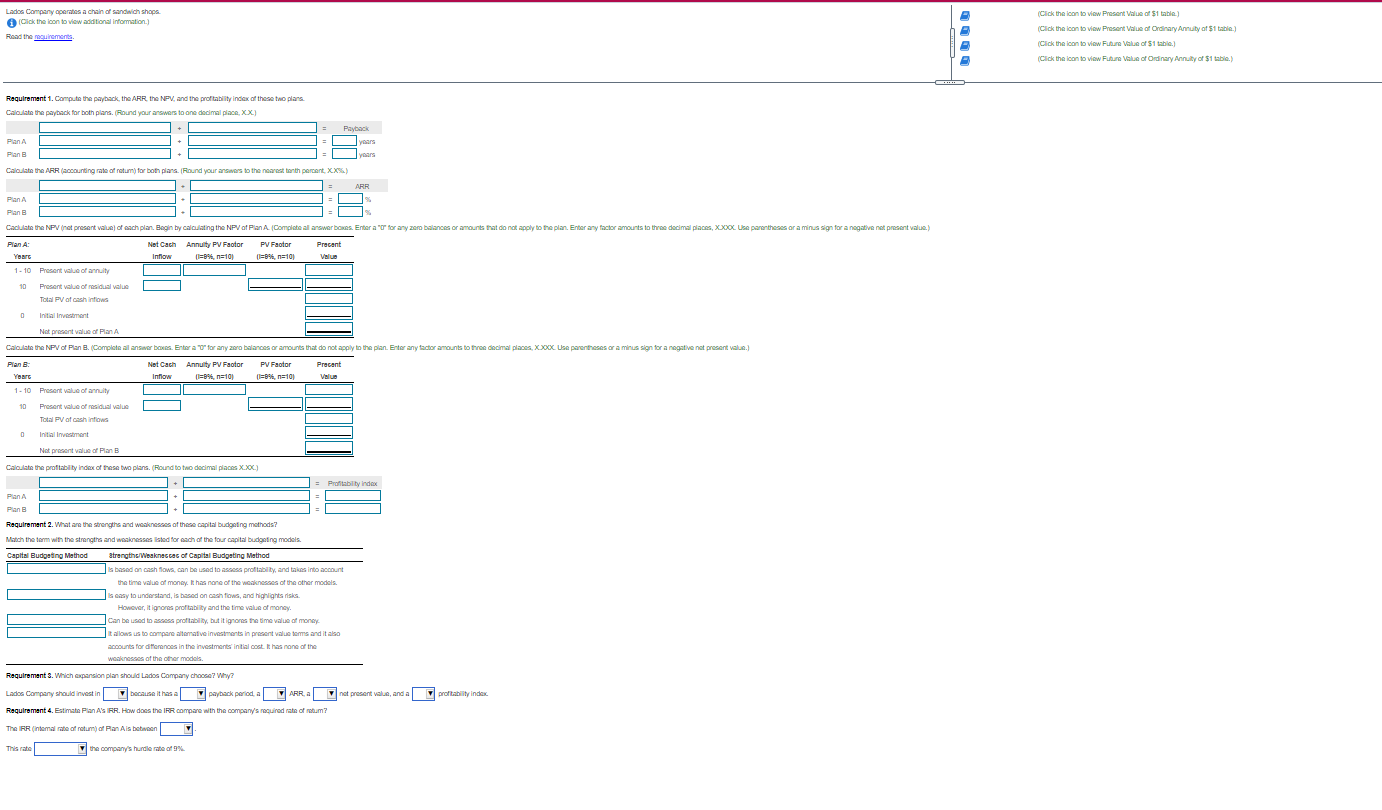

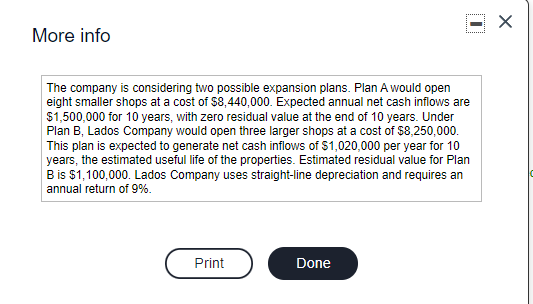

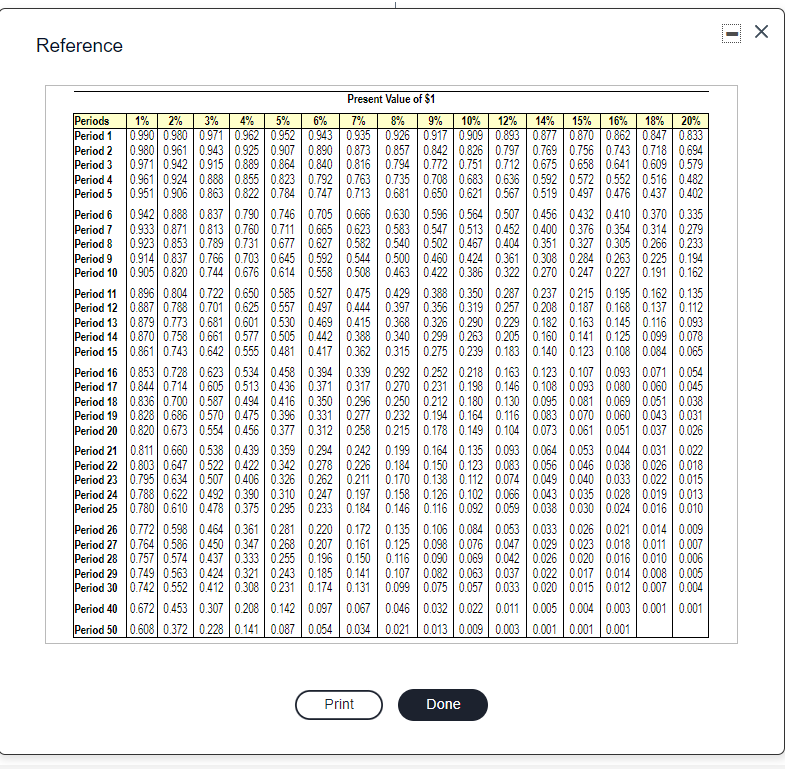

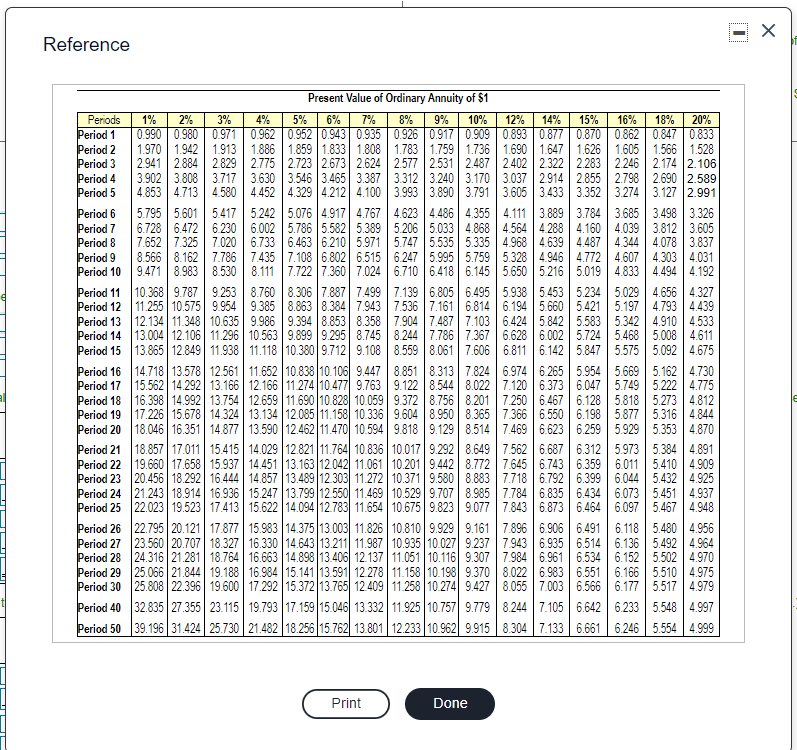

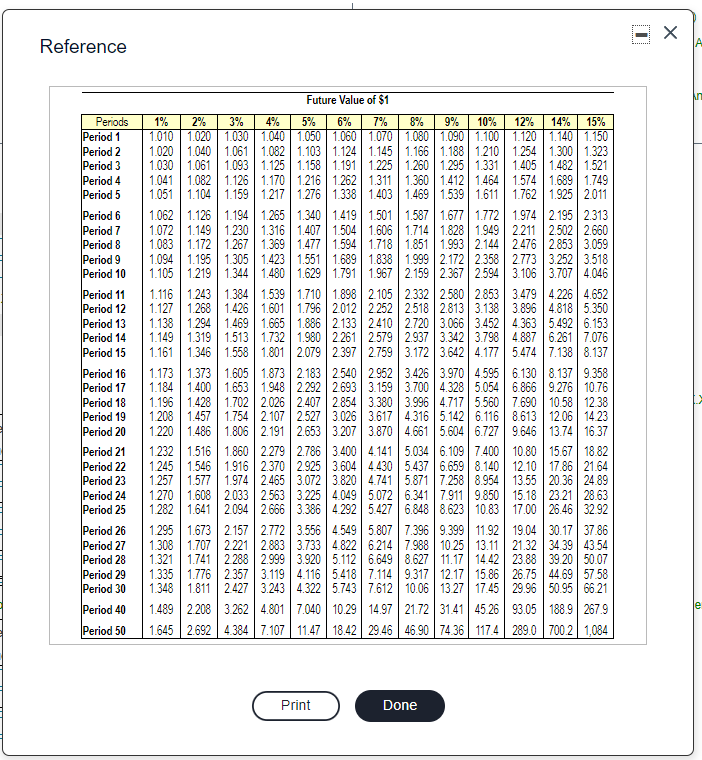

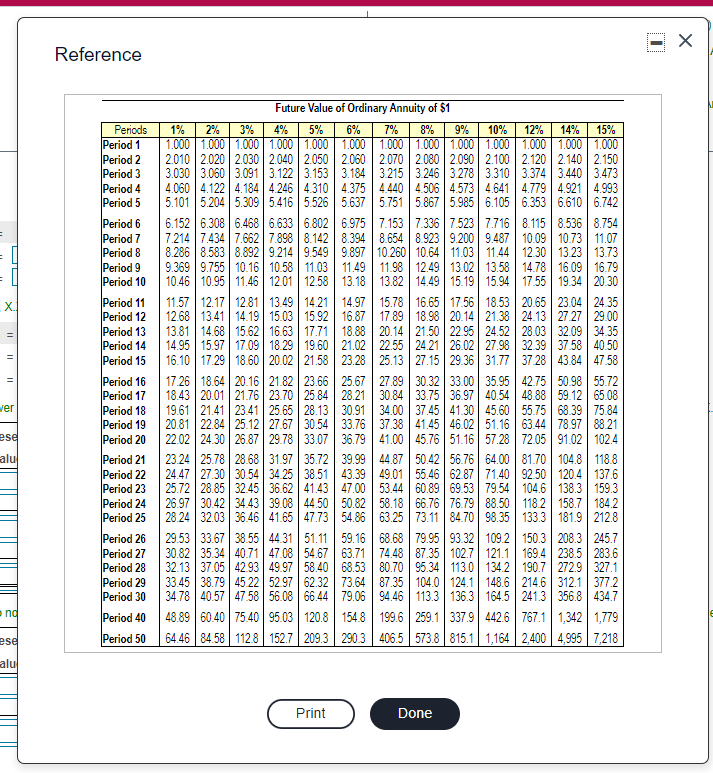

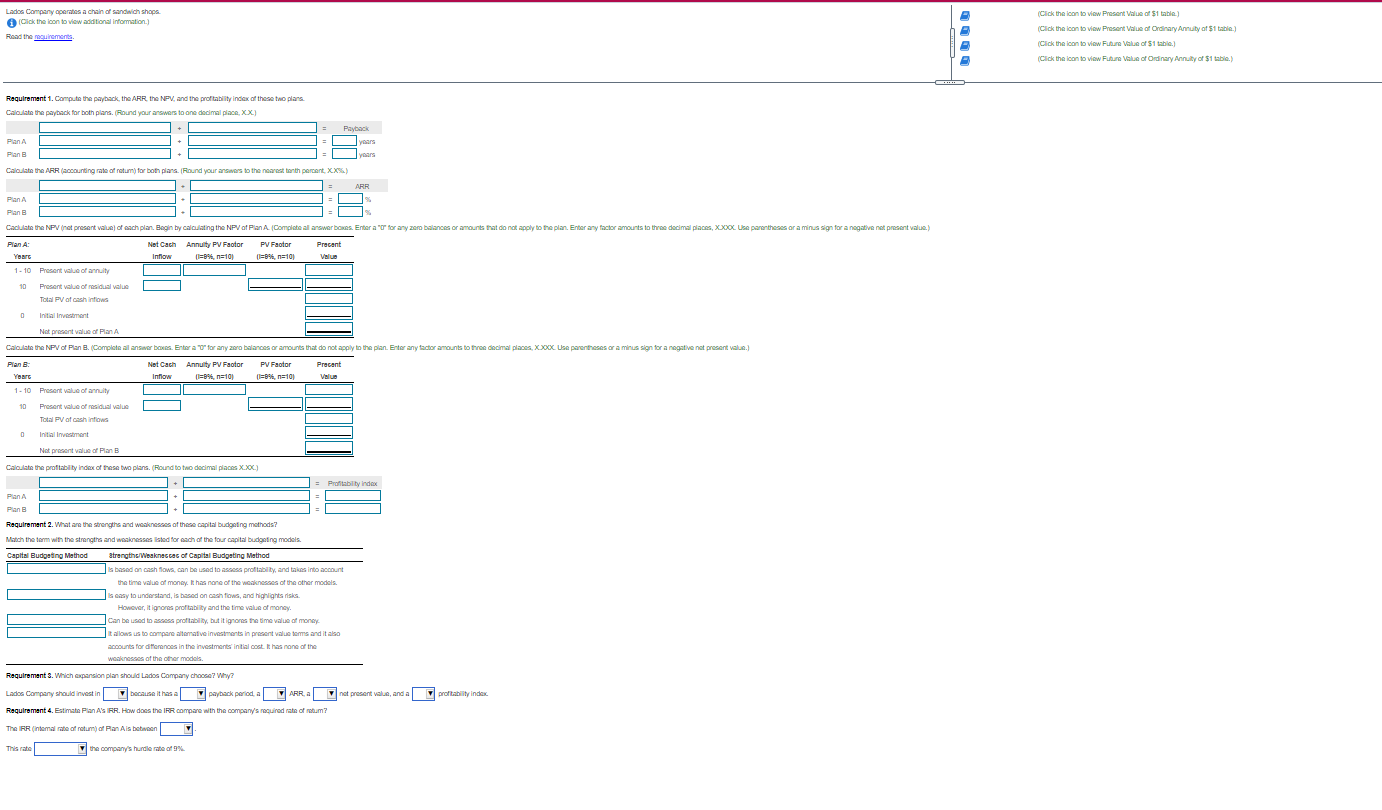

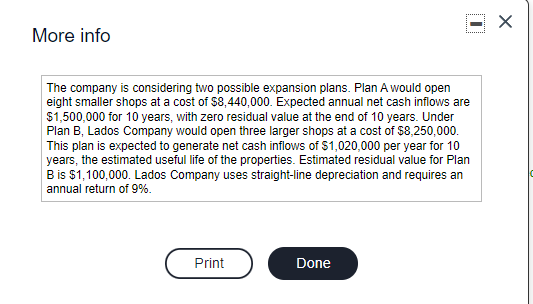

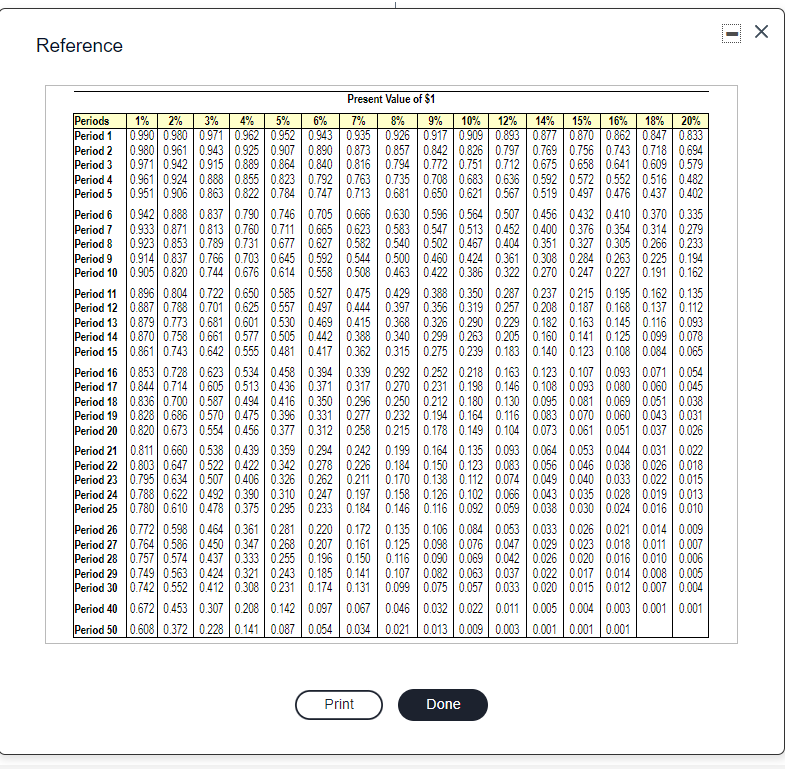

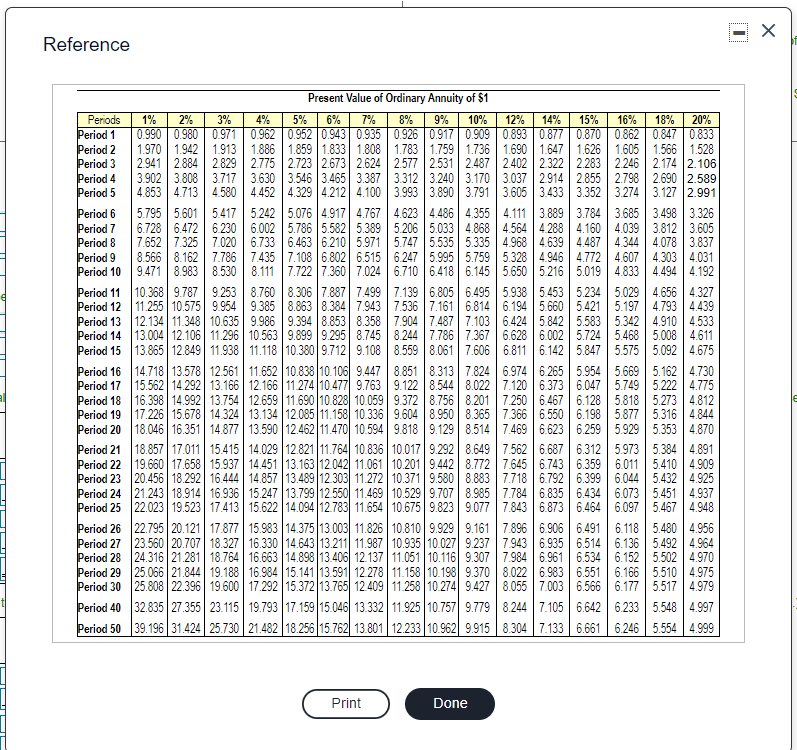

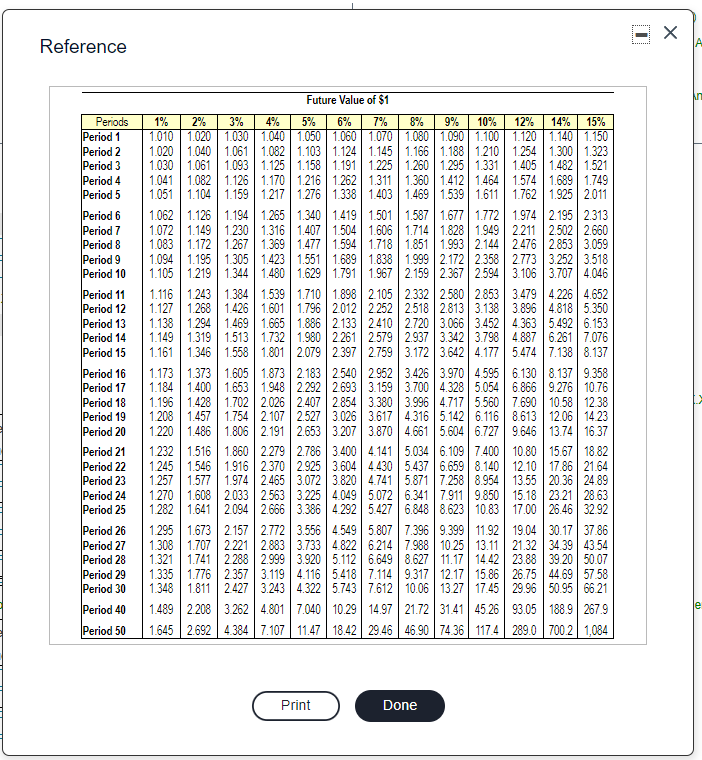

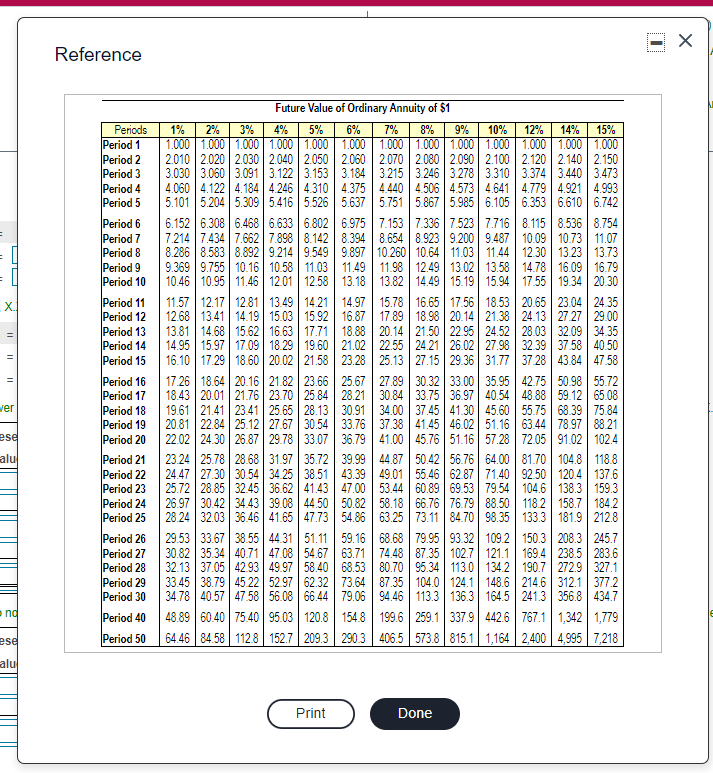

Lados Company operates a chain of sandwich shops Click the loon to view additional information Read the grements (Click the icon to view Present Value of $1 table) (Click the loon to view Present Value of Ordinary Annuity of S1 table) Click the loon to view Fun Value of $1 table) Click the loon to view Fun Val of Ordinary Annuity of $1 table.) () Requirement 1. Compute the payback, the ARR the NPV and the profitability index of these two plans Calculate the payback for both plans. (Round your answers to one decimal place, XX) = Payback Plan A Plan B years Calculate the ARR accounting rate of return for both plans. Found your answers to the nearest tant percent. XX) ARR Plan A Plan B Caciulate the NPV (not present value of each plan. Begin by calculating the NPV of Plan A Complete all answer bons. Entor ar for any zero balances or amounts that do not apply to the plan. Enter any factor amounts to three decimal places, Xxx Use parentheses or a minus sign for a negative not present value) . A. . Plan A: Net Cach Annuity PV Factor PV Factor Precent Year Inflow 18%, 10 18%, n=10) Value 1 - 10 Prosent vele family 10 Present value of residual value Total PV of cash intows Intal Investment Not present value of Plan A Calculate the NPV of Plan B. (Complete all answer bous. Entora "for any zero balances or amounts that do not apply to the plan. Enter any factor amounts to the decimal places, Xxxx. Use parentheses or a minus sign for a negative not present value Plan B. Net Cach Annuity PV Factor PV Factor Precent Yoang Inflow 18%, n=10) 11=8%, n=10) Value 1-10 Present value of annuity 10 Present value of residual valus Total PV of cash now Initial investment Not present value of Plan B Calculate the profitability index of these two plans. (Round to decimal places X.X.) Probity Index Plan A Plan B Requirement 2. What are the strengths and weaknesses of these capital budging methods? Match the form with the strengths and was nesses listed for each of the four capital budgeting models. Capital Budgeting Method Strength/Weaknec car of Capital Budgeting Method is based on cash flows, can be used to ascesa profitability, and this into account the time value of money. has none of the weaknesses of the other models seasy to understand, is based on cash flows and highlights risks However, it ignores profitability and the time value of money. Can be used to ascesa profitability, but it ignores the time value of money It allows us to compare alternative investments in present value terms and it also accounts for dones in the investments into the one of the weakness of the other models Requirements. Which expansion plan should Lados Company choose? Why? Lados Company should invest in the sayback period aRRaat prosent value, and a probability index because it has a , VARRA not Requirement 4. Estimate Plan As RR. How does the IRR compare with the company's required rate of robum? The IRR (internal rate of return of an Ais between This rate the company's hurdle rate of 9% More info The company is considering two possible expansion plans. Plan A would open eight smaller shops at a cost of $8,440,000. Expected annual net cash inflows are $1,500,000 for 10 years, with zero residual value at the end of 10 years. Under Plan B, Lados Company would open three larger shops at a cost of $8,250,000. This plan is expected to generate net cash inflows of $1,020,000 per year for 10 years, the estimated useful life of the properties. Estimated residual value for Plan B is $1,100,000. Lados Company uses straight-line depreciation and requires an annual return of 9% Print Done Reference Present Value of $1 1% 6% 9% Periods 2% 3% 4% 5% 7% 8% 10% 12% 14% 15% 16% 18% 20% Period 1 0.990 0.980 0.971 0.962 0.9520.943 0.935 0.926 0.917 0.9090.893 0.877 0.870 0.862 0.847 0.833 Period 2 0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.797 0.769 0.756 0.743 0.7180.694 Period 3 0.971 0.942 0.915 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.712 0.675 0.658 0.641 0.609 0.579 Period 4 0.961 0.924 0.888 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.636 0.592 0.572 0.552 0.516 0.482 Period 5 0.951 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.567 0.519 0.497 0.476 0.437 0.402 Period 6 0.942 0.888 0.837 0.790 0.746 0.705 0.6660.630 0.596 0.564 0.507 0.456 0.432 0.410 0.370 0.335 Period 7 0.933 0.871 0.813 0.7600.7110.665 0.623 0.583 0.547 0.513 0.452 0.400 0.376 0.354 0.3140.279 Period 8 0.923 0.853 0.789 0.731 0.677 0.627 0.5820.540 0.502 0.467 0.404 0.351 0.327 0.305 0.266 0.233 Period 9 0.914 0.837 0.766 0.703 0.645 0.592 0.5440.500 0.460 0.424 0.361 0.308 0.2840263 0.225 0.194 Period 10 0.905 0.820 0.744 0.676 0.6140558 0.508 0.463 0.422 0.386 0.322 0.270 0.2470 227 0.1910.162 Period 11 0.896 0.804 0.722 0.650 0.585 0527 0.475 0.429 0.388 0.350 0.287 0.237 0.215 0.1950.162 0.135 Period 12 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.257 0.208 0.187 0.168 0.137 0.112 Period 13 0.879 0.773 0.681 0.601 0.530 0.469 0.415 0.368 0.326 0.290 0.229 0.182 0.163 0.145 0.116 0.093 Period 14 0.870 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.263 0.205 0.160 0.141 0.125 0.099 0.078 Period 15 0.861 0.743 0.642 0.555 0.4810417 0.362 0.315 0.275 0.239 0.183 0.140 0.123 0.108 0.084 0.065 Period 16 0.853 0.728 0.623 0.534 0.458 0.394 0.3390.292 0.252 0.218 0.163 0.123 0.107 0.093 0.071 0.054 Period 17 0.844 0.714 0.605 0.513 0.436 0.371 0.317 0.270 0.231 0.198 0.146 0.108 0.093 0.080 0.060 0.045 Period 18 0.836 0.700 0.587 0.494 0.4160350 0.296 0.250 0.212 0.180 0.130 0.095 0.081 0.069 0.051 0.038 Period 19 0.828 0.686 0.570 0.475 0.396 0331 0.277 0.232 0.194 0.164 0.116 0.083 0.070 0.060 0.043 0.031 Period 20 0.820 0.673 0.554 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0.104 0.073 0.061 0.051 0.037 0.026 Period 21 0.811 0.660 0.538 0.439 0.359 0 2940.242 0.199 0.1640.135 0.093 0.064 0.053 0.044 0.031 0.022 Period 22 0.803 0.647 0.522 0.422 0.3420278 0.226 0.184 0.150 0.123 0.083 0.056 0.046 0.038 0.026 0.018 Period 23 0.795 0.634 0.507 0.406 0.3260262 0.211 0.170 0.138 0.112 0.074 0.049 0.040 0.033 0.022 0.015 Period 24 0.788 0.622 0.492 0.390 0.310 0.247 0.197 0.158 0.126 0.1020.066 0.043 0.035 0.028 0.019 0.013 Period 25 0.780 0.610 0.478 0.375 0.295 0.233 0.184 0.146 0.116 0.092 0.059 0.038 0.030 0.024 0.0160.010 Period 26 0.772 0.598 0.464 0.361 0.281 0 220 0.172 0.135 0.106 0.084 0.053 0.033 0.026 0.021 0.014 0.009 Period 27 0.764 0.586 0.450 0.347 0.268 0.207 0.161 0.125 0.098 0.076 0.047 0.029 0.023 0.018 0.0110.007 Period 28 0.757 0.574 0.437 0.333 0.255 0.1960.150 0.116 0.090 0.069 0.042 0.026 0.0200.0160.010 0.006 Period 29 0.7490.563 0.424 0.321 0.243 0.185 0.141 0.107 0.082 0.063 0.037 0.022 0.017 0.014 0.008 0.005 Period 30 0.742 0.552 0.412 0.308 0.231 0.174 0.131 0.099 0.075 0.057 0.033 0.020 0.015 0.012 0.007 0.004 Period 40 0.672 0.453 0.307 0.208 0.142 0.097 0.067 0.046 0.032 0.022 0.0110.005 0.0040.003 0.001 0.001 Period 50 0.608 0.372 0.228 0.141 0.087 0.054 0.034 0.021 0.013 0.009 0.003 0.001 0.001 0.001 Print Done Reference Present Value of Ordinary Annuity of $1 Periods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 18% 20% Period 1 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.9170.909 0.893 0.877 0.870 0.862 0.847 0.833 Period 2 1.970 1.942 1.913 1.886 1859 1.833 1.8081.783 1.759 1.736 1.690 1.647 1.626 1.605 1.566 1.528 Period 3 2.9412.8842829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.402 2322 2.283 2.246 2.174 2.106 Period 4 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2914 2.855 2.798 2.690 2.589 Period 5 4.853 4.713 4580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.605 3.433 3.352 3.2743.127 2.991 Period 6 5.795 5.601 5.417 5.242 5.076 | 4.917 4.767 4.623 4.486 4355 4.111 3.8893.784 3.685 3.498 3.326 Period 7 6.728 6.472 6230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.564 4.288 4.160 4.0393.812 3.605 Period 8 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4.639 4.4874.344 4.078 3.837 Period 9 8.566 8.1627.786 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.328 4.9464.7724.607 4.303 4.031 Period 10 9.471 8.983 8.530 8.111 7.722 7.360 7.0246.710 6.418 6.145 5.650 5216 5.019 4.833 4.494 4.192 Period 11 10.368 9.7879 253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 5.938 5.453 5.2345.029 4.656 4327 Period 12 11.255 10.575 9.954 9.385 8.8638.384 7.943 7.536 7.161 | 6.8146.194 5.660 5.421 5.197 4.793 4.439 Period 13 12.134 11.348 10.635 9.986 9.3948.853 8.358 7.904 7.487 7.103 6.424 5.8425.583 5.342 4.910 4533 Period 14 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.628 6.002 5.724 5.468 5.008 4.611 Period 15 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.061 7.606 6.811 6.142 5.847 5.575 5.092 4.675 Period 16 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7.8246.9746265 5.954 5.669 5.1624.730 Period 17 15.562 14.292 13.166 12.166 1127410.477 9.763 9.122 8.544 8.022 7.120 6373 6.047 5.749 5.222 4.775 Period 18 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.2017.250 6.467 6.128 5.818 5.273 4812 Period 19 17.226 15.678 14.324 13.134 12.08511.158 10.336 9.604 8.950 8.365 7.366 6.550 6.198 5.877 5.316 4.844 Period 20 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.129 8.5147.469 6.623 6.259 5.9295.353 4.870 Period 21 18.857 17.011 15.415 14.029 12.821 11.764 10.836 10.017 9.292 8.649 | 7.562 6.687 6.3125.973 5.384 4.891 Period 22 19.660 17.658 15.937 14.451 13.163 12.042 11.061 10.2019.442 8.772 7.645 6.743 6.359 | 60115.410 4.909 Period 23 20.456 18.292 16.444 14.857 13.489 12 303 11.272 10.371 9.580 8.883 7.718 6.792 6.399 6.044 5.432 4.925 Period 24 21.24318.914 16.936 15 247 13.799 12 550 11.469 10.529 9.707 8.9857.784 6.835 6.4346.073 5.451 4.937 Period 25 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.8239.077 7.8436.873 6.464 6.097 5.467 4.948 Period 26 22.795 20.12117.877 15.983 14.375 13.003) 11.826 10.8109.929 9.1617.896 6.906 6.491 6.118 5.480 4.956 Period 27 23.560 20.707 18.327 16.330 14.643 13.211 11.987 10.935 10.027 9.237 7.943 6.935 6.514 6.136 5.492 4.964 Period 28 24.31621.28118.764 16.663 14.898 13.406 12 137 11.051 10.116 9.307 7.984 6.961 | 6.5346.152 5.5024.970 Period 29 25.066 21.844 19.188 16.984 15.141 13.591 12 278 11.158 10.1989.370 8.022 6.983 6.551 6.166 5.510 4.975 Period 30 25.808 22.396 19.600 17.292 15.372 13.765 12.409 11.258 10 274 9.4278.055 7.003 6.566 6.1775.517 4.979 Period 40 32.835 27.355 23.115 19.793 17.159 15.046 1333211.925 10.757 9.7798.244 7.105 6.642 6.233 5.548 4.997 Period 50 39.196 31.424 25.730 21.482 18.256 15.762 13.801 12.233 10.962 9.915 8.304 7.133 6.661 6.246 5.554 4.999 Print Done Reference Future Value of $1 Periods Period 1 Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 Period 8 Period 9 Period 10 Period 11 Period 12 Period 13 Period 14 Period 15 Period 16 Period 17 Period 18 Period 19 Period 20 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 1.010 1.020 1.030 1.040 1.050 1.060 1.070 1.080 1.090 1.100 1.120 1.140 1.150 1.020 1.040 1.061 1.082 1.103 1.124 1.145 1.166 | 1.188 1.210 1.254 1.300 1.323 1.030 1.061 1.093 1.125 1.158 1.191 1225 1.260 1.295 1331 1.405 1.482 1.521 1.041 1.0821.126 | 1.170 | 1.216 1.2621.311 1.360 1.412 1.464 1.574 1.689 1.749 1.051 1.104 1.159 | 1.217 1.276 1.338 1.403 1.469 1.539 1.611 1.762 1.925 2011 1.062 1.126 1.194 1.265 1.340 1.419 1.501 1.587 1.677 1772 1.9742.195 2.313 1.072 1.149 1230 1.316 1.407 1.504 1.606 1.7141.828 1.949 2.211 2.502 2.660 1.083 1.1721.267 1.369 1.477 1.594 1.718 1.851 1.993 2.144 2.476 2.853 3.059 1.094 1.195 1.305 1.423 | 1551 1.689 1.838 1.999 2.172 2.358 2773 3.252 3.518 1.105 1.219 1.344 1.480 1.629 1.791 1.967 2.159 2.367 2.594 3.106 3.707 4.046 1.116 1.243 1.384 1.539 1.710 1.898 2105 2.332 2.580 2.853 3.479 4.226 4.652 1.127 1.268 1.426 1.601 1.796 2012 2 252 2.518 2.813 3.138 3896 4.818 5.350 1.138 1.2941.469 1.665 1.886 2133 2410 2.720 3.066 3.452 4363 5.492 6.153 1.149 1.319 1.513 1.732 1.980 2261 2579 2.937 3.342 3.798 4.887 6.261 7.076 1.161 1.346 1.558 1.801 2.079 23972.759 3.1723.642 4.177 5.474 7.1388.137 1.173 1.373 1.605 1.873 2.183 2540 2952 3.426 3.970 4.595 6.130 8.1379.358 1.184 1.400 1.653 1.948 2.2922693 3.159 3.700 4.328 5.054 6.866 9.276 10.76 1.196 1.428 1.702 2.0262.407 2854 3.380 3.996 4.717 5.560 7.690 10.58 1238 1 208 1.4571.754 2.107 2.527 3.026 3.617 4.316 5.142 6.116 8.613 12.06 1423 1 220 1.486 1.806 2.1912.653 3.207 3.870 4.661 5.604 6.727 9.646 13.74 16:37 1232 1.516 1.860 2.279 2.786 3.40041415.034 6.109 7.400 10.80 15.67 18.82 1245 1.546 1.916 2.370 2.925 3.604 4430 5.4376.659 8.140 12.10 17.86 21.64 1257 1.577 1.974 2.465 3.07238204741 5.871 | 7.258 8.954 13.55 20.36 24.89 1270 1.608 2033 2.563 3.225 4049 5.0726.341 7.911 9.850 15.18 23.21 28 63 1282 1.6412094 2.666 3.386 42925.427 6.848 8.623 10.83 17.00 26.46 32.92 1295 1.673 2.157 2.772 3.556 45495.8077.3969.399 11.92 19.04 30.1737.86 1.308 1.707 2 221 2.883 3.733 4.822 6.214 7.988 10 25 13.11 2132 34.394354 1321 1.7412288 2.999 3.920 5.112 6.649 8.627 11.17 14.42 23.88 39.20 50.07 1.335 1.776 2357 3.119 4.116 5.418 7.1149.317 12.17 15.86 26.75 44.69 57.58 1.348 1.8112427 3.243 | 4.3225.743 7.612 | 10.06 13 27 17.45 29.96 50.9566 21 1.489 2 2083 262 4.801 7.040 10.29 14.97 21.72 31.41 45 2693.05 188.9 267.9 1.645 2.692 4.384 7.107 | 11.47 18.42 29.46 46.90 74.36 117.4289.0 7002 1,084 Period 21 Period 22 Period 23 Period 24 Period 25 Period 26 Period 27 Period 28 Period 29 Period 30 je Period 40 Period 50 Print Done Reference Periods Period 1 Period 2 Period 3 Period 4 Period 5 - = 0 = 0 x Period 6 Period 7 Period 8 Period 9 Period 10 Period 11 Period 12 Period 13 Period 14 Period 15 Period 16 Period 17 Period 18 Period 19 Period 20 Future Value of Ordinary Annuity of $1 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 2010 2.020 2030 2040 2050 2.060 2070 2080 2.090 2.100 2.1202.140 2.150 3.030 3.060 3.091 3.122 3.153 3.1843 215 3246 3.278 3.310 3.374 3.440 3.473 4.060 4.122 4.1844.246 4.310 4.375 4.440 4506 | 4.573 4.641 4.779 4.921 4.993 5.101 5.2045.309 5.416 5.526 5.637 5.7515.867 5.985 6.105 6.353 6.610 6.742 6.152 6.308 6.468 6.633 6.802 6.9757.1537.336 7523 7.7168.115 8.536 8.754 7.2147.434 7.6627.898 8.142 8.394 8.654 8.9239.2009.487 10.09 10.73 11.07 8.286 | 8.583 8.89292149549 9.897 10.260 10.64 | 11.03 11.44 12:30 13 23 13.73 9.369 9.755 10.16 10.58 11.03 11.49 11.98 12.49 13.02 13.58 14.78 16.09 16.79 10.46 10.95 | 11.46 1201 12.58 13.18 13.82 14.49 15.19 15.94 17.55 19.34 20.30 11.57 12.17 12 81 13.49 1421 14.97 15.78 16.65 1756 18.53 2065 23.04 2435 12.68 13.41 | 14.19 15.03 | 15.92 | 16.87 17.89 18.98 20.14 21.38 24.13 27 27 29.00 13.81 14.68 15.62 16.63 17.71 18.88 20.14 21.50 22.95 24.52 28.03 32.09 34 35 14.95 15.97 | 17.09 18 29 19.60 21.02 22.55 24.21 26.02 27.98 32.39 37 58 40.50 16.10 17.29 18.60 20.02 2158 23.28 25.13 27.15 29.36 31.77 3728 43.844758 17.26 18.64 20.16 21.82 23.66 25.67 27.89 30.32 33.00 35.95 42.75 50.98 55.72 18.43 20.01 | 21.76 23.70 25.84 28.21 30.84 33.75 36.97 40.54 48.88 59.12 65.08 19.61 21.41 23.41 25.65 28.13 30.91 34.00 37.45 41.30 45.60 55.75 68.39 75.84 20.81 22.84 25.12 27.67 30.54 33.76 37 38 41.45 46.02 51.16 63.44 78.978821 22.02 24 30 26.87 29.78 33.07 36.79 41.00 45.76 51.1657.28 72.05 | 91.02 1024 23 24 25.78 28.68 31.97 35.72 39.99 44.87 50.42 56.76 64.00 81.70 104.8 118.8 24.47 27 30 30.5434.25 38.51 43.39 49.01 55.46 6287 71.40 92.50 120.4 137.6 25.72 28.85 | 32.45 36.62 41.43 | 47.00 53.44 60.89 69.53 79.54 104.6 138.3 159.3 26.97 30.42 34.4339.08 4450 50.82 58.18 66.76 76.7988.50 1182 1587 | 1842 28.24 32.03 36.46 | 41.65 47.73 54.86 63.25 73.11 84.7098.35 133.3 181.9 212.8 29.53 33.67 38.55 44 31 51.11 59.16 68.68 | 79.95 93.32 1092 150.3 208.3245.7 30.82 35 34 40.71 47.08 54 67 63.7174.48 87.35 102.7 121.1 169.4 2385 283.6 32.13 37.05 42.93 49.97 58.40 68.53 80.70 95.34 113.0 134.2 190.7 2729 3271 33.45 38.79 4522 52.97 62.32 | 73.64 87.35 104.0 1241 148.6 214.6 312.13772 34.78 40.57 47.58 56.08 66.44 79.06 94.46 113.3 136.3 164.5 241.3 | 356.8 434.7 48.8960.40 75.40 95.03 | 120.8 154 8 199.6 259.1 3379 4426767.1 1,342 1,779 64.46 84.58 | 1128 152.7 209.3 290 3406.5 573.8 815.1 1,164 2,400 4,995 7,218 11 wer ese alul Period 21 Period 22 Period 23 Period 24 Period 25 Period 26 Period 27 Period 28 Period 29 Period 30 ng Period 40 esel Period 50 alul Print Done