Answered step by step

Verified Expert Solution

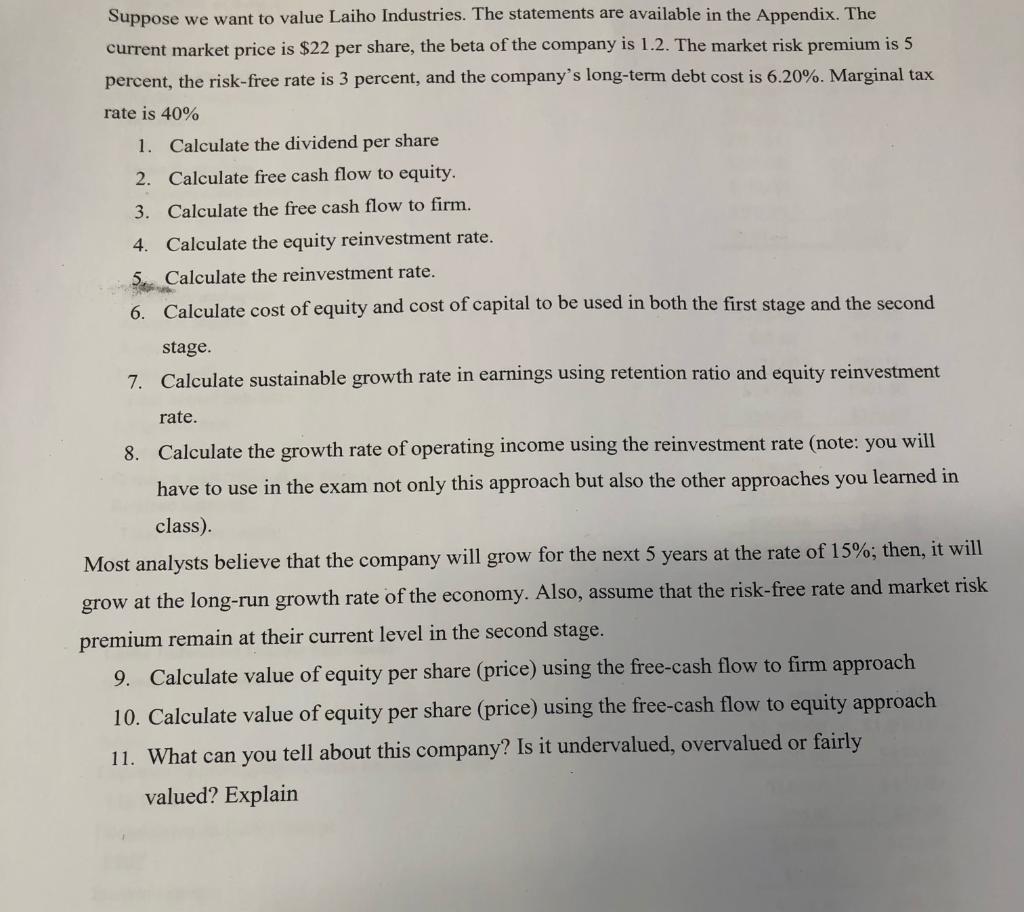

Question

1 Approved Answer

Laiho Industries December 31 Balance Sheet Assets 2018 2017 Cash and Cash Equivalents $37.66 $10.00 Accounts Receivable $180.00 $150.00 Inventories $180.00 $200.00 Total current assets

| Laiho Industries December 31 Balance Sheet | ||

| Assets | 2018 | 2017 |

| Cash and Cash Equivalents | $37.66 | $10.00 |

| Accounts Receivable | $180.00 | $150.00 |

| Inventories | $180.00 | $200.00 |

| Total current assets | $397.00 | $360.00 |

| Gross fixed assets | $650.00 | $570.00 |

| Less acumulated depreciation | $150.00 | $120.00 |

| Net fixed assets | $500.00 | $450.00 |

| Total assets | $897.00 | $810.00 |

| Liabilities and equity | ||

| Accounts Payable | $108.00 | $90.00 |

| Accruals | $67.00 | $51.50 |

| Notes payable | $72.00 | $60.00 |

| Total current Liabilities | $247.00 | $201.50 |

| Long-Term Debt | $350.00 | $350.00 |

| Total Liabilities | $597.00 | $551.50 |

| Common Stock (50 million shares) | $50.00 | $50.00 |

| Retained Earnings | $250.66 | $208.50 |

| Total common equity | $300.66 | $258.50 |

| Total liabilities and quiety | $897.55 | $810.00 |

| Laiho Industries Income Statement (in millions) | ||

| Sales | $1,200.00 | $1,000.00 |

| Expenses excluding depreciation and amoortization | $1,020.00 | $850.00 |

| EBITDA | $180.00 | $150.00 |

| Depreciation and amortization | $30.00 | $25.00 |

| EBIT | $150.00 | $125.00 |

| Interest expense | $21.70 | $20.20 |

| EBT | $128.30 | $104.80 |

| Taxes (26%) | $25.66 | $20.96 |

| Net Income | $102.64 | $83.84 |

| Common Dividends | $60.48 | $46.38 |

| Addition to retained earnings | $42.16 | $37.46 |

| Statement of Stockholder's Equity (In millions) | ||

| Balance of Retained Earnings, December 31, 2017 | $208.50 | |

| Add: Net income | $102.64 | |

| Less: Common dividends paid | -$60.48 | |

| Balance of retained Earnings, December 31, 2018 | $250.66 | |

| Statement of Cash Flows (in millions) | ||

| Operating Activities | ||

| Net Income | $102.60 | |

| Depreciation and amortization | $30.00 | |

| increase in accounts payabale | $18.00 | |

| increase in accruals | $15.50 | |

| increase in accounts receivable | -$30.00 | |

| increase in inventories | $20.00 | |

| Net cash provided by operating activities | $156.10 | |

| Investing Activities | ||

| Additions to property, plant, and equipment | -$80.00 | |

| Net cash used in investing | -$80.00 | |

| Financing Activities | ||

| Increase in notes payable | $12.00 | |

| Increase in long-term debt | $0.00 | |

| Increase in common stock | $0.00 | |

| Payment of common dividends | -$60.50 | |

| Net cash provided by financing activities | -$48.50 | |

| Summary | ||

| Net increase/decrease in cash | $27.70 | |

| Cash Balance at the beginning of the year | $10.00 | |

| Cash balance at the end of the year | $37.70 |

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started