Question

Lake acquired a controlling interest in Boxwood several years ago. During the current fiscal period, the two companies individually reported the following income (exclusive of

Lake acquired a controlling interest in Boxwood several years ago. During the current fiscal period, the two companies individually reported the following income (exclusive of any investment income):

| Lake | $ | 386,000 |

| Boxwood | 90,000 | |

Lake paid a $65,000 cash dividend during the current year, and Boxwood distributed $20,000.

Boxwood sells inventory to Lake each period. Intra-entity gross profits of $27,300 were present in Lake's beginning inventory for the current year, and its ending inventory carried $37,300 in intra-entity gross profits.

View each of the following questions as an independent situation. The effective tax rate for both companies is 21 percent.

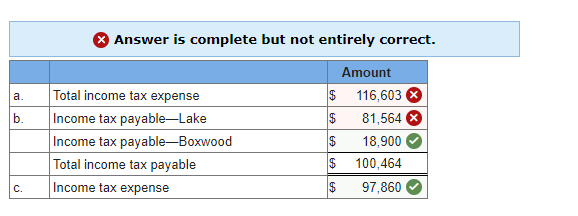

If Lake owns a 60 percent interest in Boxwood, what total income tax expense must be reported on a consolidated income statement for this period? (Round the intermediate calculations and final answers to the nearest dollar amount.)

If Lake owns a 60 percent interest in Boxwood, what total amount of income taxes must be paid by these two companies for the current year? (Round the intermediate calculations and final answers to the nearest dollar amount.)

If Lake owns a 90 percent interest in Boxwood and a consolidated tax return is filed, what amount of income tax expense would be reported on a consolidated income statement for the year?

Please I need to answer A and B becuse I got both Wrong

Answer is complete but not entirely correctStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started