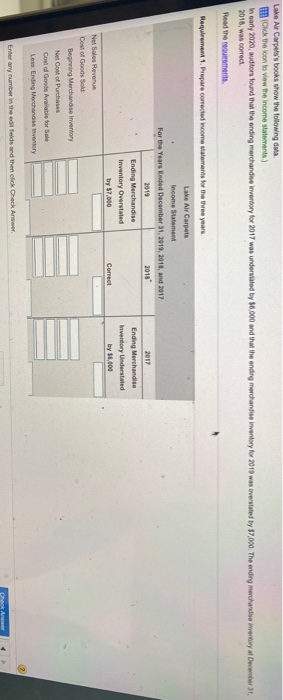

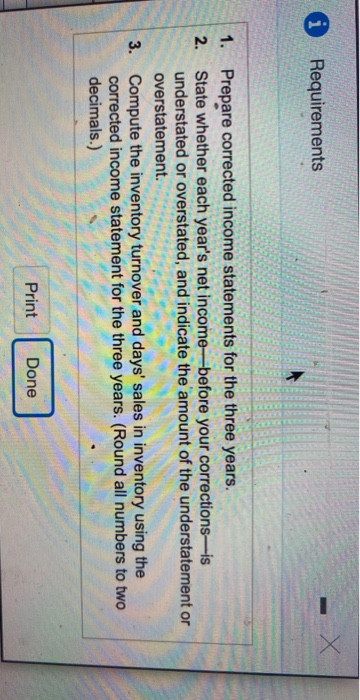

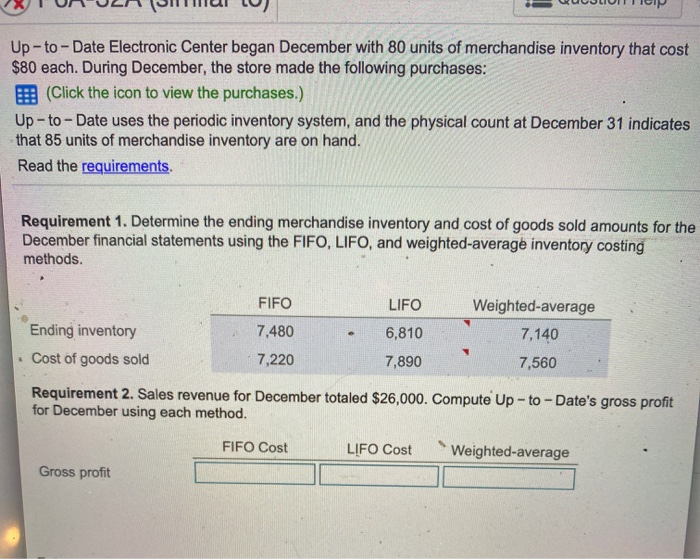

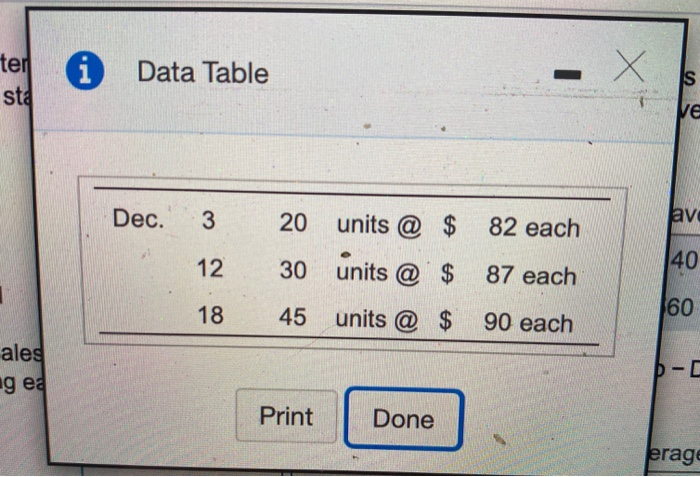

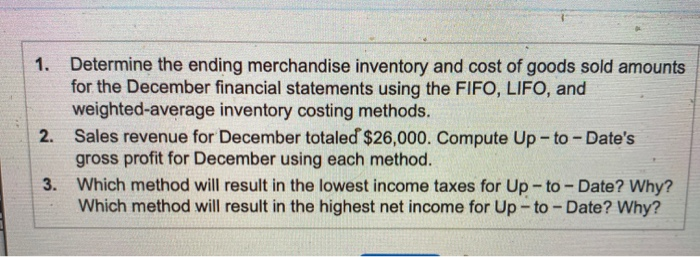

Lake Air Carpet's books show the following dia (Click the foon to view the income statements) in early 2020, auditors found that the ending merchandise Invertory for 2017 was undervisted by 360.000 and that the ending merchandise Inventory for 2019 was overstated by 37,000. The ending merchandise invertory at December 31 2018, was correct Read the requirements Requirement 1. Prepare core come valements for the three years Lake Air Carpets Income Statement For the Years Ended December 31, 2010, 2011, and 2017 2019 2018 Ending Merchandise Inventory Overstated by 17,000 Correct Net Sales Revenge Cost of Goods Sold: Beginning Merchandise Invertory Net Conto Purchase Cos dos Available for Sale Los Ending Merchandise vertory 2017 Ending Merchandise Inventory Understated by 10,000 Enter any number the fields and then click Check Answer C Am Requirements 1. Prepare corrected income statements for the three years. 2. State whether each year's net income before your corrections-is understated or overstated, and indicate the amount of the understatement or overstatement 3. Compute the inventory turnover and days' sales in inventory using the corrected income statement for the three years. (Round all numbers to two decimals.) Print Done Up-to-Date Electronic Center began December with 80 units of merchandise inventory that cost $80 each. During December, the store made the following purchases: B (Click the icon to view the purchases.) Up-to-Date uses the periodic inventory system, and the physical count at December 31 indicates that 85 units of merchandise inventory are on hand. Read the requirements. Requirement 1. Determine the ending merchandise inventory and cost of goods sold amounts for the December financial statements using the FIFO, LIFO, and weighted-average inventory costing methods. FIFO LIFO Weighted average 7,140 e 6,810 Ending inventory Cost of goods sold 7.480 7,220 7,890 7,560 Requirement 2. Sales revenue for December totaled $26,000. Compute Up-to-Date's gross profit for December using each method. FIFO Cost LIFO Cost Weighted average Gross profit ter sta f Data Table X IS ve Dec. 3 av 20 units @ $ 82 each 12 30 units @ $ 40 87 each 18 60 45 units @ $ 90 each aleg ng ea -C Print Done erage 1. Determine the ending merchandise inventory and cost of goods sold amounts for the December financial statements using the FIFO, LIFO, and weighted-average inventory costing methods. 2. Sales revenue for December totaled $26,000. Compute Up-to-Date's gross profit for December using each method. 3. Which method will result in the lowest income taxes for Up-to-Date? Why? Which method will result in the highest net income for Up-to-Date? Why? Lake Air Carpet's books show the following dia (Click the foon to view the income statements) in early 2020, auditors found that the ending merchandise Invertory for 2017 was undervisted by 360.000 and that the ending merchandise Inventory for 2019 was overstated by 37,000. The ending merchandise invertory at December 31 2018, was correct Read the requirements Requirement 1. Prepare core come valements for the three years Lake Air Carpets Income Statement For the Years Ended December 31, 2010, 2011, and 2017 2019 2018 Ending Merchandise Inventory Overstated by 17,000 Correct Net Sales Revenge Cost of Goods Sold: Beginning Merchandise Invertory Net Conto Purchase Cos dos Available for Sale Los Ending Merchandise vertory 2017 Ending Merchandise Inventory Understated by 10,000 Enter any number the fields and then click Check Answer C Am Requirements 1. Prepare corrected income statements for the three years. 2. State whether each year's net income before your corrections-is understated or overstated, and indicate the amount of the understatement or overstatement 3. Compute the inventory turnover and days' sales in inventory using the corrected income statement for the three years. (Round all numbers to two decimals.) Print Done Up-to-Date Electronic Center began December with 80 units of merchandise inventory that cost $80 each. During December, the store made the following purchases: B (Click the icon to view the purchases.) Up-to-Date uses the periodic inventory system, and the physical count at December 31 indicates that 85 units of merchandise inventory are on hand. Read the requirements. Requirement 1. Determine the ending merchandise inventory and cost of goods sold amounts for the December financial statements using the FIFO, LIFO, and weighted-average inventory costing methods. FIFO LIFO Weighted average 7,140 e 6,810 Ending inventory Cost of goods sold 7.480 7,220 7,890 7,560 Requirement 2. Sales revenue for December totaled $26,000. Compute Up-to-Date's gross profit for December using each method. FIFO Cost LIFO Cost Weighted average Gross profit ter sta f Data Table X IS ve Dec. 3 av 20 units @ $ 82 each 12 30 units @ $ 40 87 each 18 60 45 units @ $ 90 each aleg ng ea -C Print Done erage 1. Determine the ending merchandise inventory and cost of goods sold amounts for the December financial statements using the FIFO, LIFO, and weighted-average inventory costing methods. 2. Sales revenue for December totaled $26,000. Compute Up-to-Date's gross profit for December using each method. 3. Which method will result in the lowest income taxes for Up-to-Date? Why? Which method will result in the highest net income for Up-to-Date? Why