Answered step by step

Verified Expert Solution

Question

1 Approved Answer

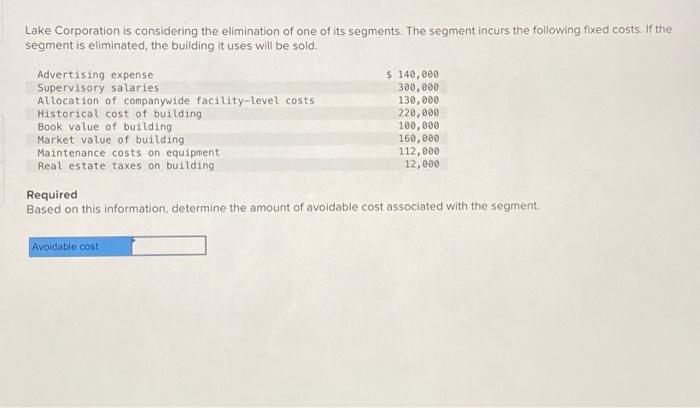

Lake Corporation is considering the elimination of one of its segments. The segment incurs the following fixed costs. If the segment is eliminated, the building

Lake Corporation is considering the elimination of one of its segments. The segment incurs the following fixed costs. If the segment is eliminated, the building it uses will be sold. Advertising expense Supervisory salaries Allocation of companywide facility-level costs Historical cost of building Book value of building Market value of building Maintenance costs on equipment Real estate taxes on building $ 140,000 300,000 130,000 220,000 100,000 160,000 112,000 12,000 Required Based on this information, determine the amount of avoidable cost associated with the segment. Avoidable cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started