Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lakeside Incorporated produces a product that currently sells for $46.80 per unlt. Current production costs per unit Include direct materlals, $13; direct labor, $15; varlable

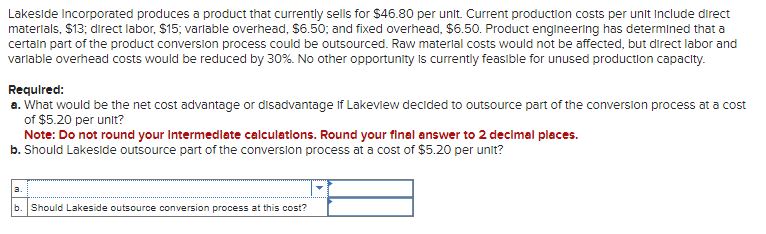

Lakeside Incorporated produces a product that currently sells for $46.80 per unlt. Current production costs per unit Include direct materlals, $13; direct labor, $15; varlable overhead, $6.50; and fixed overhead, $6.50. Product engineering has determined that a certain part of the product converslon process could be outsourced. Raw materlal costs would not be affected, but direct labor and varlable overhead costs would be reduced by 30%. No other opportunity is currently feasible for unused production capacity. Required: a. What would be the net cost advantage or disadvantage If Lakeview decided to outsource part of the conversion process at a cost of $5.20 per unlt? Note: Do not round your Intermedlate calculations. Round your final answer to 2 decimal places. b. Should Lakeside outsource part of the conversion process at a cost of $5.20 per unlt

Lakeside Incorporated produces a product that currently sells for $46.80 per unlt. Current production costs per unit Include direct materlals, $13; direct labor, $15; varlable overhead, $6.50; and fixed overhead, $6.50. Product engineering has determined that a certain part of the product converslon process could be outsourced. Raw materlal costs would not be affected, but direct labor and varlable overhead costs would be reduced by 30%. No other opportunity is currently feasible for unused production capacity. Required: a. What would be the net cost advantage or disadvantage If Lakeview decided to outsource part of the conversion process at a cost of $5.20 per unlt? Note: Do not round your Intermedlate calculations. Round your final answer to 2 decimal places. b. Should Lakeside outsource part of the conversion process at a cost of $5.20 per unlt Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started