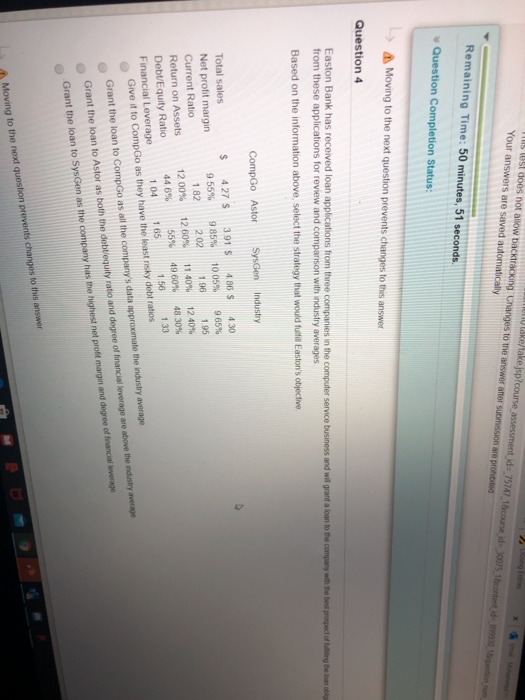

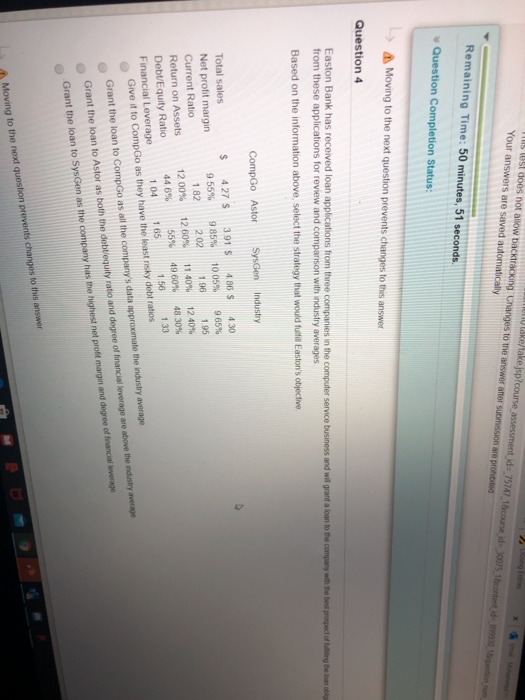

Lake/take.jsp?course assessmentide 75747 16coune sust does not allow backtracking Changes to the answer mer submission are prohibited Your answers are saved automatically 300131 1 Remaining Time: 50 minutes, 51 seconds. Question Completion Status: Moving to the next question prevents changes to this answer Easton Bank has received loan applications from three companies in the computer service business and wil grant aan to the company with the belowed from these applications for review and comparison with industry averages Based on the information above, select the strategy that would fulfill Easton's objective CompGo Astor SysGen Industry Total sales $ 427 S 391 $ 486 S 430 Net profit margin 955% 9 85% 10.05% 96596 Current Ratio 1.82 2021 96 195 Return on Assets 1200% 12.00% 12 60% 12.60% 11 40% 12.40% Debt/Equity Ratio 446% 55% 49 60% 48 30% Financial Leverage 1.04 165 156 133 Give it to CompGo as they have the least risky debt ratios Grant the loan to CompGo as all the company's data approximate the industry average Grant the loan to Astor as both the debequity ratio and degree of financial leverage are above the industry Grant the loan to SysGen as the company has the highest not profit margin and degree of financial leverage Moving to the next question prevents changes to this answer ou have a proto X 2 Closing Entries Email Mohammed H X P U: Prince Mhar x + 0 Show step=null nt id=75747 18 course_id = 30075_1.content de 599930_1&question num 3.x=0&toggle state are prohibited Quebon of 17 1 points Save Answer usiness and wil granatoan to the company with the best prospect of fulfilling the loan obligations Specific data shown below, has been selected re w ustry Lake/take.jsp?course assessmentide 75747 16coune sust does not allow backtracking Changes to the answer mer submission are prohibited Your answers are saved automatically 300131 1 Remaining Time: 50 minutes, 51 seconds. Question Completion Status: Moving to the next question prevents changes to this answer Easton Bank has received loan applications from three companies in the computer service business and wil grant aan to the company with the belowed from these applications for review and comparison with industry averages Based on the information above, select the strategy that would fulfill Easton's objective CompGo Astor SysGen Industry Total sales $ 427 S 391 $ 486 S 430 Net profit margin 955% 9 85% 10.05% 96596 Current Ratio 1.82 2021 96 195 Return on Assets 1200% 12.00% 12 60% 12.60% 11 40% 12.40% Debt/Equity Ratio 446% 55% 49 60% 48 30% Financial Leverage 1.04 165 156 133 Give it to CompGo as they have the least risky debt ratios Grant the loan to CompGo as all the company's data approximate the industry average Grant the loan to Astor as both the debequity ratio and degree of financial leverage are above the industry Grant the loan to SysGen as the company has the highest not profit margin and degree of financial leverage Moving to the next question prevents changes to this answer ou have a proto X 2 Closing Entries Email Mohammed H X P U: Prince Mhar x + 0 Show step=null nt id=75747 18 course_id = 30075_1.content de 599930_1&question num 3.x=0&toggle state are prohibited Quebon of 17 1 points Save Answer usiness and wil granatoan to the company with the best prospect of fulfilling the loan obligations Specific data shown below, has been selected re w ustry