Answered step by step

Verified Expert Solution

Question

1 Approved Answer

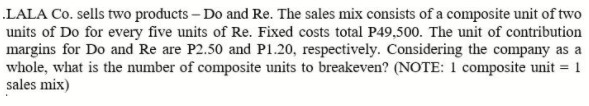

.LALA Co. sells two products - Do and Re. The sales mix consists of a composite unit of two units of Do for every

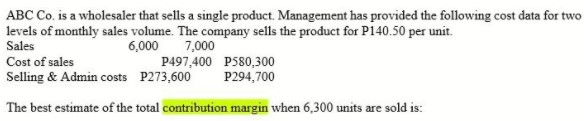

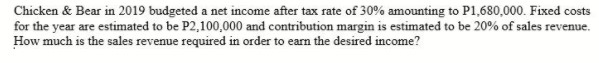

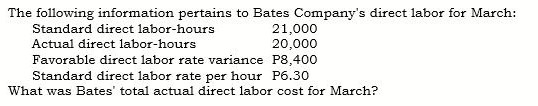

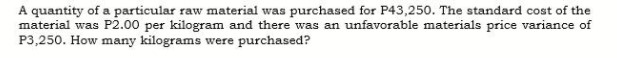

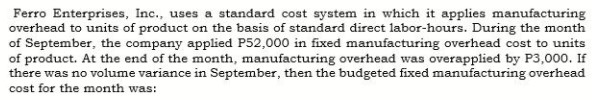

.LALA Co. sells two products - Do and Re. The sales mix consists of a composite unit of two units of Do for every five units of Re. Fixed costs total P49,500. The unit of contribution margins for Do and Re are P2.50 and P1.20, respectively. Considering the company as a whole, what is the number of composite units to breakeven? (NOTE: 1 composite unit = 1 sales mix) Given a selling price of P80 per unit, contribution margin ratio of 30% and a fixed costs of P240,000, how much is the total variable costs at the break-even point? ABC Co. is a wholesaler that sells a single product. Management has provided the following cost data for two levels of monthly sales volume. The company sells the product for P140.50 per unit. Sales Cost of sales 6,000 7,000 P497,400 P580,300 P294,700 Selling & Admin costs P273,600 The best estimate of the total contribution margin when 6,300 units are sold is: Chicken & Bear in 2019 budgeted a net income after tax rate of 30% amounting to P1,680,000. Fixed costs for the year are estimated to be P2,100,000 and contribution margin is estimated to be 20% of sales revenue. How much is the sales revenue required in order to earn the desired income? The following information pertains to Bates Company's direct labor for March: Standard direct labor-hours Actual direct labor-hours 21,000 20,000 Favorable direct labor rate variance P8,400 Standard direct labor rate per hour P6.30 What was Bates' total actual direct labor cost for March? A quantity of a particular raw material was purchased for P43,250. The standard cost of the material was P2.00 per kilogram and there was an unfavorable materials price variance of P3,250. How many kilograms were purchased? Ferro Enterprises, Inc., uses a standard cost system in which it applies manufacturing overhead to units of product on the basis of standard direct labor-hours. During the month of September, the company applied P52,000 in fixed manufacturing overhead cost to units of product. At the end of the month, manufacturing overhead was overapplied by P3,000. If there was no volume variance in September, then the budgeted fixed manufacturing overhead cost for the month was:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started