Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lallana is a company operating in the manufacturing and maintenance industry. Lallana is listed on the Johannesburg Stock Exchange and has a 3 1 December

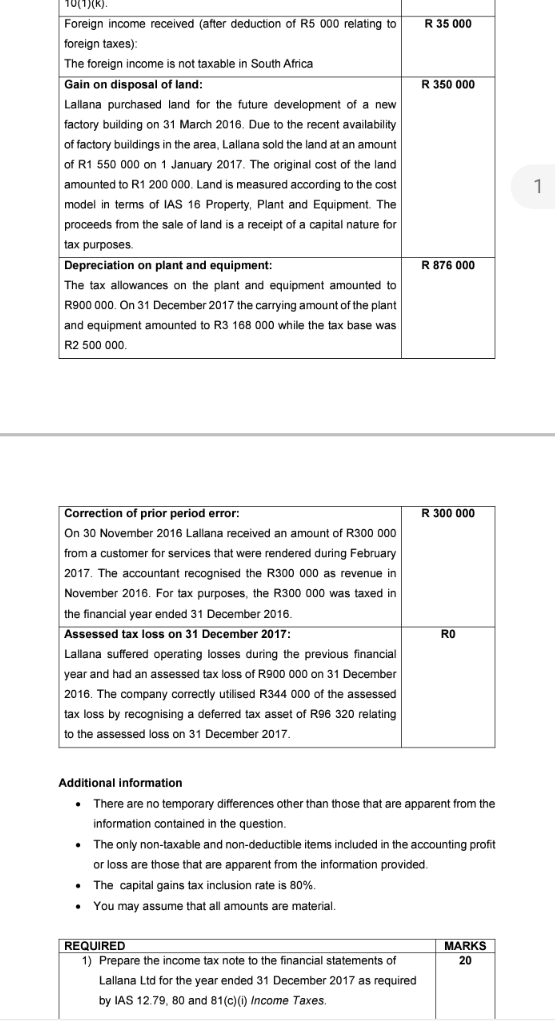

Lallana is a company operating in the manufacturing and maintenance industry. Lallana is listed on the Johannesburg Stock Exchange and has a December financial year end. You are currently reviewing the financial statements of Lallana. Your assistant has presented the following schedule of information relating to the year ended December : ITEM AMOUNT Lallana's accounting profit for the year ended December after correctly accounted for all items: R Dividends received: Dividends received are exempt from normal tax in terms of s k R Foreign income received after deduction of R relating to foreign taxes: The foreign income is not taxable in South Africa R Gain on disposal of land: Lallana purchased land for the future development of a new factory building on March Due to the recent availability of factory buildings in the area, Lallana sold the land at an amount of R on January The original cost of the land amounted to R Land is measured according to the cost model in terms of IAS Property, Plant and Equipment. The proceeds from the sale of land is a receipt of a capital nature for tax purposes. R Depreciation on plant and equipment: The tax allowances on the plant and equipment amounted to R On December the carrying amount of the plant and equipment amounted to R while the tax base was R R

tableForeign income received after deduction of R relating toR foreign taxes:The foreign income is not taxable in South Africa,R

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started