Question

Lamps Plus manufactures lamps for residential homes. The president of the company, Laura Cole, is convinced that she must get concessions from the workers if

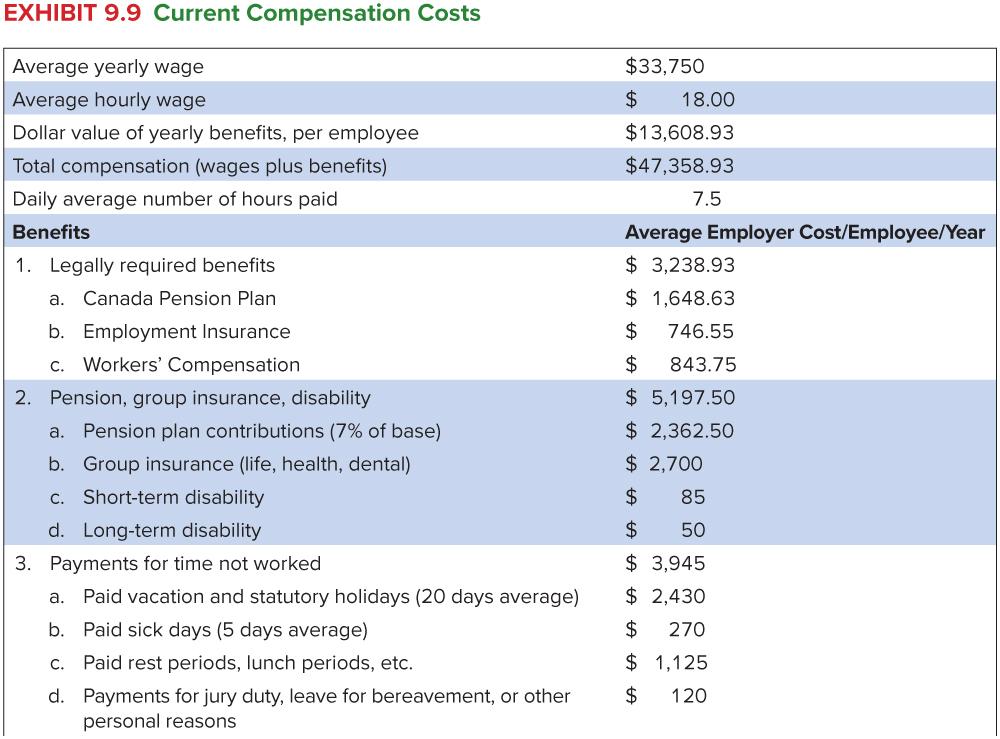

Lamps Plus manufactures lamps for residential homes. The president of the company, Laura Cole, is convinced that she must get concessions from the workers if Lamps Plus is to compete effectively with increasing foreign competition. In particular, Cole is displeased with the cost of employee benefits. She doesn't mind conceding a competitive wage increase (maximum 3%), but she wants the total compensation package to cost 3% less. The current costs are shown in Exhibit 9.9.

Image transcription text

EXHIBIT 9.9 Current Compensation Costs Average yearly wage $33,750 Average hourly wage $ 18.00 Dollar value of yearly benefits, per employee $13,608.93 Total compensation (wages plus benefits) $47,358.93 Daily average number of hours paid 7.5 Benefits Average Employer Cost/Employee/Year 1. Legally required benefits $ 3,238.93 a. Canada Pension Plan $ 1,648.63 b. Employment Insurance $ 746.55 c. Workers' Compensation $ 843.75 2. Pension, group insurance, disability $ 5,197.50 a. Pension plan contributions (7% of base) $ 2,362.50 b. Group insurance (life, health, dental) $ 2,700 c. Short-term disability $ 85 d. Long-term disability $ 50 3. Payments for time not worked $ 3,945 a. Paid vacation and statutory holidays (20 days average) $ 2,430 b. Paid sick days (5 days average) $ 270 c. Paid rest periods, lunch periods, etc. tA 1,125 d. Payments for jury duty, leave for bereavement, or other $ 120 personal reasons

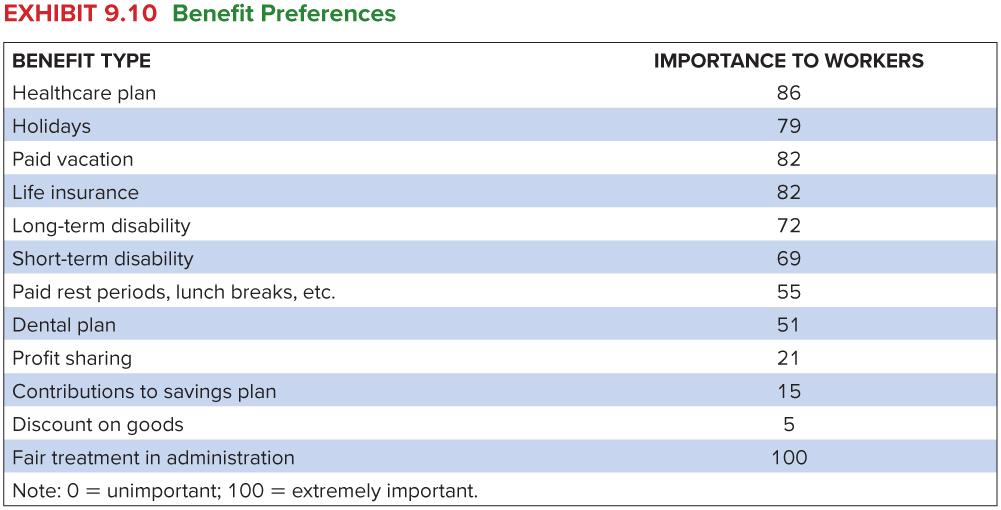

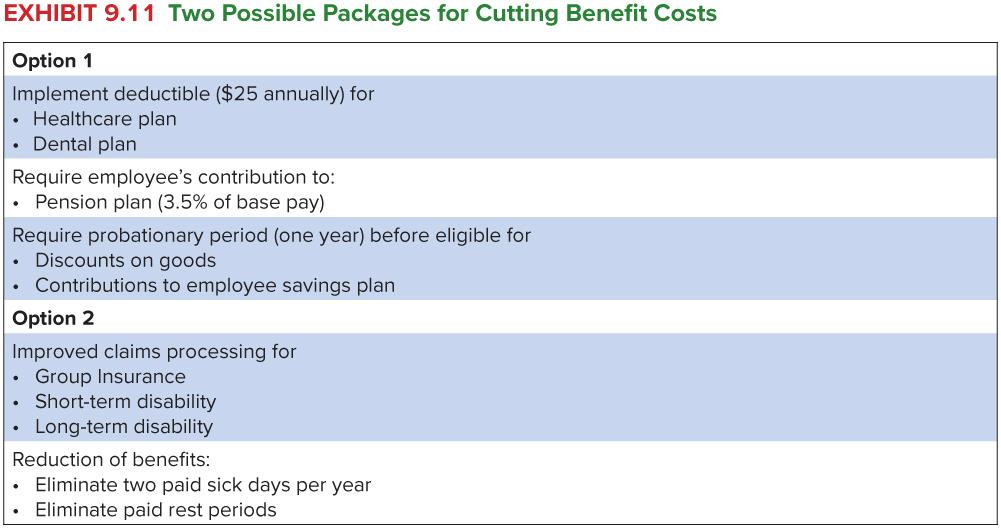

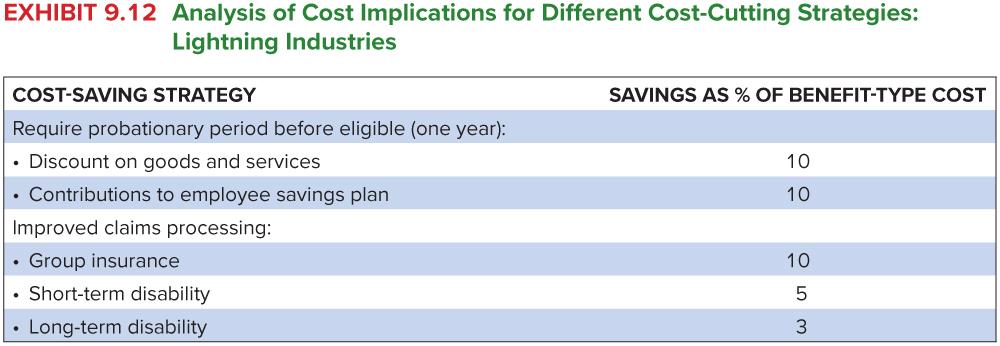

Your assistant has surveyed other companies that are obtaining concessions from employees (Exhibit 9.11). You also have data from a consulting firm that indicates employee preferences for different forms of benefits (Exhibit 9.10). Based on all this information, you have two possible concession packages that you can propose, labelled "Option 1" and "Option 2" (Exhibit 9.11).

Image transcription text

EXHIBIT 9.1 O Benefit Preferences BENEFIT TYPE IMPORTANCE TO WORKERS Healthcare plan 86 Holidays 79 Paid vacation 82 Life insurance 82 Long-term disability 72 Short-term disability 69 Paid rest periods, lunch breaks, etc' 55 Dental plan 51 Profit sharing 21 Contributions to savings plan '15 Discount on goods 5 Fair treatment in administration 100 Note: 0 = unimportant; 100 = extremely important.

Image transcription text

EXHIBIT 9.11 Two Possible Packages for Cutting Benefit Costs Option 1 Implement deductible ($25 annually) for . Healthcare plan . Dental plan Require employee's contribution to: . Pension plan (3.5% of base pay) Require probationary period (one year) before eligible for . Discounts on goods Contributions to employee savings plan Option 2 Improved claims processing for . Group Insurance Short-term disability . Long-term disability Reduction of benefits: Eliminate two paid sick days per year Eliminate paid rest periods

Image transcription text

EXHIBIT 9.1 2 Analysis of Cost Implications for Different Cost-Cutting Strategies: Lightning Industries COST-SAVING STRATEGY Require probationary period before eligible {one year): SAVINGS AS % OF BENEFIT-TYPE COST - Discount on goods and services 10 - Contributions to employee savings plan 10 Improved claims processing: . Group insurance 10 - Short-term disability 5 . Long-term disabilityPlease answer the following questions:

- Cost out each of the two options, given the data in Exhibits 9.9 and 9.10.

- Which package would you recommend to Cole? Why? Which of the options do you think employees will be more likely to accept? You may want to refer to Exhibit 9.9.

- Could you propose a better options than the two suggested that will achieve Cole's goal and at the same time be more likely to be accepted by the employees with less resistance?

EXHIBIT 9.9 Current Compensation Costs Average yearly wage Average hourly wage Dollar value of yearly benefits, per employee Total compensation (wages plus benefits) Daily average number of hours paid Benefits 1. Legally required benefits a. Canada Pension Plan b. Employment Insurance c. Workers' Compensation 2. Pension, group insurance, disability a. Pension plan contributions (7% of base) b. Group insurance (life, health, dental) c. Short-term disability d. Long-term disability 3. Payments for time not worked $33,750 $ 18.00 $13,608.93 $47,358.93 7.5 Average Employer Cost/Employee/Year $ 3,238.93 $ 1,648.63 $ 746.55 $ 843.75 $ 5,197.50 $ 2,362.50 $ 2,700 $ 85 $ 50 $ 3,945 a. Paid vacation and statutory holidays (20 days average) $ 2,430 b. Paid sick days (5 days average) $ 270 c. Paid rest periods, lunch periods, etc. $ 1,125 d. Payments for jury duty, leave for bereavement, or other personal reasons $ 120

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started