Question

Lan Corp. an accrual-basis calendar year repair-service corporation, began business on Monday, January 3, Year 4. Lans valid S corporation election took effect retroactively on

Lan Corp. an accrual-basis calendar year repair-service corporation, began business on Monday, January 3, Year 4. Lans valid S corporation election took effect retroactively on January 3, Year 4.

For items 1 through 4, determine the amount, if any, using the fact pattern for each item.

Assume the following facts:

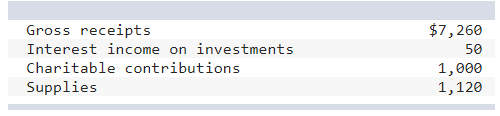

Lans Year 4 books recorded the following items:

Assume the following facts:

On January 3, Year 4, Taylor and Barr each owned 100 shares of the 200 issued shares of Lan stock. Taylors basis in Lan shares on that date was $10,000. Taylor sold all of his Lan shares to Pike on January 31, Year 4, and Lan made a valid election to terminate its tax year. Taylors share of ordinary income form Lan prior to the sale was $2000. Lan made a cash distribution of $3000 to Taylor on January 30, Year 4.

What was Taylors basis in Lan shares for determining gain or loss from the sale to Pike?

Gross receipts Interest income on investments Charitable contributions Supplies $7,260 50 1,000 1,120 Taylor's basis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started