Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lana, an unmarried taxpayer with AGI of $ 2 0 4 , 4 0 0 , has three qualifying children, all under age 1 7

Lana, an unmarried taxpayer with AGI of $ has three qualifying children, all under age

View the AGI threshold amounts.

Requirement

What is the amount of her child tax credit? Assume the year is Round intermediary calculations up to the next whole number.

Lana's child tax credit:

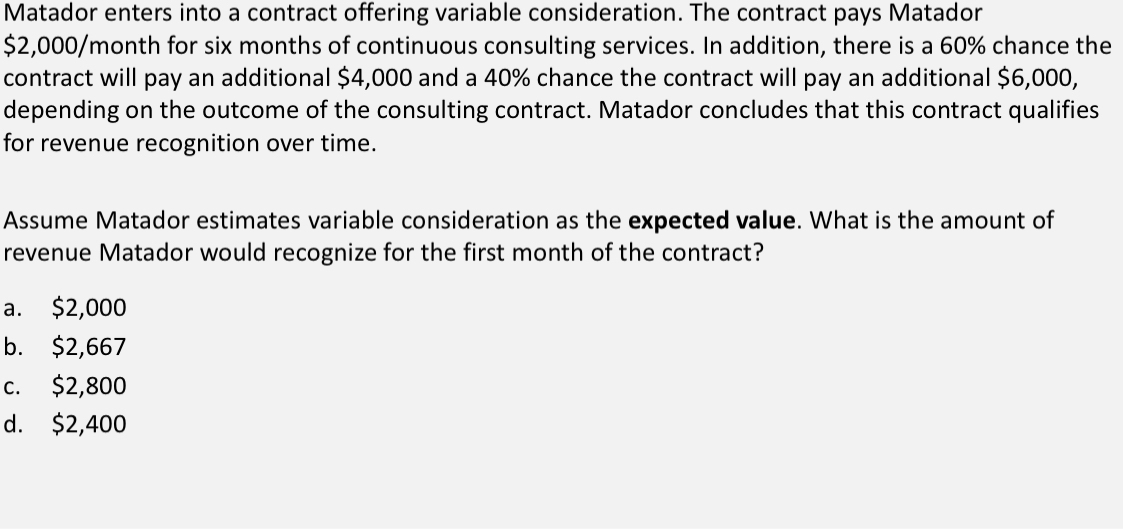

Matador enters into a contract offering variable consideration. The contract pays Matador $month for six months of continuous consulting services. In addition, there is a chance the contract will pay an additional $ and a chance the contract will pay an additional $ depending on the outcome of the consulting contract. Matador concludes that this contract qualifies for revenue recognition over time.

Assume Matador estimates variable consideration as the expected value. What is the amount of revenue Matador would recognize for the first month of the contract?

a $

b $

c $

d $

Matador enters into a contract offering variable consideration. The contract pays Matador $month for six months of continuous consulting services. In addition, there is a chance the contract will pay an additional $ and a chance the contract will pay an additional $ depending on the outcome of the consulting contract. Matador concludes that this contract qualifies for revenue recognition over time.

Assume Matador estimates variable consideration as the expected value. What is the amount of revenue Matador would recognize for the first month of the contract?

a $

b $

c $

d $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started