Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lancaster and Reed are partners in a successful sporting goods store. Their profit and loss sharing agreement stipulates that interest of 10% is to

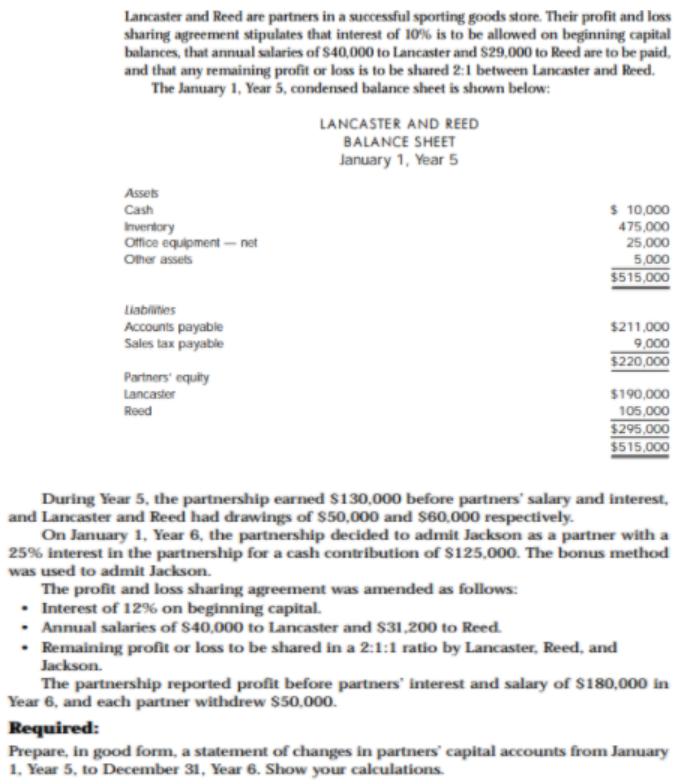

Lancaster and Reed are partners in a successful sporting goods store. Their profit and loss sharing agreement stipulates that interest of 10% is to be allowed on beginning capital balances, that annual salaries of $40,000 to Lancaster and s29,000 to Reed are to be paid, and that any remaining profit or loss is to be shared 2:1 between Lancaster and Reed. The January 1, Year 5, condensed balance sheet is shown below: LANCASTER AND REED BALANCE SHEET January 1, Year 5 Assets $ 10,000 475,000 25,000 Cash Inventory Office equipment - net Oher assets 5,000 $515,000 Liablities Accounts payable Sales tax payable $211,000 9,000 $220,000 Partners' equity Lancaster $190,000 Reed 105,000 $295,000 $515,000 During Year 5, the partnership earned $130,000 before partners' salary and interest, and Lancaster and Reed had drawings of $50,000 and $60,000 respectively. On January 1, Year 6, the partnership decided to admit Jackson as a partner with a 25% interest in the partnership for a cash contribution of $125,000. The bonus method was used to admit Jackson. The profit and loss sharing agreement was amended as follows: Interest of 12% on beginning capital. Annual salaries of $40,000 to Lancaster and $31.200 to Reed. Remaining profit or loss to be shared in a 2:1:1 ratio by Lancaster, Reed, and Jackson. The partnership reported profit before partners' interest and salary of $180,000 in Year 6, and each partner withdrew $50.000. Required: Prepare, in good form, a statement of changes in partners' capital accounts from January 1. Year 5, to December 31, Year 6. Show your calculations.

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Profut 2 Loss Appnatim Accout Dec 31geng Salory Net Profit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started