Answered step by step

Verified Expert Solution

Question

1 Approved Answer

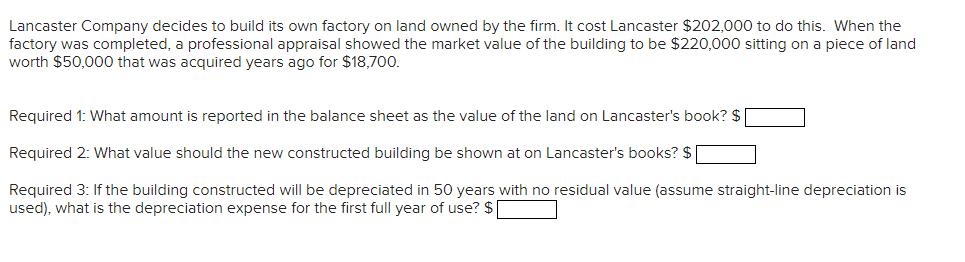

Lancaster Company decides to build its own factory on land owned by the firm. It cost Lancaster $202,000 to do this. When the factory

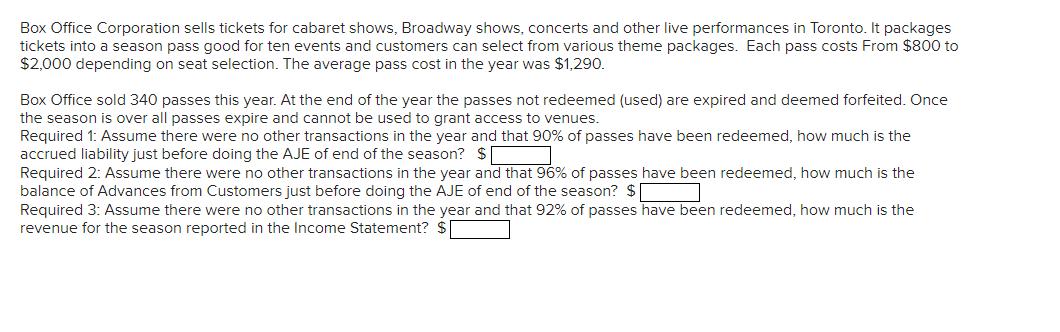

Lancaster Company decides to build its own factory on land owned by the firm. It cost Lancaster $202,000 to do this. When the factory was completed, a professional appraisal showed the market value of the building to be $220,000 sitting on a piece of land worth $50,000 that was acquired years ago for $18,700. Required 1: What amount is reported in the balance sheet as the value of the land on Lancaster's book? $ Required 2: What value should the new constructed building be shown at on Lancaster's books? $ Required 3: If the building constructed will be depreciated in 50 years with no residual value (assume straight-line depreciation is used), what is the depreciation expense for the first full year of use? $ Box Office Corporation sells tickets for cabaret shows, Broadway shows, concerts and other live performances in Toronto. It packages. tickets into a season pass good for ten events and customers can select from various theme packages. Each pass costs From $800 to $2,000 depending on seat selection. The average pass cost in the year was $1,290. Box Office sold 340 passes this year. At the end of the year the passes not redeemed (used) are expired and deemed forfeited. Once the season is over all passes expire and cannot be used to grant access to venues. Required 1: Assume there were no other transactions in the year and that 90% of passes have been redeemed, how much is the accrued liability just before doing the AJE of end of the season? $ Required 2: Assume there were no other transactions in the year and that 96% of passes have been redeemed, how much is the balance of Advances from Customers just before doing the AJE of end of the season? $ Required 3: Assume there were no other transactions in the year and that 92% of passes have been redeemed, how much is the revenue for the season reported in the Income Statement? $ Lancaster Company decides to build its own factory on land owned by the firm. It cost Lancaster $202,000 to do this. When the factory was completed, a professional appraisal showed the market value of the building to be $220,000 sitting on a piece of land worth $50,000 that was acquired years ago for $18,700. Required 1: What amount is reported in the balance sheet as the value of the land on Lancaster's book? $ Required 2: What value should the new constructed building be shown at on Lancaster's books? $ Required 3: If the building constructed will be depreciated in 50 years with no residual value (assume straight-line depreciation is used), what is the depreciation expense for the first full year of use? $ Box Office Corporation sells tickets for cabaret shows, Broadway shows, concerts and other live performances in Toronto. It packages. tickets into a season pass good for ten events and customers can select from various theme packages. Each pass costs From $800 to $2,000 depending on seat selection. The average pass cost in the year was $1,290. Box Office sold 340 passes this year. At the end of the year the passes not redeemed (used) are expired and deemed forfeited. Once the season is over all passes expire and cannot be used to grant access to venues. Required 1: Assume there were no other transactions in the year and that 90% of passes have been redeemed, how much is the accrued liability just before doing the AJE of end of the season? $ Required 2: Assume there were no other transactions in the year and that 96% of passes have been redeemed, how much is the balance of Advances from Customers just before doing the AJE of end of the season? $ Required 3: Assume there were no other transactions in the year and that 92% of passes have been redeemed, how much is the revenue for the season reported in the Income Statement? $

Step by Step Solution

★★★★★

3.35 Rating (136 Votes )

There are 3 Steps involved in it

Step: 1

Required 1 The amount reported in the balance sheet as the value of the land on Lancasters books wou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started