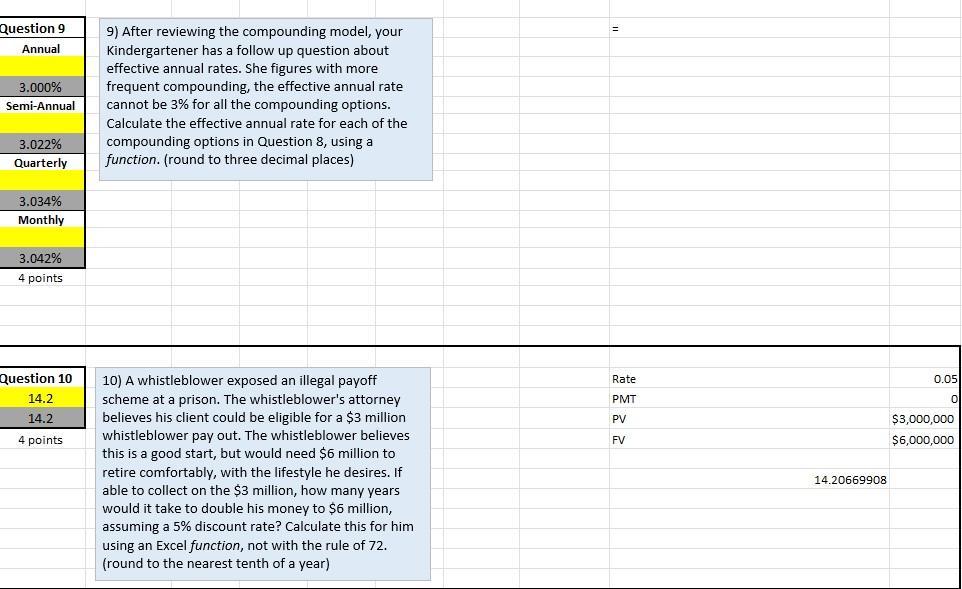

Question: Looking for the excel function in Yellow on Q9 Question 9 Annual 3.000% Semi-Annual 3.022% Quarterly 3.034% Monthly 3.042% 4 points Question 10 14.2 14.2

Looking for the excel function in Yellow on Q9

Question 9 Annual 3.000% Semi-Annual 3.022% Quarterly 3.034% Monthly 3.042% 4 points Question 10 14.2 14.2 4 points 9) After reviewing the compounding model, your Kindergartener has a follow up question about effective annual rates. She figures with more frequent compounding, the effective annual rate cannot be 3% for all the compounding options. Calculate the effective annual rate for each of the compounding options in Question 8, using a function. (round to three decimal places) 10) A whistleblower exposed an illegal payoff scheme at a prison. The whistleblower's attorney believes his client could be eligible for a $3 million whistleblower pay out. The whistleblower believes this is a good start, but would need $6 million to retire comfortably, with the lifestyle he desires. If able to collect on the $3 million, how many years would it take to double his money to $6 million, assuming a 5% discount rate? Calculate this for him using an Excel function, not with the rule of 72. (round to the nearest tenth of a year) = Rate PMT PV FV 14.20669908 0.05 0 $3,000,000 $6,000,000

Step by Step Solution

3.58 Rating (169 Votes )

There are 3 Steps involved in it

Answer to Question 9 Effective Annual Rate EAR Using Excel Functions To calculate the Effect... View full answer

Get step-by-step solutions from verified subject matter experts