Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lance Brothers Enterprises acquired $710,000 of 4% bonds, dated July 1, on July 1, 2024, as a long-term investment. Management has the positive intent

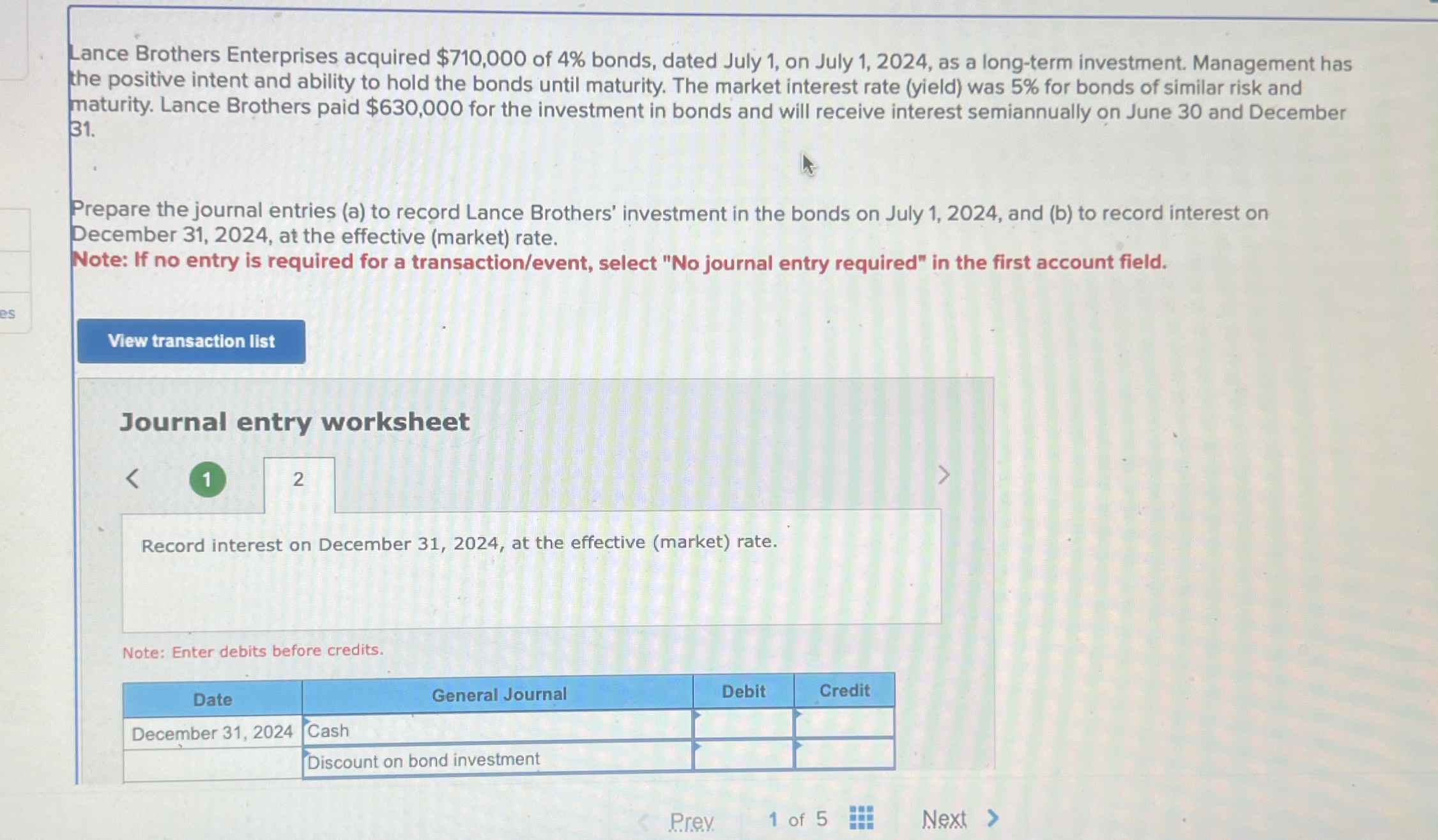

Lance Brothers Enterprises acquired $710,000 of 4% bonds, dated July 1, on July 1, 2024, as a long-term investment. Management has the positive intent and ability to hold the bonds until maturity. The market interest rate (yield) was 5% for bonds of similar risk and maturity. Lance Brothers paid $630,000 for the investment in bonds and will receive interest semiannually on June 30 and December 31. Prepare the journal entries (a) to record Lance Brothers' investment in the bonds on July 1, 2024, and (b) to record interest on December 31, 2024, at the effective (market) rate. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. es View transaction list Journal entry worksheet < 1 2 Record interest on December 31, 2024, at the effective (market) rate. Note: Enter debits before credits. Date December 31, 2024 Cash General Journal Debit Credit Discount on bond investment Prev 1 of 5 Next >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started