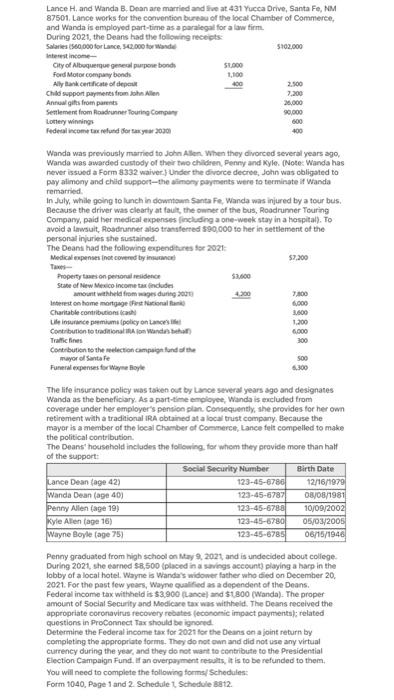

Lance H, and Wanda B. Dean are married and Swe at 431 Yucca Drive, Santa Fe, NM 87501. Lance works for the comvention bureas of the local Chamber of Commeree, and Wanda is employed part-time as a paralegal for a law tirm. Wanda was pecviously married to John Alen. When they divorced several years ago, Wanda was awarded custody of their two childen. Penny and Kyle. (Notes Wanda has never issued a Form 8332 waiver, ) Under the divorce decree, John was caligated to pay atimony and chid support-the afimony payments were to terminate if Wanda remarried. In July. while going to lunch in dewertown Santa Fe, Wanda was injured by a tour bus. Elecause the driver was clearty at fault, the owner of the bus, Roodrunner Touring Compary, paid tser medical expenses (including a one-week stay in a hospital). To avoid a Lawsuit, Rosodranner also transferted 590,000 to her in settlement of the personat injuries sthe sustained. The life insurance policy was taken out by Lance several years ago and designates Wanda as the beneficiary. As a part-time employee, Wanda is excluded from coverage under her employer's pension plar. Comequently, she prevides for her own retirement with a traditional tRA obtained at a local trist company. Because the mayor is a meenbor of the local Chamber of Coramerce, Lance felt compelled to make the political contribution. The Deans' hecrsehald includes the following. for whem they peovide more than half of the sunoort: Peney graduated from high school on 14xy9,2021, and is undecided about coliege. During 2021, she earned 98,500 (placed in a savings account) playing a harp in the lobby of a local hotel. Wayne is Wanda's widower father who died on December 20, 2021. For the past few years, Wayne qualified as a dependent of the Deans. Federal income tax withheld is $3,900 (Lancel and $1.800 (Wanda). The proper ameunt of 5ocial Security and Modicare tax was withtseid. The Deans received the appropriate coronavirus recovory rebates (econorsic impoct payments); related questions in ProConnect Tax should be ignoned. Determine the Federal income tax for 2021 tor the Deans on a joint return by completing the appropriate foems. They do not own and did not use any virtual currency during the year, and they do not want to centribute to the Presidential Election Campaign Fund. If an overpayment resulth, it is to be refunded to them. You will need to complete the following forms/ Schedules: Form 1040, Page 1 and 2 Schedule 1, Schedule Bat2. Lance H, and Wanda B. Dean are married and Swe at 431 Yucca Drive, Santa Fe, NM 87501. Lance works for the comvention bureas of the local Chamber of Commeree, and Wanda is employed part-time as a paralegal for a law tirm. Wanda was pecviously married to John Alen. When they divorced several years ago, Wanda was awarded custody of their two childen. Penny and Kyle. (Notes Wanda has never issued a Form 8332 waiver, ) Under the divorce decree, John was caligated to pay atimony and chid support-the afimony payments were to terminate if Wanda remarried. In July. while going to lunch in dewertown Santa Fe, Wanda was injured by a tour bus. Elecause the driver was clearty at fault, the owner of the bus, Roodrunner Touring Compary, paid tser medical expenses (including a one-week stay in a hospital). To avoid a Lawsuit, Rosodranner also transferted 590,000 to her in settlement of the personat injuries sthe sustained. The life insurance policy was taken out by Lance several years ago and designates Wanda as the beneficiary. As a part-time employee, Wanda is excluded from coverage under her employer's pension plar. Comequently, she prevides for her own retirement with a traditional tRA obtained at a local trist company. Because the mayor is a meenbor of the local Chamber of Coramerce, Lance felt compelled to make the political contribution. The Deans' hecrsehald includes the following. for whem they peovide more than half of the sunoort: Peney graduated from high school on 14xy9,2021, and is undecided about coliege. During 2021, she earned 98,500 (placed in a savings account) playing a harp in the lobby of a local hotel. Wayne is Wanda's widower father who died on December 20, 2021. For the past few years, Wayne qualified as a dependent of the Deans. Federal income tax withheld is $3,900 (Lancel and $1.800 (Wanda). The proper ameunt of 5ocial Security and Modicare tax was withtseid. The Deans received the appropriate coronavirus recovory rebates (econorsic impoct payments); related questions in ProConnect Tax should be ignoned. Determine the Federal income tax for 2021 tor the Deans on a joint return by completing the appropriate foems. They do not own and did not use any virtual currency during the year, and they do not want to centribute to the Presidential Election Campaign Fund. If an overpayment resulth, it is to be refunded to them. You will need to complete the following forms/ Schedules: Form 1040, Page 1 and 2 Schedule 1, Schedule Bat2