Answered step by step

Verified Expert Solution

Question

1 Approved Answer

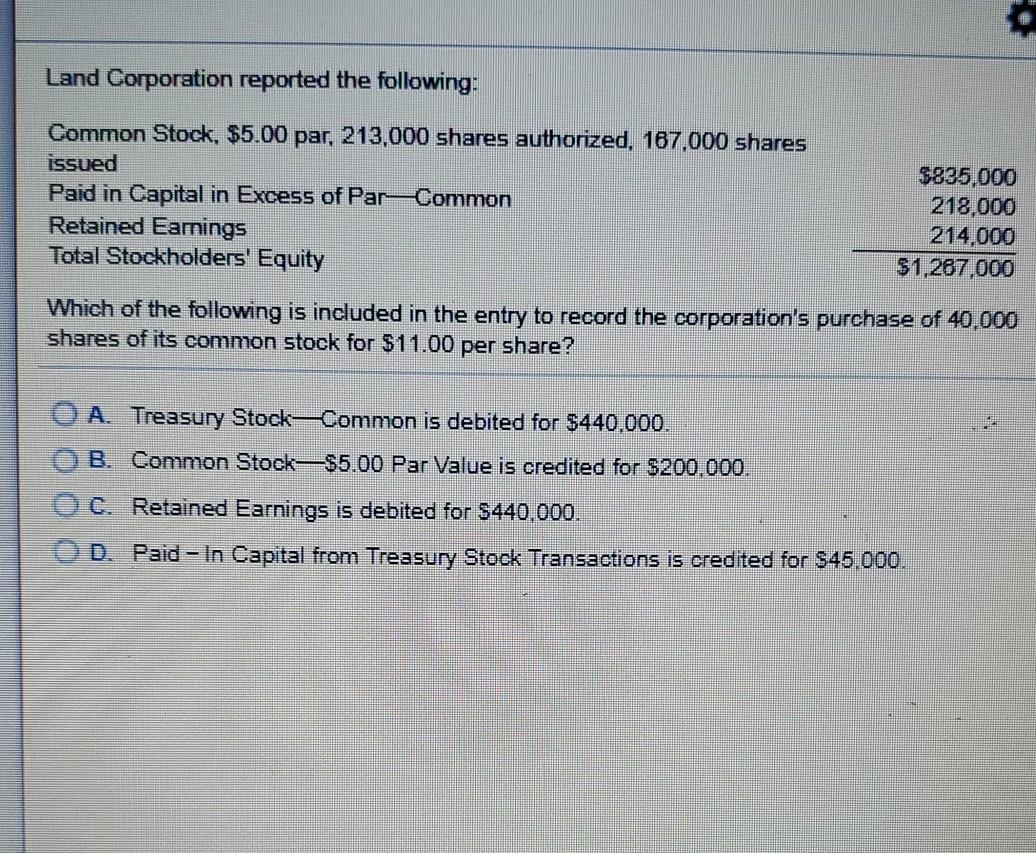

Land Corporation reported the following: Common Stock, $5.00 par, 213,000 shares authorized, 167,000 shares issued Paid in Capital in Excess of ParCommon Retained Earings Total

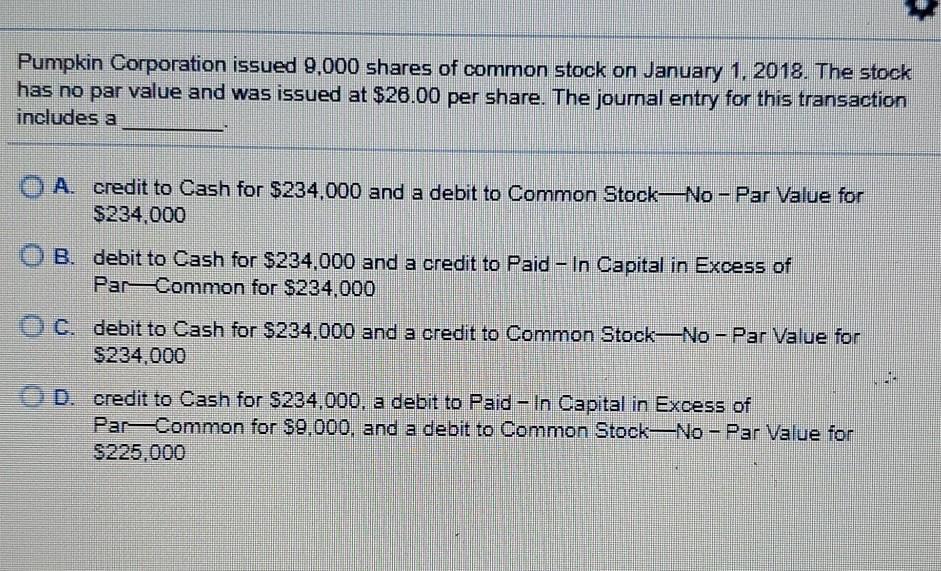

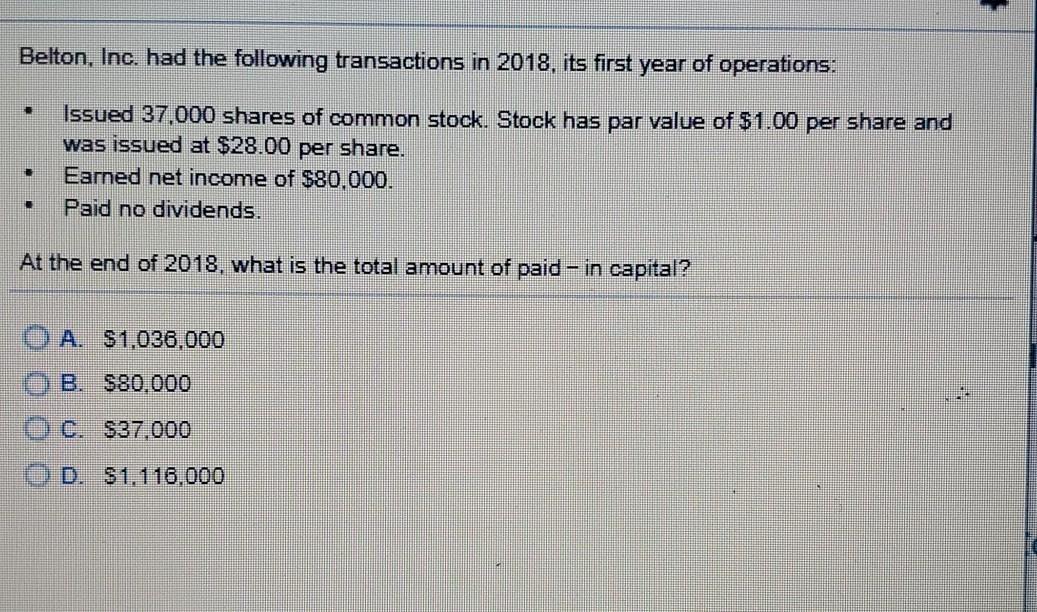

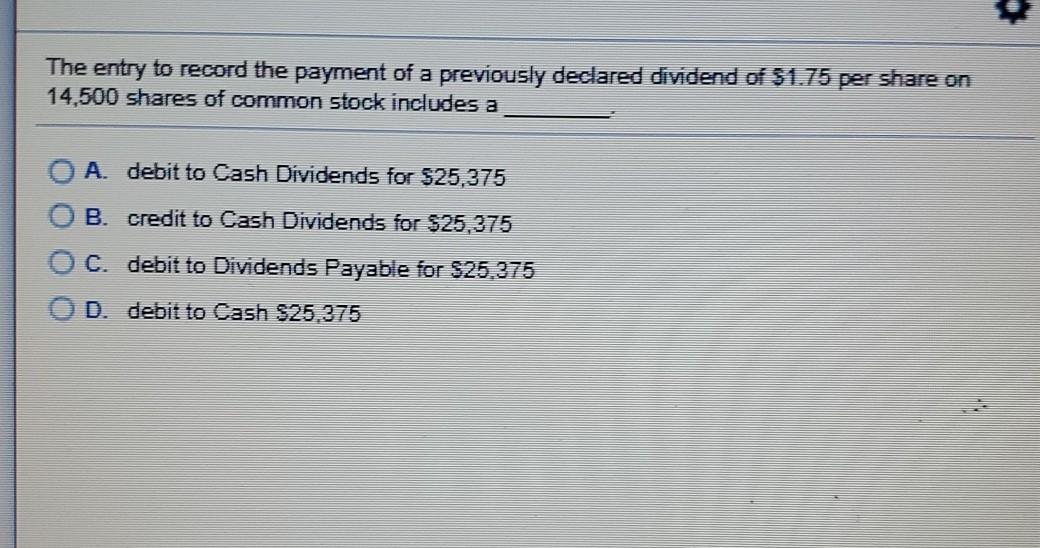

Land Corporation reported the following: Common Stock, $5.00 par, 213,000 shares authorized, 167,000 shares issued Paid in Capital in Excess of ParCommon Retained Earings Total Stockholders' Equity $835,000 218,000 214,000 $1,267,000 Which of the following is included in the entry to record the corporation's purchase of 40,000 shares of its common stock for $11.00 per share? A. Treasury Stock-Common is debited for $440,000. B. Common Stock$5.00 Par Value is credited for $200.000. O C. Retained Earnings is debited for $440,000. D. Paid - In Capital from Treasury Stock Transactions is credited for $45.000. Pumpkin Corporation issued 9,000 shares of common stock on January 1, 2018. The stock has no par value and was issued at $26.00 per share. The journal entry for this transaction includes a O A. credit to Cash for $234.000 and a debit to Common Stock-No - Par Value for $234.000 O B. debit to Cash for $234.000 and a credit to Paid - In Capital in Excess of Par Common for $234,000 O C. debit to Cash for $234.000 and a credit to Common Stock-No - Par Value for $234,000 D. credit to Cash for $234.000, a debit to Paid - In Capital in Excess of Par Common for $9.000, and a debit to Common Stock No-Par Value for $225,000 Belton, Inc. had the following transactions in 2018, its first year of operations: Issued 37.000 shares of common stock. Stock has par value of $1.00 per share and was issued at $28.00 per share. Earned net income of $80.000. Paid no dividends. At the end of 2018, what is the total amount of paid - in capital? A. $1,036.000 B. $80.000 C. $37.000 D. $1.116.000 The entry to record the payment of a previously declared dividend of $1.75 per share on 14,500 shares of common stock includes a A. debit to Cash Dividends for $25,375 B. credit to Cash Dividends for $25.375 C. debit to Dividends Payable for $25,375 D. debit to Cash $25.375

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started