Answered step by step

Verified Expert Solution

Question

1 Approved Answer

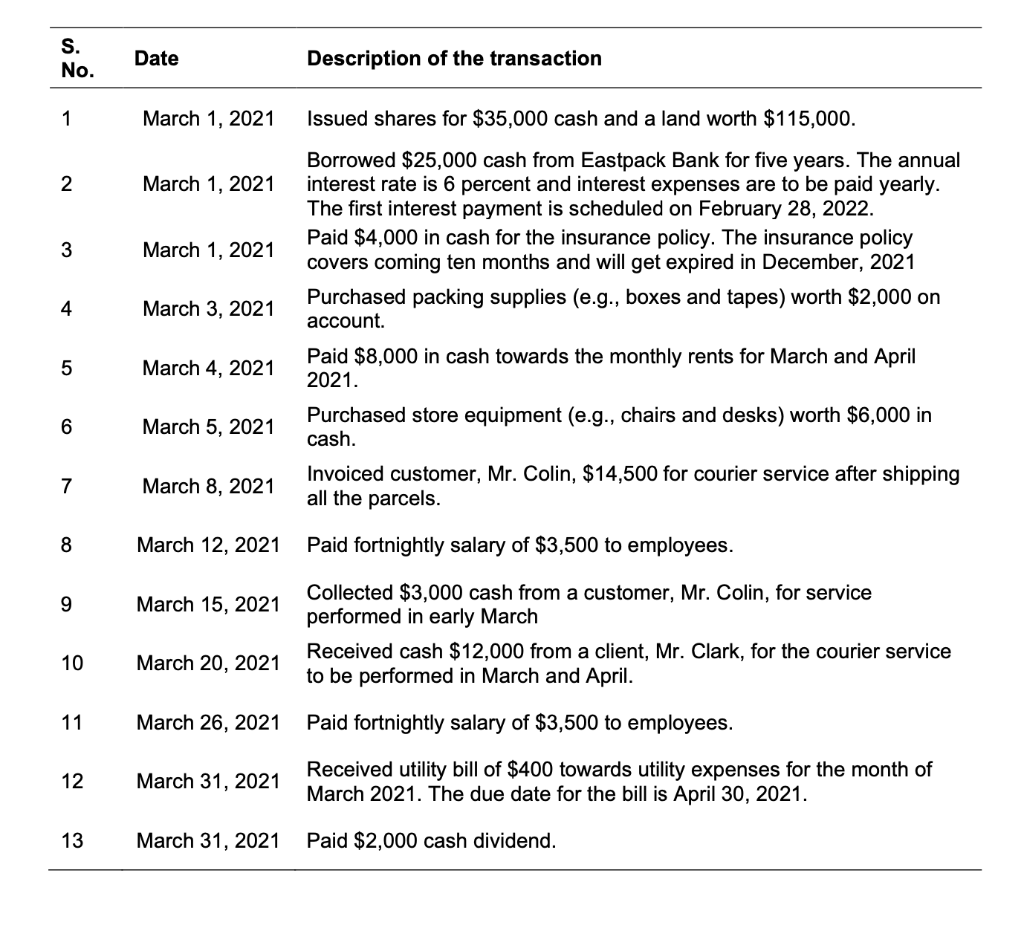

Landers Inc. is a logistics company which ships parcels across town, around Australia. It started its operations in March 2021 and completed the following transactions

Landers Inc. is a logistics company which ships parcels across town, around Australia. It started its operations in March 2021 and completed the following transactions during its first month of operations. Note that the company spends $3,500 each fortnight on alternative Friday ($ 350 for each working day) starting from March 12, 2021 to pay salaries to its employees.

At the end of March 2021, accountants estimated that

- Packing supplies on hand are worth $500.

- Depreciation expenses for store equipment in March 2021 are $150.

- Out of $12,000 revenue received from a client, Mr. Clark, $4,000 of courier service

- has been performed during March 2021.

Required:

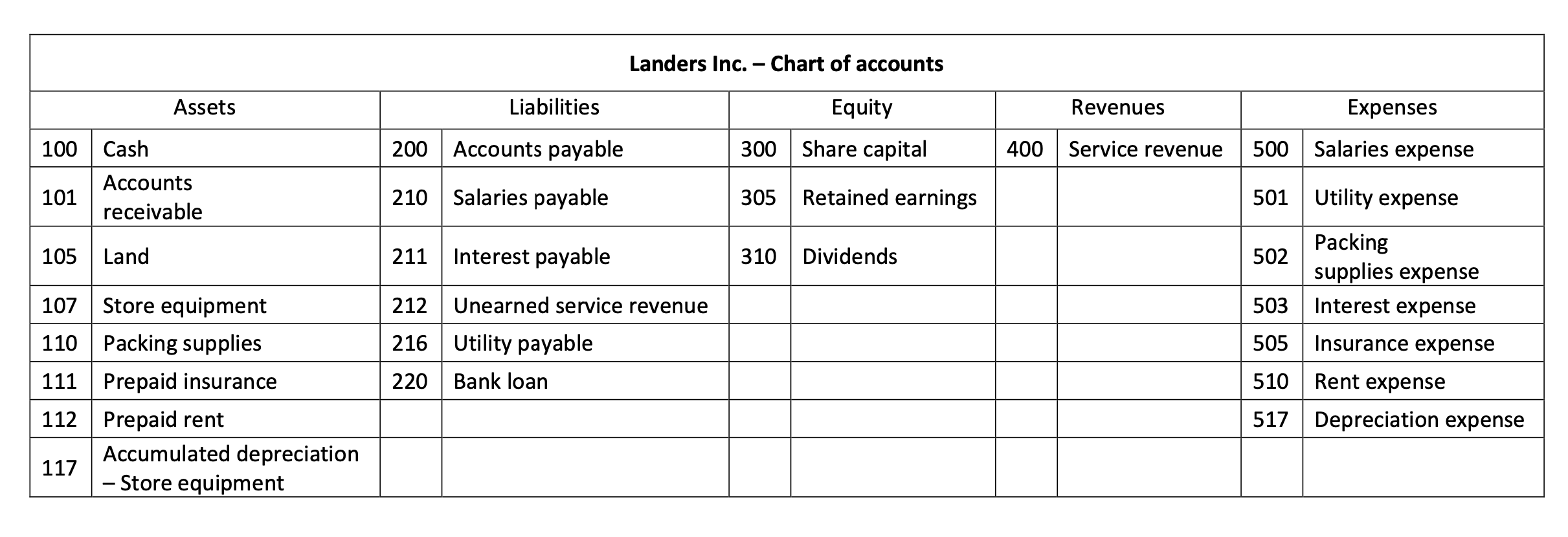

- Post the journal entries (including the adjusting entries) using the T-accounts.

- Calculate the balance of retained earnings as at 31 March, 2021.

- Prepare the statement of profit or loss for the month ended 31 March, 2021 and the statement of financial position as at 31 March, 2021.

Note:

- Ignore the effect of GST.

- Narrations are not required for journal entries.

- Cross-referencing is required for posting to ledger accounts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started