Landers Inc. is a logistics company which ships parcels across town, around Australia. It started its operations in March 2021 and completed the following transactions during its first month of operations. Note that the company spends $3,500 each fortnight on alternative Friday ($ 350 for each working day) starting from March 12, 2021 to pay salaries to its employees.

At the end of March 2021, accountants estimated that

-

Packing supplies on hand are worth $500.

-

Depreciation expenses for store equipment in March 2021 are $150.

-

Out of $12,000 revenue received from a client, Mr. Clark, $4,000 of courier service

has been performed during March 2021.

-

-

Required:

-

Record each transaction including all the relevant adjusting entries in the journal.

-

Post the journal entries (including the adjusting entries) using the T-accounts.

-

Prepare an adjusted trial balance. Calculate the balance of retained earnings as at 31 March, 2021.

Prepare the statement of profit or loss for the month ended 31 March, 2021 and the statement of financial position as at 31 March, 2021.

-

Ignore the effect of GST.

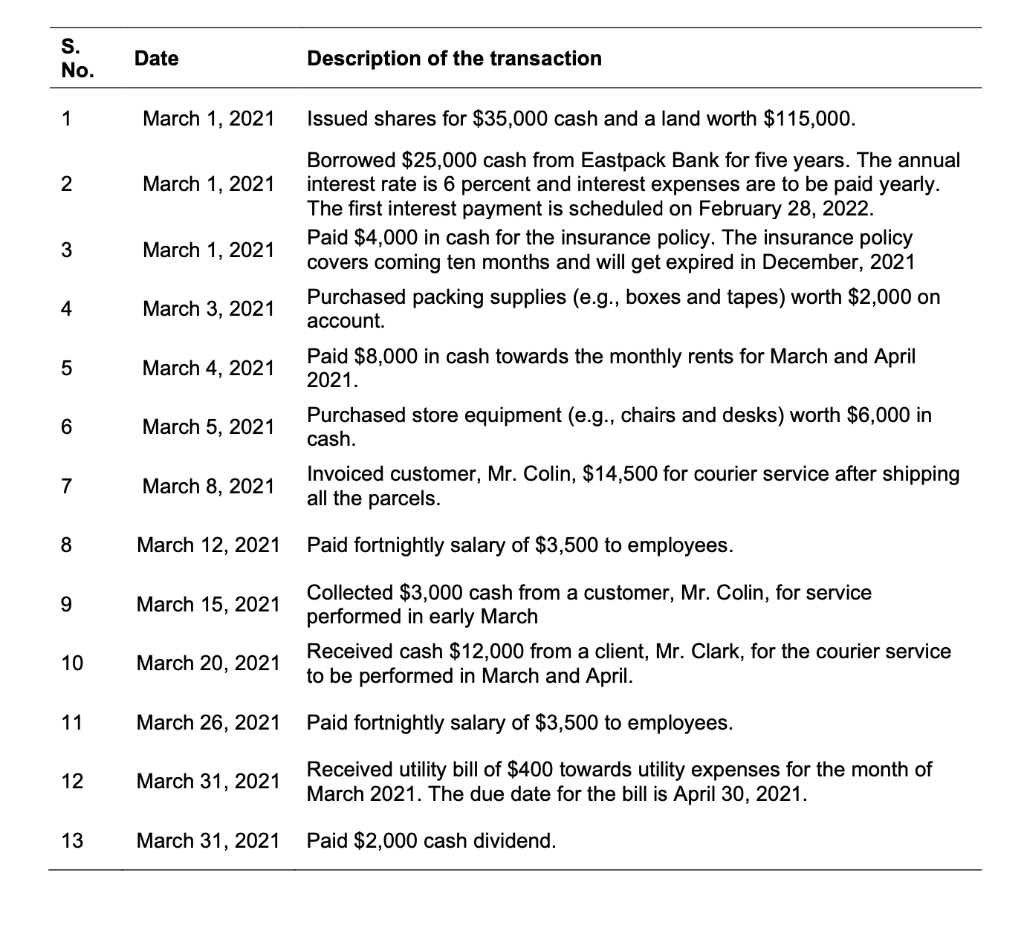

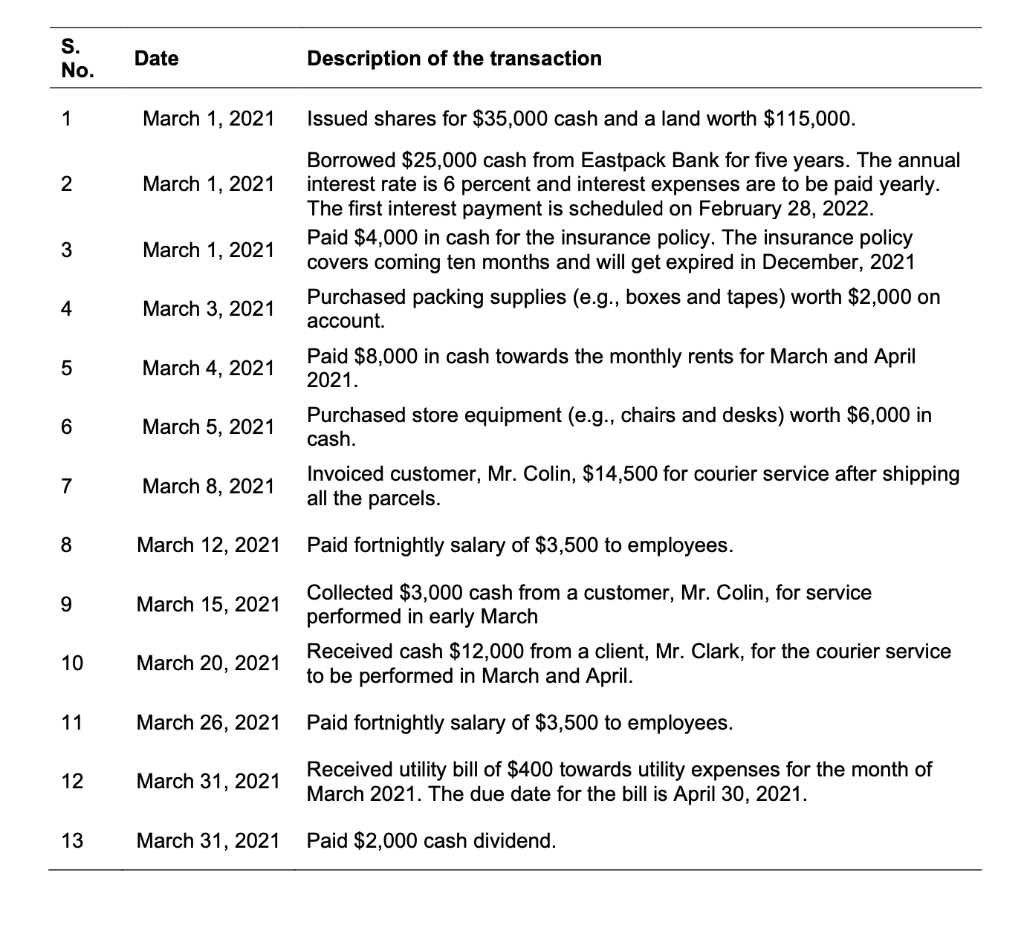

S. No. Date Description of the transaction 1 March 1, 2021 Issued shares for $35,000 cash and a land worth $115,000. 2 March 1, 2021 3 March 1, 2021 Borrowed $25,000 cash from Eastpack Bank for five years. The annual interest rate is 6 percent and interest expenses are to be paid yearly. The first interest payment is scheduled on February 28, 2022. Paid $4,000 in cash for the insurance policy. The insurance policy covers coming ten months and will get expired in December, 2021 Purchased packing supplies (e.g., boxes and tapes) worth $2,000 on account. 4 March 3, 2021 5 March 4, 2021 6 March 5, 2021 Paid $8,000 in cash towards the monthly rents for March and April 2021. Purchased store equipment (e.g., chairs and desks) worth $6,000 in cash. Invoiced customer, Mr. Colin, $14,500 for courier service after shipping all the parcels. 7 March 8, 2021 8 March 12, 2021 Paid fortnightly salary of $3,500 to employees. 9 March 15, 2021 Collected $3,000 cash from a customer, Mr. Colin, for service performed in early March Received cash $12,000 from a client, Mr. Clark, for the courier service to be performed in March and April. 10 March 20, 2021 11 March 26, 2021 Paid fortnightly salary of $3,500 to employees. 12 March 31, 2021 Received utility bill of $400 towards utility expenses for the month of March 2021. The due date for the bill is April 30, 2021. 13 March 31, 2021 Paid $2,000 cash dividend. S. No. Date Description of the transaction 1 March 1, 2021 Issued shares for $35,000 cash and a land worth $115,000. 2 March 1, 2021 3 March 1, 2021 Borrowed $25,000 cash from Eastpack Bank for five years. The annual interest rate is 6 percent and interest expenses are to be paid yearly. The first interest payment is scheduled on February 28, 2022. Paid $4,000 in cash for the insurance policy. The insurance policy covers coming ten months and will get expired in December, 2021 Purchased packing supplies (e.g., boxes and tapes) worth $2,000 on account. 4 March 3, 2021 5 March 4, 2021 6 March 5, 2021 Paid $8,000 in cash towards the monthly rents for March and April 2021. Purchased store equipment (e.g., chairs and desks) worth $6,000 in cash. Invoiced customer, Mr. Colin, $14,500 for courier service after shipping all the parcels. 7 March 8, 2021 8 March 12, 2021 Paid fortnightly salary of $3,500 to employees. 9 March 15, 2021 Collected $3,000 cash from a customer, Mr. Colin, for service performed in early March Received cash $12,000 from a client, Mr. Clark, for the courier service to be performed in March and April. 10 March 20, 2021 11 March 26, 2021 Paid fortnightly salary of $3,500 to employees. 12 March 31, 2021 Received utility bill of $400 towards utility expenses for the month of March 2021. The due date for the bill is April 30, 2021. 13 March 31, 2021 Paid $2,000 cash dividend