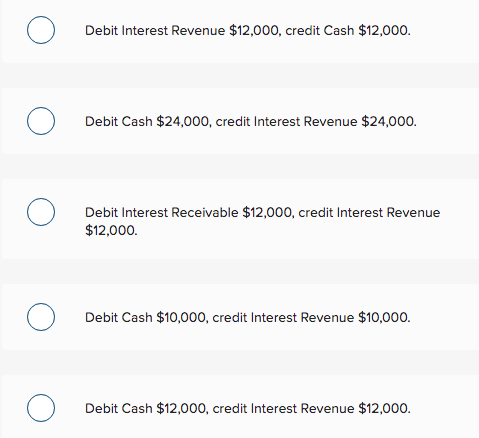

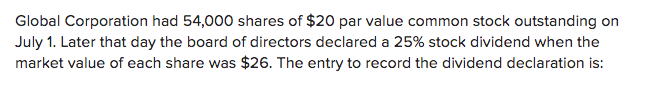

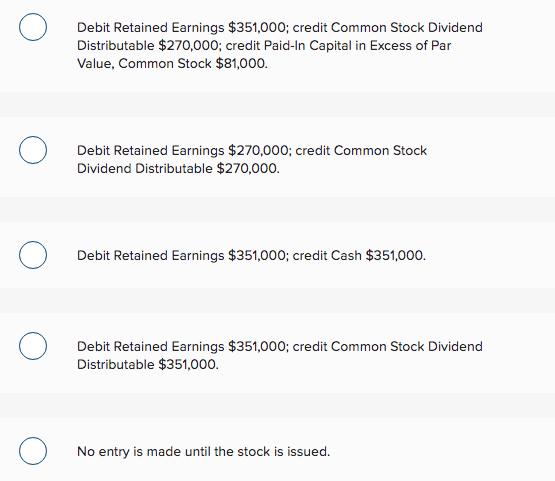

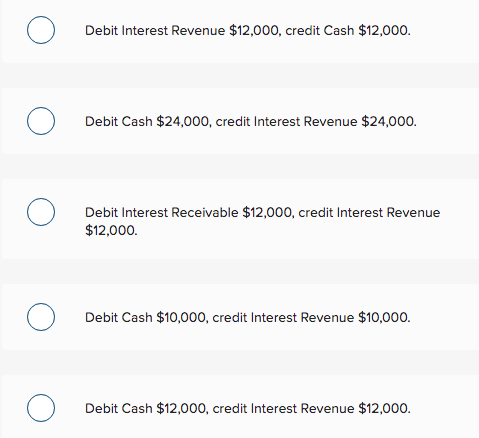

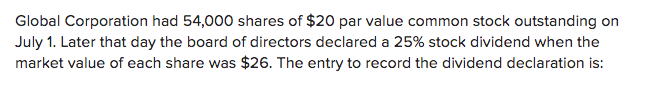

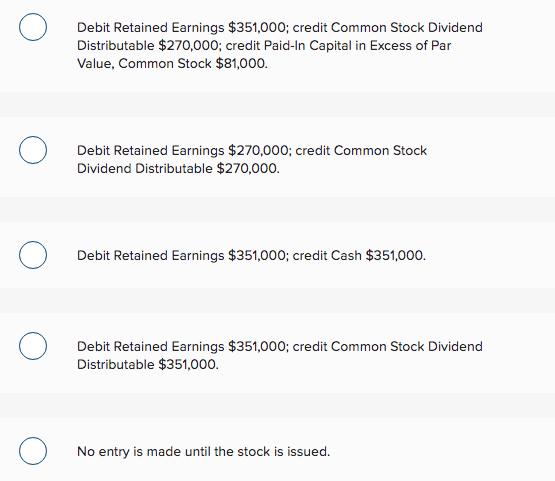

Landmark buys $400,000 of SRW Company's 6%, 6-year bonds payable, at par value on July 1. Interest payments are made semiannually on December 31 and June 30. The journal entry Landmark should make to record interest earned at year-end December 31 is: Debit Interest Revenue $12,000, credit Cash $12,000. Debit Cash $24,000, credit Interest Revenue $24,000. Debit Interest Receivable $12,000, credit Interest Revenue $12,000. Debit Cash $10,000, credit Interest Revenue $10,000. Debit Cash $12,000, credit Interest Revenue $12,000. Global Corporation had 54,000 shares of $20 par value common stock outstanding on July 1. Later that day the board of directors declared a 25% stock dividend when the market value of each share was $26. The entry to record the dividend declaration is: Debit Retained Earnings $351,000; credit Common Stock Dividend Distributable $270,000; credit Paid-In Capital in Excess of Par Value, Common Stock $81,000. Debit Retained Earnings $270,000; credit Common Stock Dividend Distributable $270,000. Debit Retained Earnings $351,000; credit Cash $351,000. Debit Retained Earnings $351,000; credit Common Stock Dividend Distributable $351,000. No entry is made until the stock is issued. On February 15, Jewel Company buys 10,400 shares of Marcelo Corp. common stock at $30.23 per share. The stock is classified as a stock investment with insignificant influence. This is the company's first and only stock investment. On March 15, Marcelo Corp. declares a dividend of $2.00 per share payable to stockholders of record on April 15. Jewel Company received the dividend on April 15 and ultimately sells half of the Marcelo Corp. stock on November 17 of the current year for $31.00 per share. The journal entry to record the sale of the 5,200 shares of stock on November 17 is: Debit Cash $161,200; credit Long-Term Investments-AFS $157,196; credit Gain on Sale of Long-Term Investments $4,004. Debit Cash $161,200; credit Stock Investments $157,196; credit Gain on Sale of Stock Investments $4,004. Debit Cash $161,200; credit Long-Term InvestmentsTrading $157,196; debit Gain on Sale of Long-Term Investments $4,004. Debit Cash $161,200; credit Long-Term Investments-Trading $157,196; credit Gain on Sale of Long-Term Investments $4,004. Debit Cash $157,196; debit Loss on Sale of Stock Investments $4,004; credit Stock Investments $161,200