Question

Landry owns and operates a tattoo parlor under the name INK Inc. There are currently seven artists providing services, including Landry. The other six artists

Landry owns and operates a tattoo parlor under the name INK Inc. There are currently seven artists providing services, including Landry. The other six artists are paid as independent contractors* and provide both tattoo and body piercing services. In addition to providing services, the business sells body jewelry, tattoo & piercing care products, and tanning bed time. A full-time receptionist is employed to arrange appointments and perform other clerical duties such as counter sales and record keeping.

Landry has eight private rooms for providing services, each equipped with a sink, cabinet, and autoclave. Each artist provides their own instruments. Each artist, excluding Landry, "rents' a room at a cost of $400 per month. Charges for all client services are billed and collected by the receptionist who accumulates total revenues for each artist.

The outside artists are paid a commission of 75% of their gross revenues for both tattoo and piercing services. Commissions for services are paid to the artist on a monthly basis with the cost of room rent & cost of supplies deducted from the commission revenue. Any supplies used by the six outside artists must be purchased through the business. Landry does not have to purchase supplies and simply takes what is necessary from the supply inventory. Landry draws a monthly salary from the business as compensation.

The tanning bed is owned by the parlor and is housed in the currently vacant eighth room. All net billings received from the bed goes to the parlor. Variable parlor costs are incurred based on the number of outside artists employed at any time (currently six).

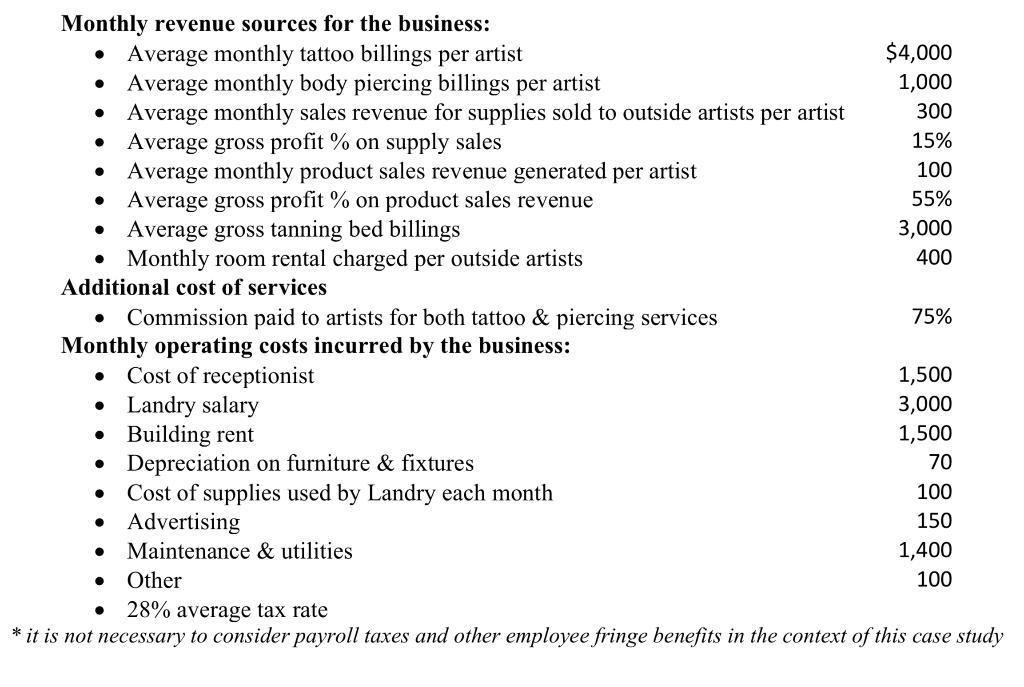

In addition to the information provided in the above narrative, Landry has assembled the following information on monthly activity and costs to operating INK Inc.:

A. How would you calculate the current average net monthly income of the parlor?

Provide calculation support in good form on tab A - Current Net Income of an Excel Sheet

B. Which alternative would provide the most value for Landry? Given the following information?

Provide calculation support in good form at tab B - Eliminate Tanning Bed

Landry is considering eliminating the tanning bed services and renting the room to a new artist, bringing the number of an outside artists employed to seven. The sale of the tanning bed would bring in $1,000 for the sale ($800 after-tax) and would reduce depreciation expense by $40 per month. Assume that fixed and variable revenues & costs per artist would remain constant per artist, with product sales averages for revenues and costs remain constant with the addition of a new artist, would Landry be better off under financially under this new arrangement?

C. From a cost point of view, which option (continue Renting or Buy) would provide the lowest cost based on the time value of money, assuming a period of 15 years and a cost of capital (Interest Rate) or 5% APR.

Use the details of the opportunity information below for this question.

Provide calculation support in good form at Tab C - Rent or Buy

Landry is considering a move to a new location. The details of the opportunity:

o The purchase of a new building on the same block. The cost of the building would be $210,000 with a $10,000 down payment required and 15-year annual mortgage payments of $19,268 per payment. For simplicity use the annualized payment of $19,268 for your calculation**. Use the PV of an ordinary annuity table for this calculation.

o Extra space in the building could be rented out to another business for $3,000 per year.

o Purchase of the building would eliminate the need of renting the current space. For simplicity, use the annualized amount of $1,500 x 12 = $18,000 per year paid at the end of the year for your calculations**. Assume that Landry's current lease would extend without cost increase for the next 15 years. Use the PV of an ordinary annuity table for this calculation.

**although the mortgage and rents would require monthly payments, we are simplifying this problem. The difference in time value of money between12 monthly versus one annual payment for both the mortgage and rent is considered immaterial in the context in the decision.

4. Lastly, what are those qualitative factors that should be considered, when making decisions in Questions B & C? Other than quantitative factors, business owners need to consider qualitative factors in the analysis of their decisions.

Examples can include: (1) effect on employee morale, schedules and other internal elements; (2) relationships with and commitments to suppliers; (3) effect on present and future customers; and (4) long-term future effect on profitability.

Monthly revenue sources for the business: Average monthly tattoo billings per artist Average monthly body piercing billings per artist Average monthly sales revenue for supplies sold to outside artists per artist Average gross profit % on supply sales Average monthly product sales revenue generated per artist Average gross profit % on product sales revenue Average gross tanning bed billings Monthly room rental charged per outside artists Additional cost of services Commission paid to artists for both tattoo & piercing services Monthly operating costs incurred by the business: Cost of receptionist Landry salary Building rent Depreciation on furniture fix res Cost of supplies used by Landry each month Advertising Maintenance & utilities $4,000 1,000 300 15% 100 55% 3,000 400 75% 1,500 3,000 1,500 70 100 150 1,400 100 Other 28% average tax rate * it is not necessary to consider payroll taxes and other employee fringe benefits in the context of this case study

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

A To calculate the current average net monthly income of the tattoo parlor we need to consider the revenues and costs Lets calculate it Total monthly tattoo billings for all artists 7 artists 4000 280...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started